By Huw Jones

LONDON (Reuters) - Policymakers should "tether" London to the European Union to avoid isolating the region's largest financial hub, harming the euro zone economy and spawning an offshore financial centre, the head of the U.S. derivatives watchdog said.

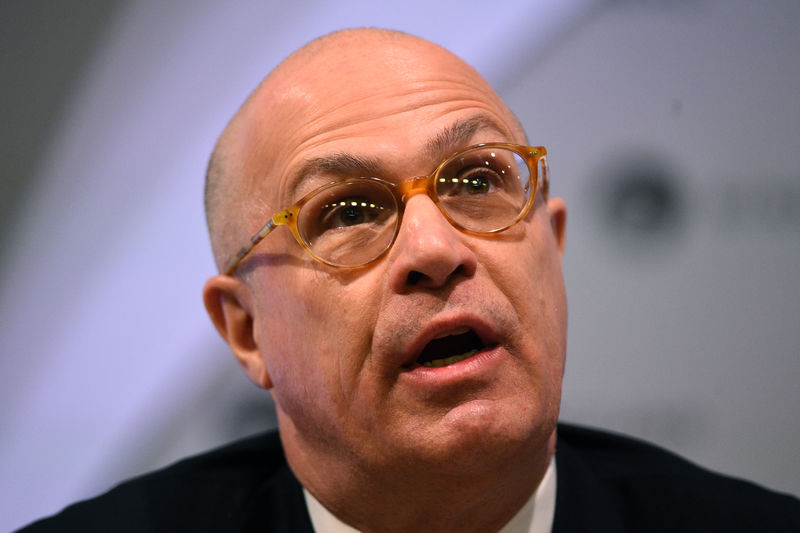

"It is clear that London is shedding, and will continue to shed, a not insignificant amount of its financial service offerings and specialties to other European financial centres as a result of Brexit," Christopher Giancarlo, chairman of the Commodity Futures Trading Commission (CFTC), said on Tuesday.

Banks, insurers and asset managers using London as a gateway to investors across the EU have opened hubs in Dublin, Paris, Frankfurt, Amsterdam and Luxembourg to maintain customer links.

"Despite this, I believe that London will remain one of the world's major financial centres and Europe's largest," Giancarlo said in a speech in London's financial district.

EU policymakers want to see chunks of clearing in euro-denominated transactions shifted from London to Frankfurt where they can be closely scrutinised, in a proposed move Giancarlo called "Fortress Europe".

Giancarlo said it was not in the EU's interests to restrict financial activities to the euro zone as the bloc needs the type of access to global capital that no EU city was capable of assembling any time soon.

"In short, the EU needs the City of London, and the City of London needs the EU. I expect that sooner or later that is going to become apparent to the political classes on both sides of the Channel," said Giancarlo, who is due to step down shortly.

Even without Brexit, there would be some "rebalancing" between London and other European financial centres as the EU builds a capital markets union, he said.

London also needs the EU to remain an integral part of the European economy and avoid becoming an "offshore" financial centre, Giancarlo added.

Brussels has said that financial firms in Britain face a narrow form of access to the EU available to other "third" countries like the United States and Japan, which falls far short of the unfettered access enjoyed at present.

Giancarlo said that keeping London "tethered" to Europe after Brexit should be a starting point for policymakers, otherwise activities will flow from Britain to New York and Asia, and Europe's economy would suffer.

Brussels rejected a broad two-way form of "mutual recognition" access proposed by Britain's financial sector and Giancarlo said industry needed to step up.

"Leaders of business and finance from both sides of the Channel need to get together and persuasively explain to their respective political representatives why the EU and the City need each other," Giancarlo said.

"It is time to pull out a fresh sheet of paper and draw up the right arrangement between the EU and a post-Brexit London."