Benzinga - by The Arora Report, Benzinga Contributor.

To gain an edge, this is what you need to know today.

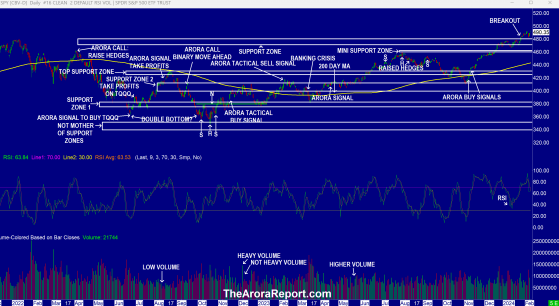

Blowout Jobs Report And Earnings Please click here for an enlarged version of the chart of SPDR S&P 500 ETF Trust (ARCA:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows a rally after a shallow pullback.

- The chart shows that the shallow pullback approached but did not penetrate the high band of the support zone. From a technical perspective this is a positive.

- The chart shows an attempt of a new breakout. This new breakout would have likely followed through if it was not for the jobs report data upsetting bulls’ hopium this morning.

- The jobs report is a blowout. Here are the details:

- Non-farm payrolls came at 353K vs. 175K consensus.

- Non-farm private payrolls came at 317K vs. 150K consensus.

- Unemployment rate came at 3.7% vs. 3.8% consensus.

- Average work week came at 34.1 vs. 34.4 consensus.

- This is the strongest jobs report since January 2023.

- In The Arora Report analysis, this jobs report is simply too strong for the Fed to cut rates. Even though Powell was clear that a rate cut in March was not the base case, stock market bulls have continued to buy stocks on hopes of a rate cut in March.

- In The Arora Report analysis, this jobs report significantly upsets stock market bulls’ hopium. If it was not for the blowout earnings from Amazon.com, Inc. (NASDAQ: AMZN) and Meta Platforms Inc (NASDAQ: META), the stock market would have likely fallen by as much as 1000 DJIA points on this report. Now the questions for prudent investors are the following:

- In view of blowout earnings from AMZN and META, will the momo crowd even care about the jobs report?

- Will the new narrative of momo gurus that interest rates no longer matter ring true with investors?

- Layoffs helped AMZN and META report blowout earnings. If the premarket gains hold, META and AMZN have added about $275B in market cap since they reported earnings after the close yesterday.

- META is initiating its first dividend and a $50B buyback. The addition of a dividend and the buyback to stellar earnings is resulting in META stock running up 17.15% since it reported earnings to the time of this writing. This is highly unusual for a $1T company. When a $1T company starts moving like a penny stock, you know that the positive sentiment is at an extreme.

- At extremes, sentiment is a contrary indicator. In plain English, extreme positive sentiment is a sell signal.

- As we have been sharing with you, sentiment is not a precise timing indicator. It should be only one component of a 360 degree analysis such as the one provided by the adaptive ZYX Asset Allocation Model with inputs in ten categories.

- META initiating a dividend will put pressure on other cash rich tech companies to initiate dividends. Going forward, speculation of tech companies adding dividends will add fuel to the fire of extreme optimism about tech companies.

- The historical pattern of trading in META stock after earnings is that the stock runs up right after the earnings report and later on during the conference call, the stock falls when guidance is given. This historical pattern makes trading META stock after earnings a losing proposition. However, yesterday was different. Because of extreme positive sentiment, no pullback occurred during the conference call.

- We have been sharing with you the semiconductor breakthrough in China that led to an incredible Huawei phone. Our call has been that the Huawei phone will undermine Apple iPhone sales in China. We have also been warning you about the China risk to Apple. These calls have proven spot on. Apple sales in China declined by 13%. This caused an initial pullback in Apple Inc (NASDAQ: AAPL). However, sentiment is so extreme in the stock market that the slight dip in AAPL stock is being aggressively bought in the premarket as investors ignore the drop in sales in China.

- In The Arora Report analysis, investors need to be mindful that market conditions are such that good news is great news and bad news is good news. These are precisely the market conditions when prudent investors should stay alert and build cash and hedges. Building cash and hedges now will allow for taking advantage of better buying opportunities in the future.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

In the early trade, money flows are neutral in Alphabet Inc Class C (NASDAQ: GOOG).

In the early trade, money flows are negative in AAPL and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows were extremely positive in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ) before the release of the jobs report. Since the release of the jobs report, money flows have become negative.

Oil Oil is being sold on the prospect of a ceasefire deal in the Middle East.

The most popular ETF for oil is United States Oil ETF (ARCA:USO).

Bitcoin Bitcoin (CRYPTO: BTC) is moving up with positive sentiment emanating from tech stocks.

Protection Band And What To Do Now It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of seven year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the 2008 financial crash, the start of a mega bull market in 2009, the COVID crash, the post-COVID bull market, and the 2022 bear market. Please click here to sign up for a free forever Generate Wealth Newsletter.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga