Benzinga - by Piero Cingari, Benzinga Staff Writer.

Both the S&P 500 and Nasdaq 100 indices surged to new historic highs on Tuesday, driven by strong performance in the technology and semiconductor sectors. Toward the end of the trading week, which was shortened by the Juneteenth holiday, profit-taking in chipmaker stocks emerged, tempering earlier gains.

Nvidia Corp. (NASDAQ:NVDA) snapped a eight-week winning streak, dropping by more than 4% for the week. This decline also pulled down the broader chipmaker industry, as tracked by the iShares Semiconductor ETF (NYSE:SOXX).

Concerns are growing among analysts regarding the lack of broad participation in the stock market rally and the significant concentration of major equity indices in a few mega-cap names.

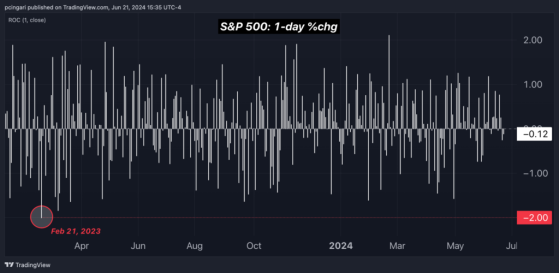

Despite these warnings, the ongoing market rally continues to set new records. The S&P 500 is experiencing its longest streak without a 2% loss since the Great Recession. The last time the S&P 500 declined by more than 2% in a single session was 377 sessions ago, on Feb. 21, 2023.

Chart of the Week: S&P 500 Records Longest Streak Without a 2% Loss Since Financial Crisis

Gilead Sciences Inc. (NASDAQ:GILD) emerged as the week's top-performing stock within the S&P 500 following the release of efficacy data for its potential HIV prevention drug, lenacapavir. The drug, administered twice yearly via injection, showed 100% efficacy in HIV prevention for cisgender women.

Oil prices rebounded above $80 per barrel, buoyed by larger-than-expected inventory declines that supported a recovery in energy sector stocks after two consecutive weeks of declines.

On the macro front, surveys of private sector activity in June indicated the strongest pace of expansion in two years, accompanied by welcome declines in price pressures.

You may have missed:

Nvidia's Market Lead

Nvidia Corp. (NASDAQ:NVDA)’s remarkable rise to become the world’s most valuable company is attributed to its pivotal role in a “once-in-a-generation” technological transformation. Economist Mohamed El-Erian this week highlighted Nvidia’s strategic focus on graphics chips and artificial intelligence that has propelled its market value to $3.33 trillion, surpassing Microsoft and Apple.

Tesla’s GPU Expansion

New drone footage showed Tesla Inc. (NASDAQ:TSLA)’s Giga Texas expansion, which CEO Elon Musk has said will house 50,000 Nvidia GPUs for AI projects. Musk has highlighted Tesla's significant investment in AI hardware and its commitment to technological advancements and infrastructure.

Mini Starlink Dishes

SpaceX has launched “Mini” Starlink dishes that fit in a backpack, priced at $599. CEO Musk gave an earlier price estimate of $250-$300. The mini dishes are more expensive than expected, but promise enhanced portability and connectivity. The kit includes a dish, kickstand and power supply and supports Wi-Fi 5 speeds.

SPY Bleeds Outflows

The SPDR S&P 500 ETF Trust (NYSE:SPY), the world's largest exchange-traded fund, has seen outflows exceeding $40 billion year-to-date. The U.S. stock market has continued to rise, as these outflows were offset by significant inflows into lower-cost Vanguard and iShares S&P 500 ETFs, demonstrating an investor preference for more cost-effective options.

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga