By Mathieu Rosemain and Gwénaëlle Barzic

PARIS (Reuters) - France's Publicis (PA:PUBP) predicted modest underlying growth for 2016 but avoided setting precise full-year targets as it digests a $3.7 billion (2.5 billion pounds) acquisition and reorganises its businesses.

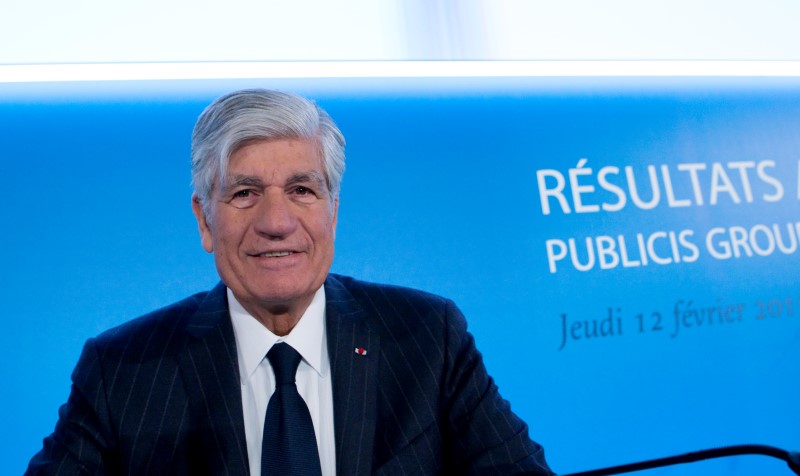

The full integration of digital and ad specialist Sapient, bought a year ago, and the internal reorganisation of Publicis' agencies to foster greater collaboration and better serve clients will be the two key drivers to its success, Chief Executive Officer Maurice Levy said.

The world's third-biggest advertising group expects an increase in sales and operating profit in 2016, which it calls a year of transition.

Publicis cut in October its 2015 organic growth target, which excludes acquisitions and is measured at constant exchange rates, to 1 percent from an initial 2.5 percent.

The group, which competes against London-based WPP (L:WPP) and New York-based Omnicom (N:OMC), is trying to win back investor support after the agency's growth lagged behind competitors because of the fallout from the failed Omnicom deal two years ago.

The Paris-based company needs time to catch up with the growth rate of its rivals and aims to beat them on underlying or organic growth, in 2018, Levy told journalists at a briefing.

The group reported fourth-quarter organic sales growth of 2.8 percent on revenue of 2.73 billion euros ($3.09 billion) on Thursday, notably driven by strong demand in North America, Publicis' biggest region by revenue.

This brought the group's yearly organic growth to 1.5 percent on sales of 9.60 billion euros, beating the Reuters consensus forecast of 0.9 percent.

Shares jumped by 6.3 percent in early Paris trading to 56 euros, making Publicis the only rising stock in the CAC 40, France's reference stock index. The group's shares have fallen by 16.5 percent over the last 12 months.

Publicis generated a record yearly free cash flow of about 1.1 billion euros. It plans to pay a dividend of 1.60 euro, up 33.3 percent from a year earlier.

"The free cash flow is once again significantly higher than expectations, which illustrates the soundness of Publicis' model, despite an organic growth that is slightly weaker than peers on the short term," said Jerome Bodin, an analyst at Natixis.

Omnicom said Tuesday that its fourth-quarter organic sales growth was 4.8 percent. WPP, the top advertising company in the world, will report full-year earnings on March 4, while Havas (PA:HAVA) will do the same on Feb. 25.