Proactive Investors - UK investors have just put more money into the market than any month since 2021 but most of it went into US stocks rather than British ones.

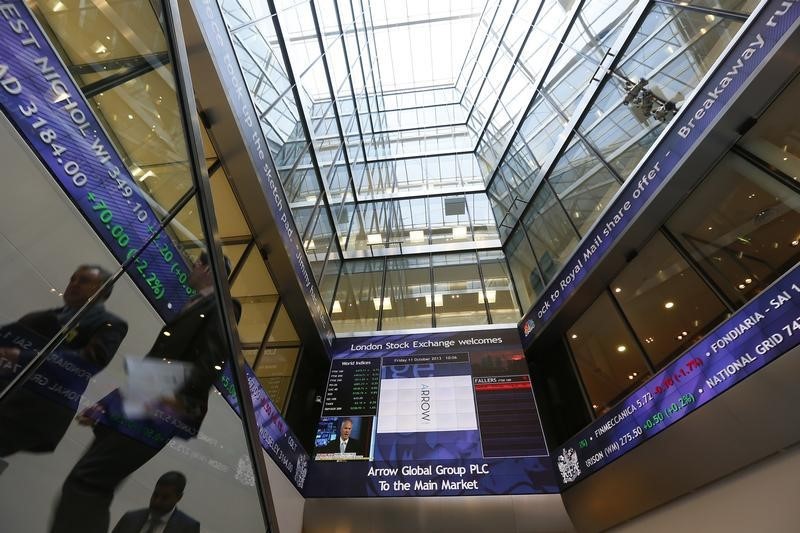

Fund network Calastone said UK-specific funds saw outflows of £673 million in January, adding UK funds have now recorded outflows in every month since June 2021.

That was despite total inflows rising to £2.01 billion in January, making it three months running investors have increased holdings in equities overall.

US equity funds were the beneficiaries with a record £1.4bn worth of flows from UK investors into their coffers.

"The markets are convinced that disinflation will bring rate cuts earlier and faster than previously expected, especially in the US," said Calastone.

"This has driven an equity market rally, particularly among the US tech stocks whose share prices benefit most from lower bond yields."

British funds, by contrast, have seen outflows of £8 billion in each of the last two years with the “doom and gloom” set to continue, Calastone predicts.

"UK equities are exceptionally cheap by historic and international comparisons, but buyers are nowhere to be found," said Edward Glyn, Calastone’s head of global markets.

European funds also saw inflows of £471m, their third-best month on record.

Asia-Pacific-focused funds though had money flowing out, dragged down by negative sentiment around China.