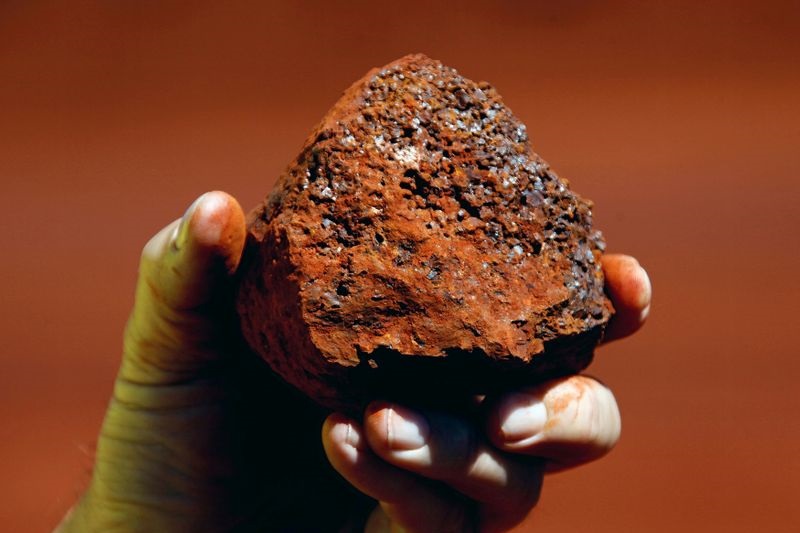

SHANGHAI - DCE iron ore futures saw a notable increase today, appreciating by 2.39%, and settled at 963.5 yuan per metric ton. This rise comes amid a period of high domestic prices which have subsequently dampened the purchasing interest of steel mills due to weak speculative demand.

In today's trading, PBF (Premium Blast Furnace) transactions were recorded at two major Chinese ports; prices reached 1010 yuan per metric ton at Shandong port and 1018 yuan per metric ton at Tangshan port. Despite the uptick in futures prices, the elevated cost of iron ore has influenced purchasing behaviors within the industry.

Additionally, inventory levels at these major ports have seen a significant increase. Over the past week, stockpiles have grown by more than three million tons, bringing the total to 115.1 million tons. This accumulation of inventory could indicate a slowdown in consumption by steel mills, which are likely responding to the pressure of higher raw material costs.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.