Benzinga - by Shanthi Rexaline, Benzinga Editor.

While most opinion polls link President Joe Biden’s poor job approval rating to the economy’s performance, a new survey has shown that it has to do mostly with voter perception rather than reality.

Pessimism In The Air: A majority of Americans believe that the U.S. economy is in a recession, blaming the president for the predicament, the results of a Guardian-commissioned Harris Poll showed Wednesday. Fifty-five percent of the respondents said the economy was contracting and 56% said the economy was in a recession.

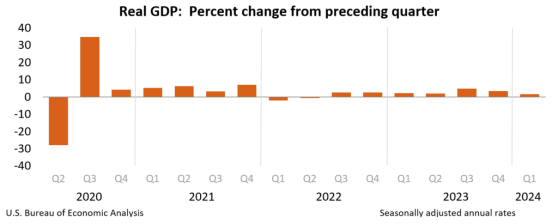

Incidentally, after emerging from a COVID-19-induced recession in the third quarter of 2020, the U.S. economy has shown positive growth for much of Biden’s tenure, except for the first and second quarters of 2022.

The two consecutive quarters of negative growth, technically called a recession, were not considered as one because other economic indicators such as those measuring the labor market remained resilient, economists said.

The Harris poll showed that 49% of Americans said the unemployment rate is at a 50-year high, while the jobless rate has been languishing at a near 50-year low of sub-4% for quite some time now.

Source: Bureau of Labor Statistics

A little less than half (49%) said the stock market fell in 2023, the poll found. But the S&P 500 Index, a broader market gauge, gained 24.23% for the year.

A whopping 72% said inflation was rising even as the measure has notably pulled back from the 9%+ level in June 2022.

The pollster said there was persistent pessimism among voters, with less than six months to go for the 2024 presidential election.

It doesn’t come as a surprise that most Republicans held a negative view of the economy under Biden, while only less than 40% of the Democrats felt the same about the economy. There was bipartisanship regarding wariness over economic news coverage. More than 60% of both parties said they didn’t know who to trust in learning about the economy.

Biden Cops The Blame: Most respondents (58%) said the economy worsened due to Biden’s management of the presidential administration, the Guardian report analyzing the poll numbers said.

They may have a point there as the government and the central bank’s stimulus measures after COVID-19 stoked inflationary pressure, prompting the Federal Reserve to raise the benchmark interest rate from near zero to a 22-year high of 5.25%-5.50%.

Stung by a higher interest rate environment, companies had to right-size operations to preserve profitability, necessitating massive layoffs. This pushed Americans to the corner, as their financial situation worsened.

Despite inflation cooling off, the Fed seems to be in no hurry to reverse rate hikes and appears to be fixated on a “higher for longer” stance.

Why It’s Important: “There's a stubborn gap between the reality represented in that data – what economists use to gauge the economy's health – and the emotional reality that underlies how Americans feel about the economy,” the report said.

The current situation has been referred to “vibecession” — a term coined by economic writer Kyla Scanlon to describe “widespread pessimism about the economy that defies statistics that show the economy is actually doing OK,” it added.

While the economy poses a major challenge for Biden’s re-election bid, the president can draw comfort from the fact that Republican voters were slightly more optimistic about the lasting impacts of Bidenomics than they were in the September Harris poll.

About four in 10 Republicans said they believed Bidenomics will have a positive lasting impact, an 11 percentage-point increase from September. The proportion of Democrats who said likewise was 81%.

The poll also found three-quarters of all respondents said they supported at least one of the key pillars of Bidenomics, namely investments in infrastructure, hi-tech electronics manufacturing, clean-energy facilities, and more union jobs.

"What Americans are saying in this data is: ‘Economists may say things are getting better, but we're not feeling it where I live,'” said John Gerzema, CEO of the Harris Poll. “Unwinding four years of uncertainty takes time. Leaders have to understand this and bring the public along.”

The SPDR S&P 500 ETF Trust (NYSE:SPY), an exchange-traded fund tracking the performance of the S&P 500 Index, fell 0.29% to $529.83 on Wednesday, according to Benzinga Pro data. The ETF has gained about 47% since Biden’s inauguration on Jan. 20, 2021.

Read Next: How To Invest In Startups

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga