Benzinga - by Benzinga Insights, Benzinga Staff Writer.

In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Advanced Micro Devices (NASDAQ:AMD) in relation to its major competitors in the Semiconductors & Semiconductor Equipment industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company's performance in the industry.

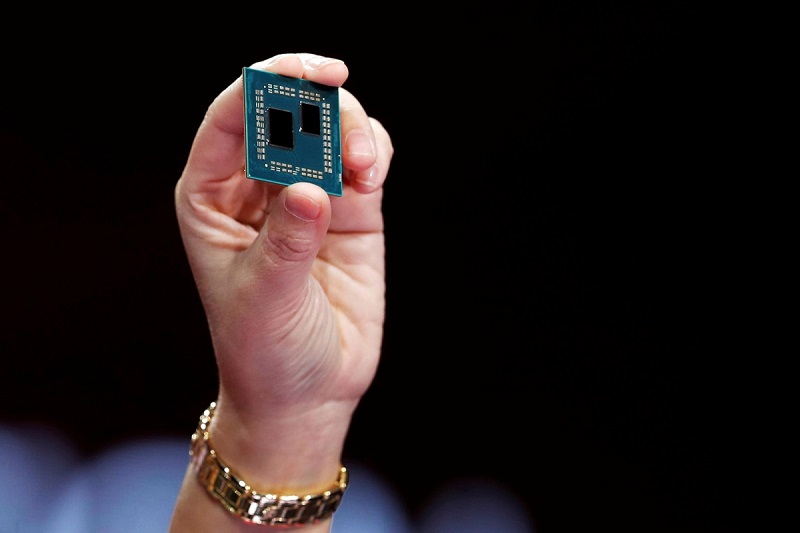

Advanced Micro Devices Background Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

| Advanced Micro Devices Inc | 1616.64 | 5.23 | 13.06 | 0.54% | $1.13 | $2.75 | 4.22% |

| NVIDIA Corp | 82.42 | 46.39 | 34.67 | 30.42% | $10.96 | $13.4 | 205.51% |

| Broadcom Inc | 36.92 | 23.77 | 14.52 | 15.3% | $5.3 | $6.41 | 4.09% |

| Intel Corp | 109.60 | 1.76 | 3.41 | 2.57% | $5.57 | $7.05 | 9.71% |

| Qualcomm Inc | 22.95 | 7.74 | 4.70 | 7.05% | $2.06 | $4.75 | -24.26% |

| Texas Instruments Inc | 23.49 | 8.93 | 8.68 | 8.18% | $1.98 | $2.43 | -10.04% |

| Analog Devices Inc | 30.12 | 2.75 | 8.11 | 1.39% | $1.18 | $1.65 | -16.36% |

| ARM Holdings PLC | 415.39 | 15.67 | 26.35 | -2.45% | $-0.12 | $0.76 | 27.94% |

| Microchip Technology Inc | 19.13 | 6.77 | 5.39 | 9.66% | $1.1 | $1.53 | 8.74% |

| STMicroelectronics NV | 10.05 | 2.42 | 2.45 | 6.69% | $1.43 | $1.95 | -3.36% |

| GLOBALFOUNDRIES Inc | 22.58 | 2.94 | 4.17 | 2.34% | $0.64 | $0.53 | -10.7% |

| ON Semiconductor Corp | 14.72 | 4.20 | 3.93 | 8.05% | $0.87 | $1.03 | -0.54% |

| ASE Technology Holding Co Ltd | 17.44 | 2.17 | 1.07 | 3.06% | $28.07 | $24.92 | -18.27% |

| United Microelectronics Corp | 8.88 | 1.77 | 2.62 | 4.72% | $29.0 | $20.46 | -24.3% |

| Skyworks Solutions Inc | 17.31 | 2.80 | 3.57 | 4.09% | $0.4 | $0.48 | -13.37% |

| First Solar Inc | 33.78 | 2.53 | 5.06 | 4.35% | $0.37 | $0.38 | 27.37% |

| Lattice Semiconductor Corp | 41.93 | 14.05 | 12.01 | 8.96% | $0.07 | $0.13 | 11.4% |

| Universal Display Corp | 41.66 | 6.15 | 14.55 | 3.77% | $0.06 | $0.11 | -12.13% |

| Rambus Inc | 27.87 | 8.22 | 17.46 | 10.86% | $0.12 | $0.08 | -6.19% |

| MACOM Technology Solutions Holdings Inc | 70 | 6.82 | 9.88 | 2.63% | $0.05 | $0.09 | -15.59% |

| Allegro Microsystems Inc | 21.07 | 4.81 | 4.98 | 6.18% | $0.09 | $0.16 | 15.92% |

| Average | 53.37 | 8.63 | 9.38 | 6.89% | $4.46 | $4.42 | 7.78% |

th, td { padding: 8px; text-align: left; }

th { background-color: #293a5a; color: #fff; text-align: left; }

tr:nth-child(even) { background-color: #f2f4f8; }

tr:hover { background-color: #e1e4ea; }

td:nth-child(3), td:nth-child(5) { text-align: left; }

.dividend-amount { font-weight: bold; color: #0d6efd; }

.dividend-frequency { font-size: 12px; color: #6c757d; } After examining Advanced Micro Devices, the following trends can be inferred:

- The current Price to Earnings ratio of 1616.64 is 30.29x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

- Considering a Price to Book ratio of 5.23, which is well below the industry average by 0.61x, the stock may be undervalued based on its book value compared to its peers.

- The stock's relatively high Price to Sales ratio of 13.06, surpassing the industry average by 1.39x, may indicate an aspect of overvaluation in terms of sales performance.

- With a Return on Equity (ROE) of 0.54% that is 6.35% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

- The company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.13 Billion, which is 0.25x below the industry average. This potentially indicates lower profitability or financial challenges.

- Compared to its industry, the company has lower gross profit of $2.75 Billion, which indicates 0.62x below the industry average, potentially indicating lower revenue after accounting for production costs.

-

The company's revenue growth of 4.22% is significantly lower compared to the industry average of 7.78%. This indicates a potential fall in the company's sales performance.

The debt-to-equity (D/E) ratio helps evaluate the capital structure and financial leverage of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Advanced Micro Devices and its top 4 peers reveals the following information:

- In terms of the debt-to-equity ratio, Advanced Micro Devices has a lower level of debt compared to its top 4 peers, indicating a stronger financial position.

- This implies that the company relies less on debt financing and has a more favorable balance between debt and equity with a lower debt-to-equity ratio of 0.05.

The low ROE of Advanced Micro Devices indicates that the company is not generating significant returns on its shareholders' equity. The low EBITDA suggests that the company's operating profitability is relatively weak. The low gross profit indicates that the company's cost of goods sold is high compared to its revenue. The low revenue growth suggests that the company's sales are not growing at a significant rate.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.