By Paul Sandle and Sarah Young

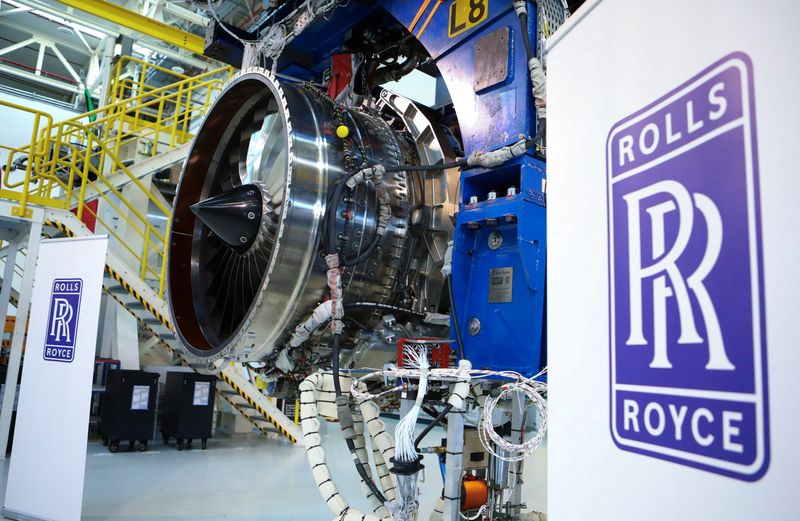

LONDON (Reuters) -Rolls-Royce aims to quadruple profit in the next five years by boosting the performance of its jet engines and bearing down on costs in boss Tufan Erginbilgic's masterplan for Britain's most prestigious engineering company.

Setting out a strategy that has been almost a year in the making, the chief executive said on Tuesday he would deliver up to 2.8 billion pounds ($3.5 billion) in annual operating profit by 2027, four times 2022's outcome and double its guidance for up to 1.4 billion pounds this year.

That would be driven by surge in profit margins at its civil aerospace business to 15-17% from 2.5% last year.

Erginbilgic, a former BP (LON:BP) executive who took over in January, said he would tackle Rolls-Royce (LON:RR)'s inefficiencies by focusing on the widebody plane sector, where it is Airbus's exclusive supplier, business aviation, defence and power systems.

Its electrical-powered aircraft business will be sold in a drive to raise up to 1.5 billion pounds from selling non-core assets, he said, while the company could re-enter the single-aisle jet market through a partnership, leveraging its next-generation UltraFan technology.

The biggest driver of profit will be a step change in margins in an engine business that powers nearly half of long-haul aircraft, including all Airbus A330neo and A350 models and some Boeing (NYSE:BA) 787 planes.

The margin target would bring Rolls-Royce closer to rivals such as General Electric (NYSE:GE), its major competitor in widebodies.

Erginbilgic said it would be achieved by extending the "time on wing" of its engines between maintenance, reducing the costs of manufacturing and repairs, a new pricing strategy and tackling previous low-margin contracts.

The company is planning 300-350 engine deliveries a year, a target Erginbilgic told investors was "totally aligned" with the plans of Airbus and Boeing.

Shares in Rolls-Royce, which have soared 161% in the year to date, reached a four-year high and were trading up 6% by mid-afternoon.

"We are setting compelling and achievable financial targets for the mid-term which will take Rolls-Royce significantly beyond any previous financial performance," Erginbilgic said.

Agency Partners analyst Nick Cunningham said the targets implied Rolls-Royce was willing to shed revenues in exchange for better profitability.

"If so, that is a deeper culture change from Rolls-Royce's traditional market share optimisation approach of past decades," he said.

Asked if he was willing to sacrifice market share, Tufan said the company had a 55% share of widebody deliveries last year and he expected that level to continue this year, with growth over the next five to 10 years.

"We will capture market share every year, but in a profitable way," he said.

SINGLE-AISLE OPPORTUNITY

Rolls-Royce said it would sell non-core assets from across the group and create partnerships if that would create extra value, including potentially returning to the single-aisle sector split between RTX's Pratt & Witney and CFM International, a joint venture between Safran (EPA:SAF) and GE.

"We don't need to enter narrowbody but it is an opportunity," Erginbilgic told analysts. "With a partnership approach, I believe it can be a profitable place."

Rolls-Royce's finances were hit by problems with its Trent 1000 engine and by the pandemic, which grounded long-haul aircraft and wiped out revenue tied to engine flying hours.

Recovery under Erginbilgic has been rapid, with a five-fold rise in first-half operating profit reported in August, helped by increasing prices for maintaining its engines and tightly managing its cost base.

($1 = 0.7921 pounds)