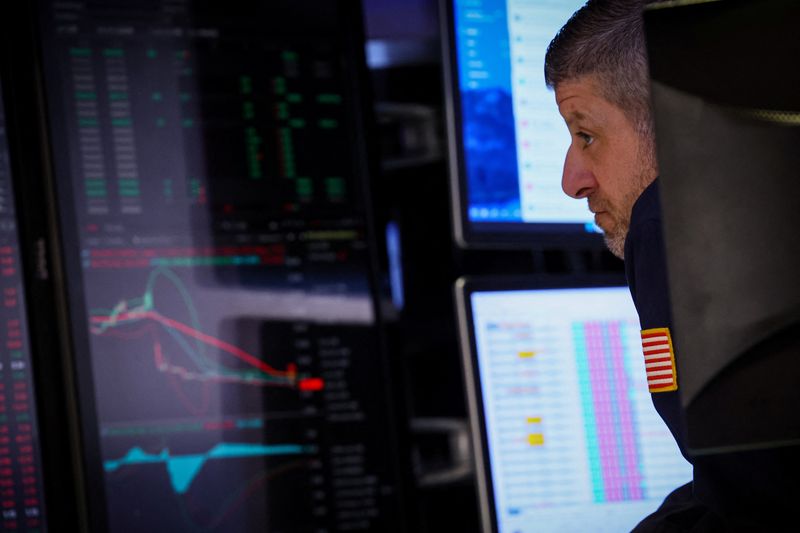

NEW YORK (Reuters) - Global macro hedge funds are now bearish on equities, leaving behind bullish bets which were part of their strategy for most of the year, while commodity trend advisers (CTAs) increased their short positions, Barclays (LON:BARC) said in a note.

A short equity bet implies that portfolio managers believe stock prices will fall.

The bank's U.S. equity strategy team wrote that global macro hedge funds are likely seeing equities repricing lower as the 10-year Treasury yields has spiked to around 5%. Since a peak at the end of July, the S&P is down roughly 9%.

CTAs, which were already bearish on equities, have added to their positions. "CTAs have built sizeable shorts in global equities, and have room to add further," Barclays said, adding the trend-following investors have become short U.S. technology stocks.

The analysts noted CTAs are bearish on most assets, including U.S. Treasuries, JGBs and Bunds, but they are long oil.