Investing.com - Shares of NVIDIA (NASDAQ:NVDA)fell 10% on the stock exchange in Friday's trading session, sending more than $210 billion in capitalisation up in smoke. The stock has thus moved further away from the all-time high of $950 per share recorded at the close on 25 March and now trades at $762, down 20% in the past month.

Nvidia suffers from macro uncertainties

Weighing on the chip giant's share price is the outlook for its industry. While demand for artificial intelligence is growing, economic uncertainty is dampening consumption and geopolitical tensions are putting future production at risk.

On the one hand, there is the Fed's monetary tightening, which could lengthen more than expected due to inflation, and on the other hand, the trade war between China and the United States, which sees the centre of interest in Taiwan, the island where most semiconductors come from and which is home to Taiwan Semiconductor Manufacturing (NYSE:TSM), the world's leading chip producer that supplies some of the big US tech companies such as Apple (NASDAQ:AAPL) and Nvidia itself.

Doubts about the chip sector are growing

It is precisely Taiwan Semiconductor Manufacturing (NYSE:TSM). recent accounts that have certified the sector's difficulties. The Taiwanese company, which is a benchmark for the entire chip market due to its size, has cut its growth expectations for 2024 by 10%. And even though demand for AI led to higher-than-expected profits in the first quarter of the year, the stock lost more than 8% in two sessions between 18 and 19 April.

The same fate had befallen the Dutch ASML (NASDAQ:ASML) the day before, which, despite better-than-expected profits at the beginning of 2024, fell 12% in three days on the stock market because new orders were about a billion less than the 4.6 billion forecast by experts.

Manufacturers are convinced that the big companies' investments in artificial intelligence will succeed in driving the sector despite the cooling demand for consumer goods. But in the meantime, doubts about the sustainability and fundamentals that led to the rally in Nvidia's shares are becoming denser.

- Take advantage of a special discount at InvestingPro+ More details at the bottom of this article

Has the time come to sell Nvidia?

Anyone who invested €1,000 five years ago in the company led by CEO Jensen Huang would today have over €16,000 in their portfolio, but after this monstrous growth is it time to sell?

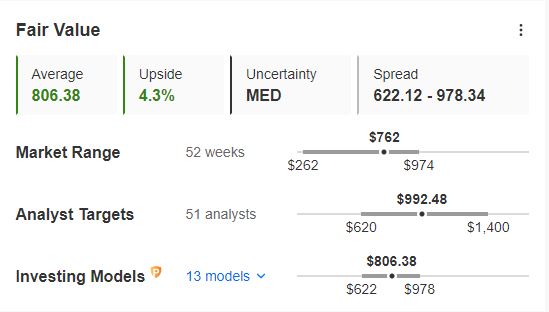

According to InvestingPro's analysis, investors can still rely on the stock. Friday's thud, in fact, brought Nvidia's share price back below its fair value. The 13 investment models certified and adapted to the stock's characteristics set its intrinsic value at $806.38. Up 4.1% from the current $762.

Analysts, however, are on average much more optimistic about the stock. The 51 experts interviewed by InvestingPro set the target price at $992.48 per share, more than 30 per cent higher than the price at which Nvidia is trading on 22 April. In short, the US giant certainly doesn't lack the legs to make a comeback and according to the most bullish investors, the stock could surprise again, reaching new highs.

--------------------------------------------------------------------------------

DISCOUNT CODE

Want to deepen your analysis on Nvidia and discover the best investment opportunities? Take advantage of a special discount to subscribe to InvestingPro+ and benefit from all our tools to optimise your investment strategy. (The link directly calculates and applies the discount of an additional 10%. In case the page does not load, please enter the code proit2024 to activate the offer).

You will have at your disposal a series of exclusive tools that will enable you to better tackle the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each security.

- Advanced security screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!