By Christoph Steitz and Tom Käckenhoff

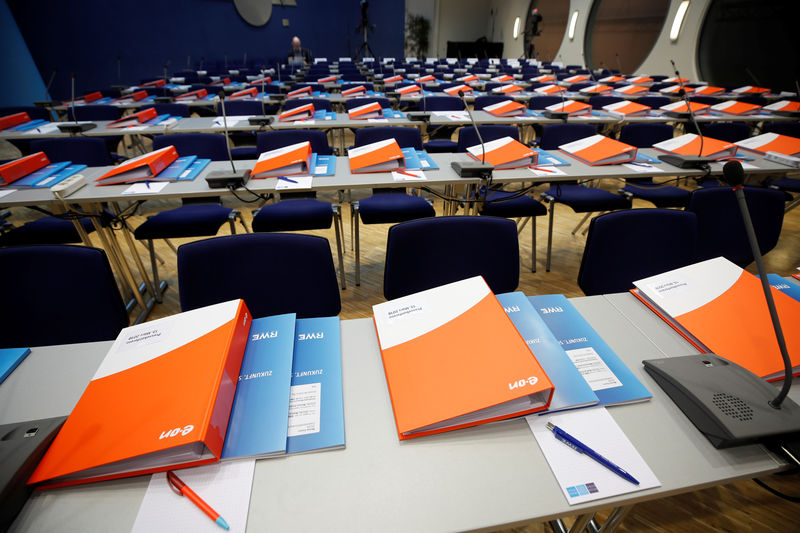

ESSEN, Germany (Reuters) - German utility RWE (DE:RWEG) on Tuesday promised shareholders higher payouts following a landmark deal to break up its Innogy (DE:IGY) business and split its assets with rival E.ON (DE:EONGn) to become Europe's third-largest renewables player.

RWE carved out and listed Innogy in 2016, hoping to extract more value from its networks and renewables assets, the most promising areas of the crisis-ridden utility sector. Since then, it tried to find a buyer for its remaining 76.8 percent stake.

The deal with E.ON, announced on Sunday, will result in RWE gaining control of Innogy's and E.ON's renewable units, turning one of Europe's largest CO2 emitters into the continent's No.3 clean power group after Italy's Enel (MI:ENEI) and Spain's Iberdrola (MC:IBE).

"In 2017, our goal was to strategically reposition RWE and consolidate its finances. We were successful in both of these undertakings," RWE Chief Executive Rolf Martin Schmitz said in a statement. "We are in good shape again."

The group said the ordinary dividend was expected to rise to 0.70 euros ($0.86) per share in 2018, up from 0.50 euros in 2017, with a further increase planned in 2019. The total dividend payout for 2017 also includes a 1.00 euro special dividend due to a nuclear fuel tax rebate.

Analysts polled by Reuters, on average, had expected RWE's ordinary dividend to remain stable at 0.71 euros per share for 2018 and 2019. E.ON late on Monday also said its dividend would rise in 2018.

E.ON, which also released a strong set of annual results late on Monday, will keep some renewables assets as part of the deal, most notably its 1.3 billion pound offshore wind park project Rampion off the Sussex coast in Britain.

Shares in E.ON were indicated 2 percent higher at the top of the German blue-chip DAX index ahead of the market open at 0800 GMT. RWE and Innogy were both seen 0.5 percent lower.

On Monday, Germany's three largest utilities added 4.3 billion euros in market value between them.