Benzinga - by Anusuya Lahiri, Benzinga Editor.

According to CNBC’s Jim Cramer, Nvidia Corp (NASDAQ:NVDA) could soon surpass Microsoft Corp’s (NASDAQ:MSFT) market capitalization. He explained that Wall Street is skeptical of Nvidia’s rapid rise, as many need to familiarize themselves with its products.

Cramer compared Nvidia’s ascent to Apple Inc’s (NASDAQ:AAPL) dethroning of Exxon Mobil Corp (NYSE:XOM), noting that Nvidia’s fame primarily comes from the enterprise sector and hard-core gamers, CNBC reports.

Also Read: AMD Expands Partnership with Samsung, New 3nm Chips to Boost Market Share

Cramer emphasized that Nvidia’s significance extends beyond gaming. He highlighted Nvidia’s pivotal role in artificial intelligence, cloud computing, and data centers, which drive its growth.

“Nvidia’s chips are the backbone of AI advancements and have become essential for tech companies and industries worldwide,” Cramer said.

Cramer noted, “Nvidia’s potential is immense, and its products are increasingly becoming integral to the tech infrastructure, making it a company that could redefine the future of technology.”

Recent reports indicated Nvidia eying Fan-Out Panel Level Packaging (FOPLP) for GB200 AI server chips as Taiwan Semiconductor Manufacturing Co (NYSE:TSM) battles supply constraints regarding Chip on Wafer on Substrate (CoWoS) packaging.

Analysts noted Nvidia as the key AI beneficiary backed by Blackwell chip production pipeline and U.S. Big Tech customers including Amazon.Com Inc (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG) Google, Meta Platforms Inc (NASDAQ:META), Microsoft.

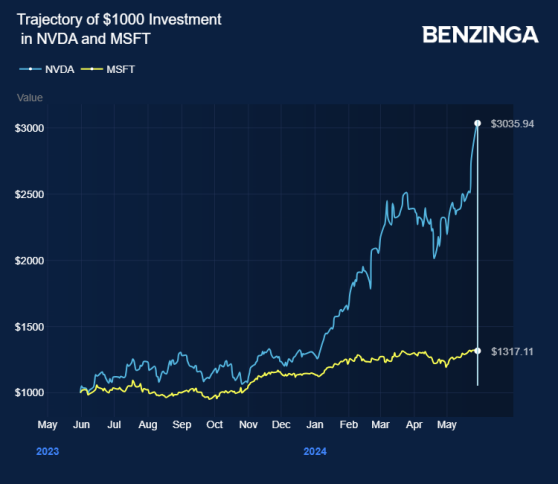

Nvidia stock gained over 186% in the last 12 months. Investors can gain exposure to the stock via VanEck Semiconductor ETF (NASDAQ:SMH) and Return Stacked Bonds & Managed Futures ETF Grizzle Growth ETF (NYSE:DARP).

Price Actions: NVDA shares were trading lower by 0.43% at $1,143.31 premarket at the last check on Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga