Benzinga - by Zacks, Benzinga Contributor.

Wall Street has been witnessing a strong rally in technology stocks since early 2023, supported by an impressive adoption of artificial intelligence. However, a section of technical and financial experts has warned that the AI space is much hyped and likely to form a bubble. In contrast, the latest quarterly financial results of AI chipset behemoth — NVIDIA Corp. (NASDAQ: NVDA) — smashed all concerns.

Blockbuster Q1 2025 NVIDIA reported that blockbuster first-quarter fiscal 2025 revenues of $26.04 billion, soared 262% year over year, marking the third straight quarter of growth in excess of 200%. The metric also exceeds the consensus estimate of $24.33 billion. Adjusted earnings per share were $6.12, ahead of the Zacks Consensus Estimate of $5.49. This compares to earnings of $1.09 per share a year ago.

The company's data center revenues soared 427% year-over-year to $22.6 billion. Gaming revenue up 18% year over year to $2.65 billion. Professional visualization revenues and automotive sales came in at $427 million and $329 million, respectively.

The AI market has gathered pace in the past few years buoyed by the rapid penetration of digital technologies and the Internet. These astonishing results were primarily due to sky-high shipments of NVIDIA's Hopper graphics processors, especially H100 GPU.

In after-market trade, the stock price of the Zacks Rank #2 company rose 6.1% to cross the $1,000 mark for the first time.

Most Important Signal For the first time, NVIDIA signaled that the customers of its high-end AI GPUs will be able to make an "immediate and strong return" on their investment. Notably, about 45% of the company's data center revenues come from giant cloud providers like — Amazon Web Services (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT) Azure, Alphabet (NASDAQ: GOOGL) Cloud and Oracle (NYSE: ORCL) Cloud.

CFO Colette Kress said that an investment of $1 by a cloud provider on H100 can generate $5 in revenues over the next four years. Using NVIDIA's latest HDX H200 chip that provides Meta Platforms' Llama 3 AI model, an investment of $1 by an API provider can generate $7 in revenues over the next four years.

Impressive Guidance

NVIDIA expects sales of $28 billion in the fiscal second quarter, higher than the current consensus estimate of $26.6 billion. CEO Jensen Huang said that the company's next-generation AI chip, called Blackwell, is the upcoming driver.

These chips will be available in data center in the fourth quarter of fiscal 2025. Huang said, "We will see a lot of Blackwell revenue this year." These chips are essential for customers' interconnected infrastructure.

What Next for NVIDIA? NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, this worldwide leader of the GPU chipset has shifted its focus from PC graphics to AI-based solutions that support high-performance computing, gaming, and virtual reality platforms.

Over the past five years, the stock price of NVDA has soared 25 times. In the near future, NVIDIA is expected to benefit in two ways. Demand for its Hopper chips remains strong owing to the significant adoption of generative AI and an industry-wide shift away from central processors to NVIDIA-made accelerators.

On the other hand, despite an improving supply of NVIDIA chipsets, demand is likely to outpace supply, resulting in price hikes for chips. The market for AI is expected to show strong growth in the coming decade. Its current size of $200-$300 billion is expected to grow to nearly $2 trillion by 2030, as estimated by several research agencies.

The stock price of NVIDIA has jumped 210% in the past year and 92% year to date. Despite this, following the first-quarter fiscal 2025 results, momentum is likely to continue for this new darling of Wall Street.

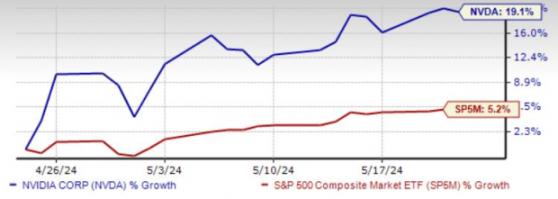

The chart below shows the price performance of NVIDIA in the past month.

Image Source - Zacks Investment Research

To read this article on Zacks.com click here.

Read the original article on Benzinga