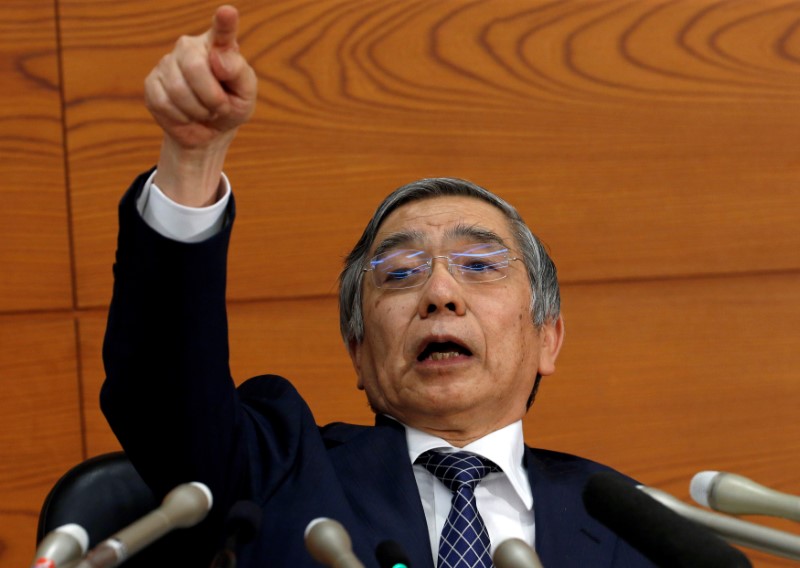

TOKYO (Reuters) - Bank of Japan Governor Haruhiko Kuroda said he expects Japan's economy to enjoy a steady recovery throughout next year as global headwinds die down, according to the Nikkei newspaper, reinforcing market expectations that the central bank will hold off on expanding stimulus in the foreseeable future.

"There are many things we can do if necessary" to jump-start growth, Kuroda said in an interview with Nikkei published on Thursday, dismissing views held by some analysts that the BOJ has run out of policy ammunition after more than three years of aggressive money printing.

But he said brightening prospects for the global economy, rising Japanese stock prices and a reversal of excessive yen gains will allow Japan's economy to sustain a steady economic recovery throughout next year.

"Overall, both the global and Japan's economies are moving in a positive and more desirable direction," he added in an interview conducted on Tuesday.

Regarding the expected policies of U.S. President-elect Donald Trump, Kuroda said he did not expect the new administration to implement extreme steps such as trade restrictions as they would hurt the U.S. economy as well as well as the economies of trade rivals.

Kuroda did not respond when asked if he would be willing to serve a second term after his five-year tenure as BOJ governor ends in April 2018, according to the Nikkei.

The BOJ revamped its policy framework in September to one better suited for a long-term battle with deflation, after more than three years of aggressive asset purchases failed to push inflation toward its 2 percent target.