Benzinga - by Zaheer Anwari, Benzinga Contributor.

- Nvidia's announcement of a 10-for-1 stock split, scheduled for June 10, could attract a larger pool of investors.

- The stock surged nearly 5% by the close of trading on Monday.

His keynote was brimming with groundbreaking developments, signaling Nvidia's aggressive pursuit of AI innovation. Among the highlights was the introduction of Nvidia ACE, a state-of-the-art generative AI designed to create lifelike human avatars.

This technology promises to revolutionize digital interactions, providing more realistic and engaging user experiences across various platforms.

Jensen Huang didn't stop there. He emphasized Nvidia's strategic collaborations with tech giants like Foxconn and Siemens, aiming to develop AI-powered robotics that could transform manufacturing processes with enhanced efficiency and flexibility.

If that wasn't enough, Huang teased the "ultra" version of Nvidia's Blackwell platform, scheduled for a 2025 launch, and hinted at a next-generation GPU architecture named Rubin.

Huang's vision extends to a future where generative AI becomes an integral part of our digital interactions. He predicts that soon, almost every interaction with the internet or a computer will involve generative AI running in the cloud, potentially transforming how services are delivered and consumed online.

Nvidia's announcement of a 10-for-1 stock split set for June 10 has generated significant interest. The stock saw a strong rise, closing up nearly 5% on Monday, as investors look forward to the lower stock price post-split. This could attract a wider range of investors.

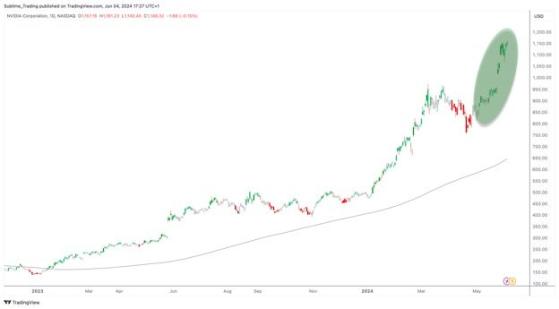

As the split date nears, Nvidia’s stock is approaching its all-time high of $1158, recorded on May 30. The stock shows strong upward momentum, but the $1000 level below the current price serves as a psychological support, reinforced by the daily 20 simple moving average. This level could offer substantial support if the stock declines.

After the closing bell on Monday, June 3, the stock closed at $1150.00, trading up by 4.83%.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga