Benzinga - by Shanthi Rexaline, Benzinga Editor.

Nvidia Corp. (NASDAQ:NVDA) stock was the best-performing S&P 500 stock in 2023 and is the second-best performer in the category this year. The outperformance has to do with the company’s lead in the hot-and-happening artificial intelligence technology.

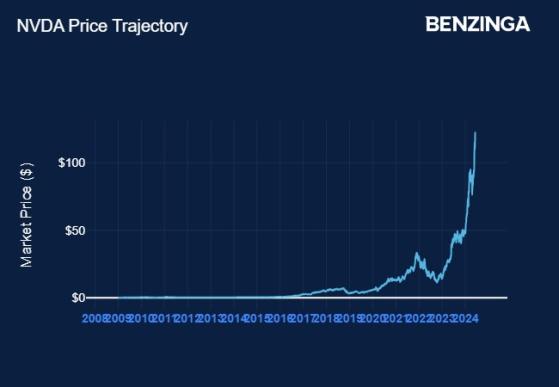

Nvidia’s Extended Sprint: The rally in Nvidia’s stock gained momentum since it broke above the Nov. 2021 peak in May 2023. It all started with the unveiling of OpenAI’s ChatGPT chatbot, which quickly caught on like wildfire and clarified the immense potential that AI offered.

Nvidia has become one of the biggest beneficiaries of the AI revolution due to the near monopoly position it has in the market for AI accelerators, which power most AI training and inference and other AI applications. The company’s Data Center business rose in prominence amid Nvidia’s transition from a gaming company to an AI stalwart. In the most recent quarter, the company reported Data Center revenue of $22.6 billion, thanks to the red-hot year-over-year growth pace of 427%. The business accounted for about 87% of the total revenue.

The stock has gained 730% since the start of 2023 and more than 144% this year.

And what’s more. Analysts and industry experts say the AI revolution is only in its first leg and will play out over the next three to five years.

Returns From Nvidia: If an astute investor had made a hypothetical $1,000 bet in Nvidia in 2009, he would have made a kill with his investment.

Source: Benzinga

A $1,000 invested in Nvidia at the end of 2008 would have fetched about 5,263.16 shares (based on a split-adjusted price of $0.19 on Dec. 31, 2008). Here’s how much these 5,263.16 shares would have been worth at the end of each subsequent year.

| Year | End-year Holding |

| 2009 | $2,263.16 |

| 2010 | $1,842.11 |

| 2011 | $1,684.21 |

| 2012 | $1,473.69 |

| 2013 | $2,000.00 |

| 2014 | $2,526.32 |

| 2015 | $4,210.53 |

| 2016 | $13,842.11 |

| 2017 | $25,210.54 |

| 2018 | $17,421.06 |

| 2019 | $30,842.12 |

| 2020 | $68,578.98 |

| 2021 | $154,579.01 |

| 2022 | $76,894.77 |

| 2023 | $260,631.68 |

If the investor held the shares until 2023, his return over the 15-year timeframe would have been 25,963.17% over and above what he invested.

In premarket trading, Nvidia shares fell 0.61% to $120.15, according to Benzinga Pro data, as the stock begins trading on a split-adjusted basis.

Read Next: ‘Wow:’ Elon Musk Applauds Nvidia’s $3-Trillion Milestone — Here’s How Tesla Stock Stacks Up Against AI Giant

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga