Investing.com - Markets are closely monitoring inflation data when repositioning their portfolios. In this scenario, experts share their investment recommendations.

- How to invest to maximize benefits from inflation? Don’t hesitate! Try InvestingPro! Subscribe HERE AND NOW and get almost 40% off for a limited time on your 1-year plan!

"Investors may need to rethink how they position their portfolios if inflation declines as expected this year and in 2025. The sharp drop in U.S. inflation during 2023 raised hopes for aggressive interest rate cuts by the Federal Reserve (Fed). But since then, the market has gone from expecting six to seven rate cuts to just two," warn Tina Fong, strategist at Schroders (LON:SDR), and Ben Read, economist at Schroders.

"With more resilient economic growth and higher-than-expected inflation, expectations for rate cuts have decreased. Fed Chairman Jerome Powell recently stated that the central bank is taking ‘longer than expected’ to reach its 2% inflation target," these experts point out.

That said, according to Schroders analysts, "inflation is still expected to fall to 2-3% this year and for the overall U.S. CPI rate to approach the central bank's 2% target by 2025. This should pave the way for the first rate cut to occur by the end of 2024."

What are the equity styles and sectors?

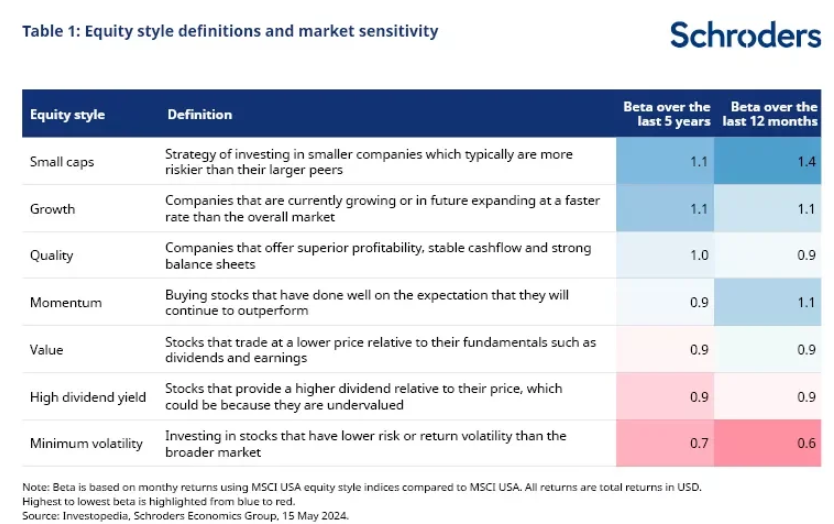

In a world where inflation tends to decrease, how should investors position their portfolios in terms of equity sectors and styles? Before delving into how different inflationary environments affect the performance of equity sectors and styles, Table 1 summarizes the different equity styles.

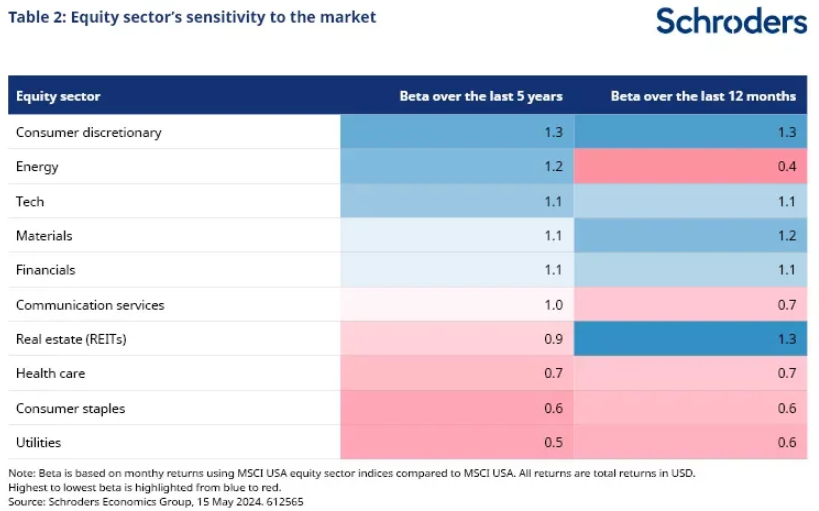

This table shows the beta to illustrate the sensitivity of the investment strategy to overall market behavior. For example, more defensive equity styles, such as value and high dividend, or sectors like utilities and healthcare, have a beta of less than 1. These are the areas that tend to perform better when the market declines, according to Schroders.

Conversely, cyclical styles like small-cap stocks or growth stocks, or sectors like consumer discretionary and energy, are more sensitive to overall market behavior. Although beta can change over time, as seen in the energy sector, which has become less sensitive to the general market in the last 12 months.

"With U.S. inflation at 3.5%, within the 3-5% range, more defensive equity sectors and styles usually perform well. However, cyclical sectors like energy and financials also tend to perform better. In contrast, growth assets, technology, and consumer discretionary assets typically struggle in this inflationary environment. However, these assets performed well last year when inflation fell below 5%, driven by improved earnings," explain Schroders analysts.

"As inflation falls to 2-3% this year, past patterns suggest that momentum style and technology assets are likely to perform better," they conclude.

How to continue taking advantage of market opportunities? Take advantage HERE AND NOW of the opportunity to get the annual InvestingPro plan at a discount. Use the code INVESTINGPRO1 and get a 40% discount on your 1-year subscription. With this, you will get:

With it, you will get:

- ProPicks: stock portfolios managed by a mix of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify complex financial data into a few words.

- Fair Value and Health Score: two synthetic indicators based on financial data that provide an immediate view of each stock's potential and risk.

- Advanced stock screener: Search for the best stocks based on your expectations, considering hundreds of metrics and financial indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can look for all the details.

- And many other services, not to mention those we plan to add soon!

Act fast and join the investment revolution! Get your OFFER HERE!