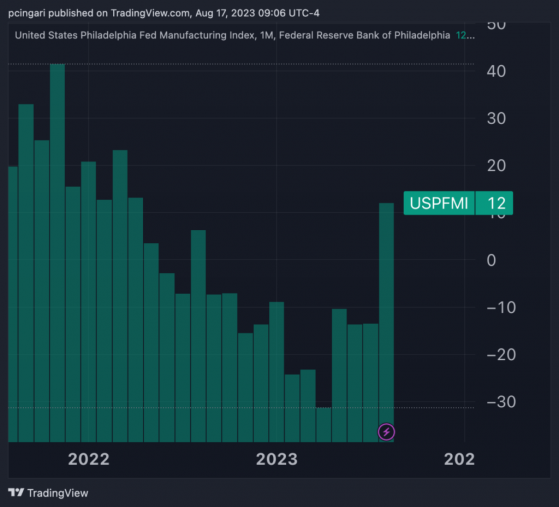

Benzinga - by Piero Cingari, Benzinga Staff Writer. Philadelphia’s manufacturing sector demonstrated a remarkable turnaround in August, as indicated by the latest report from the Philadelphia Fed Manufacturing Index.

The index surged to +12, a stark contrast to July’s dismal -13.5 figure. This positive uptick not only surpassed market expectations of -10 but also marked the sector’s first growth since August 2022.

Chart: Philly Fed Manufacturing PMI Rebounds Strongly

Signs of Recovery, Cautious Optimism

Signs of recovery were evident across multiple indicators, with general activity, new orders, and shipments all posting positive readings for the first time since May 2022. The survey did reveal a setback in terms of employment, with firms reporting a decline in workforce numbers.

The price indexes held steady, remaining close to long-term averages. The forward-looking perspective indicated a tempered optimism, as expectations for growth in the coming six months were somewhat less widespread.

Price Projections Reflect Moderate Expectations

The survey also delved into the crucial expectations regarding price changes. Participants were asked to forecast price changes in their products and those affecting U.S. consumers over the next four quarters. Firms projected a median increase of 4% in their own prices over the next year, slightly lower than the 4.5% forecast in May.

In the past year, the firms reported a median price increase of 5%, down from 6% in the previous quarter. As for the rate of inflation for U.S. consumers, the median forecast for the next year dropped to 4% from the earlier 5% in May.

Looking further ahead, the firms’ median forecast for the 10-year average inflation rate increased slightly to 3.5%, up from 3.3%.

Read now: Walmart Q2 Earnings: Smashes Expectations, Strong E-Commerce Growth and Raised Outlook

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga