Benzinga - by Zaheer Anwari, Benzinga Contributor.

- Nvidia's stock surged 7% to a new high of $1,139 following a $6 billion Series B funding announcement by Elon Musk's AI startup, xAI.

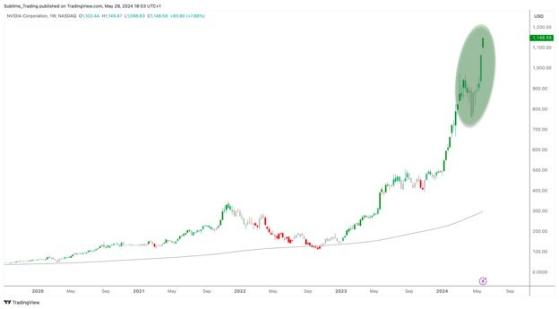

- Nvidia’s stock has seen a 32% increase in May and a 131% rise year-to-date.

- Their 10-for-1 stock split is scheduled for June 10.

The news positively impacted investors, pushing Nvidia's stock up by as much as 7% during the day. xAI plans to use Nvidia's advanced chips in its "supercomputer" designed to power Grok, its advanced chatbot, indicating strong future demand for the technology.

Despite concerns about potential market saturation and future demand slowdowns, Nvidia’s CEO confidently addressed these issues.

He highlighted the continuous need for generative AI training as a major driver for the company's growth, which boosted investor confidence and positively impacted the stock's performance.

Nvidia's trading day saw the stock opening over 3% higher than the previous day's close and ending up 7%. This increase is part of a broader upward trend, with the stock climbing 32% in May alone and a year-to-date gain of 131%, indicating a potentially record-setting year.

Adding to investor excitement is the planned 10-for-1 stock split on June 10. This move is expected to lower the stock's price per share, making it more accessible to a wider range of investors, especially those with less capital. This could significantly broaden Nvidia's investor base.

While the market reaction post-split remains uncertain, the current interest in AI technology suggests that the lower stock price could be an attractive entry point, likely supporting Nvidia's market position and potentially leading to further gains in a tech-driven AI market.

After the closing bell on Tuesday, May 28, the stock closed at $1139.01, trading up by 6.89%.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga