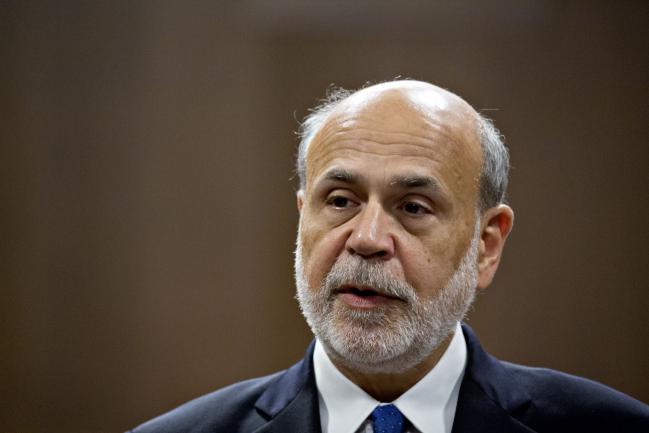

(Bloomberg) -- Former Fed Chairs Ben Bernanke and Janet Yellen warned that the U.S. economic recovery from the coronavirus shock could be slow and uneven and said the central bank may opt to cap yields on Treasury securities to help it along.

“It is possible, though not certain,” that the Fed will implement yield-curve control, they wrote on the Brookings Institution website, laying out testimony delivered Friday to the House Select Subcommittee on the Coronavirus Crisis.

The Fed has looked into the possibility of capping yields on short- to medium-term Treasuries though policy makers have suggested that further study is needed before deciding whether or not to go ahead.

Yellen told the committee that it would be a “catastrophe” if Congress decided not to continue enhanced unemployment insurance that is due to expire at the end of this month. “We need the spending that those unemployed workers can do,” she said.

Under the program, unemployed workers receive an extra $600 a week. Yellen said the program could be restructured to cap total insurance payments at a fixed percentage of regular income.

In their Brookings posting, Bernanke and Yellen said they expect the Fed to provide clearer guidance on its plans for short-term interest rates as a way to provide more stimulus to the economy.

Forward Guidance

“To maintain downward pressure on longer-term interest rates, the Federal Open Market Committee likely will provide forward guidance about the economic conditions it would need to see before it considers raising its overnight target rate,” the two former policy makers, both of whom now work at Brookings, wrote. “And it likely will clarify its plans for further securities purchases.”

The Fed has pledged to keep short-term interest rates effectively at zero until it is confident that the economy has weathered the pandemic shock and is on track to achieve its maximum employment and price-stability goals.

The former Fed chairs also called for more action on the fiscal front, including aid to state and local governments and a continuation of enhanced unemployment insurance.

“If the pandemic comes under better control, economic recovery should follow. However, the pace of the recovery could be slow and uneven,” they wrote. ‘’Fiscal and monetary policies must aim to speed the recovery and minimize the recession’s lasting effects.”

©2020 Bloomberg L.P.