Just as you thought the month was about to end, another one of our top selection of Al-powered picks is rallying.

Applied Materials (NASDAQ:AMAT) has seen a remarkable 20% increase since being featured in our Beat the S&P strategy at the beginning of the month. This surge was fueled by its Q1 results, which exceeded expectations thanks to robust demand for advanced chips for artificial intelligence and a revival in the PC market.

But the list doesn't stop there. Our regular readers would know that we just keep on picking winners, day after day.

And what's more impressive? All that for just under $9 a month. In essence, opting out of ProPicks means you're overlooking potential gains - or to put it bluntly, leaving money on the table.

By the way, our AI will rebalance again tomorrow, providing you with 70+ fresh top picks for March.

Subscribe now and don't miss out on the bull market by not knowing what to buy!

Don't believe us? Check out these other winners our predictive AI picked for you in February.

American Express

Shares of American Express (NYSE:AXP) reached their all-time high yesterday. This extraordinary performance was seen in advance by ProPicks. The company has been an integral part of our Dominate the Dow strategy since December 2023. Subscribers who joined us at that time would have seen a 28% return on their investment in American Express alone.

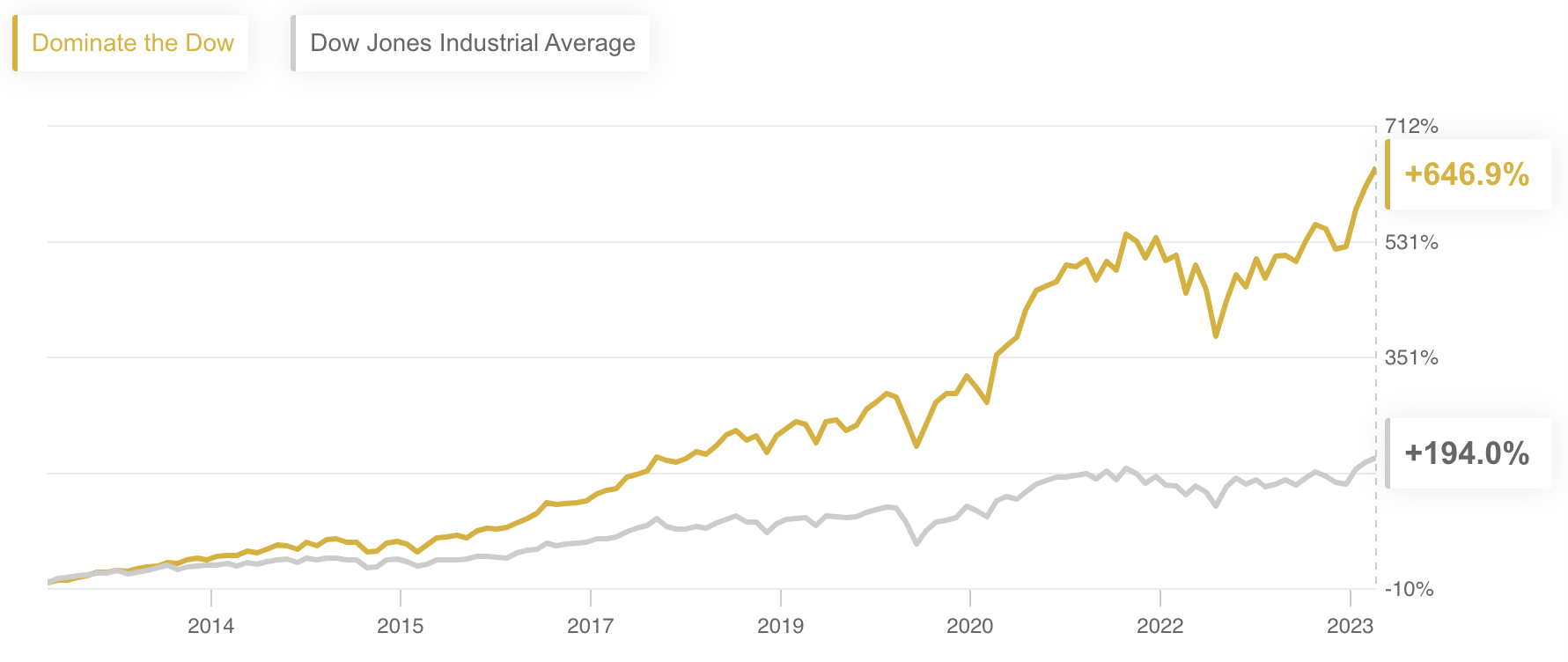

Dominate the Dow, focuses on identifying 10 standouts from stocks in the Dow Jones Industrial Average most likely to outperform the market. Over the past ten years, this strategy outperformed the market by an impressive 452.9%.

Super Micro Computer

Shares of Super Micro Computer (NASDAQ:SMCI) experienced a remarkable increase, soaring over 187% year-to-date. This surge can largely be attributed to its impressive Q2 earnings, which surpassed analyst expectations due to the continued demand for data center hardware driven by AI advancements. Super Micro Computer was added to our Tech Titans strategy at the beginning of January, coinciding with the start of its significant growth phase.

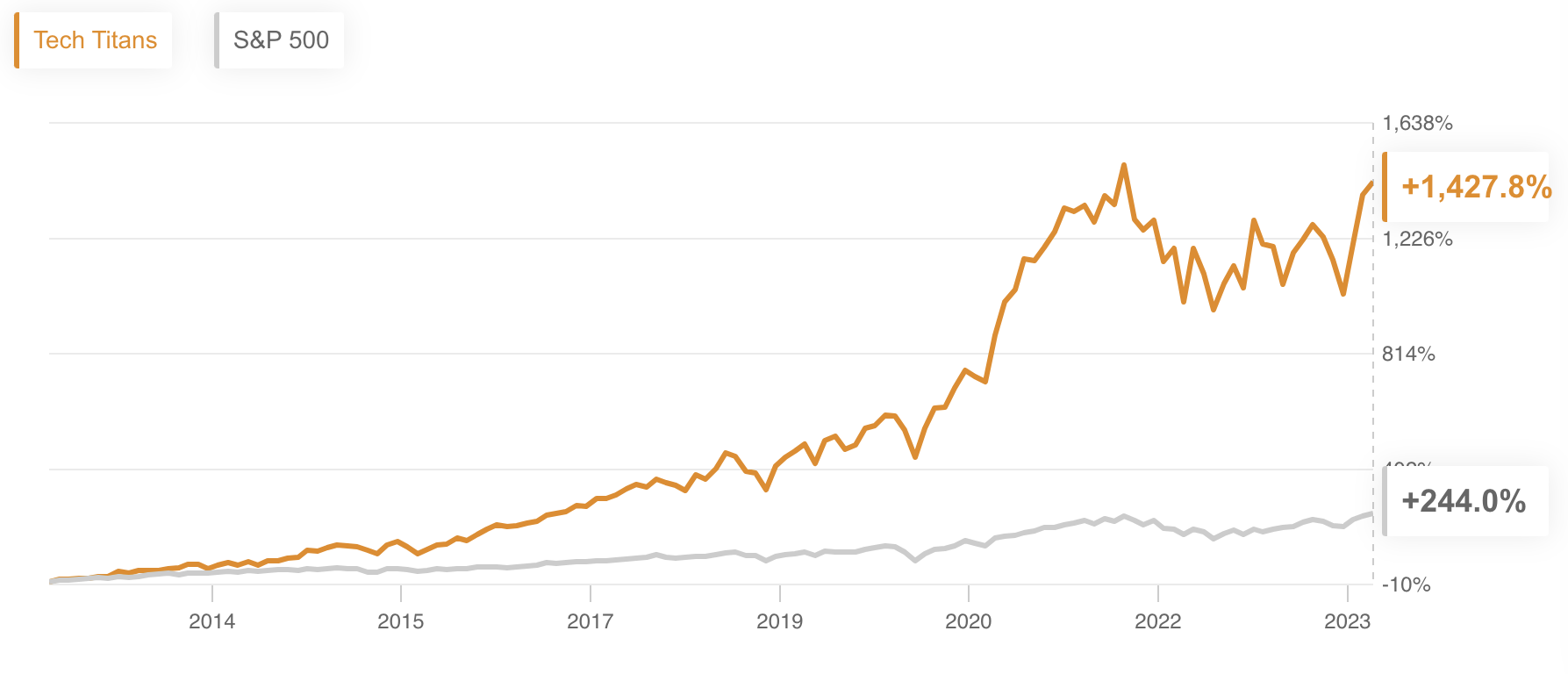

Tech Titans strategy, focused on identifying 15 companies with the most exciting tech opportunities, outperformed the market by a lofty 1,183.8% over the last decade.

PACCAR

PACCAR (NASDAQ:PCAR) shares saw an increase of over 14% year-to-date, buoyed by robust Q4 results in January that surpassed consensus estimates. The company reported a record-breaking revenue of $35.13 billion for fiscal 2023, up from $28.82 billion in 2022. PACCAR has been an integral part of our Top Value Stocks strategy from December 1 to January 31. During these two months, the stock experienced a surge of more than 13%.

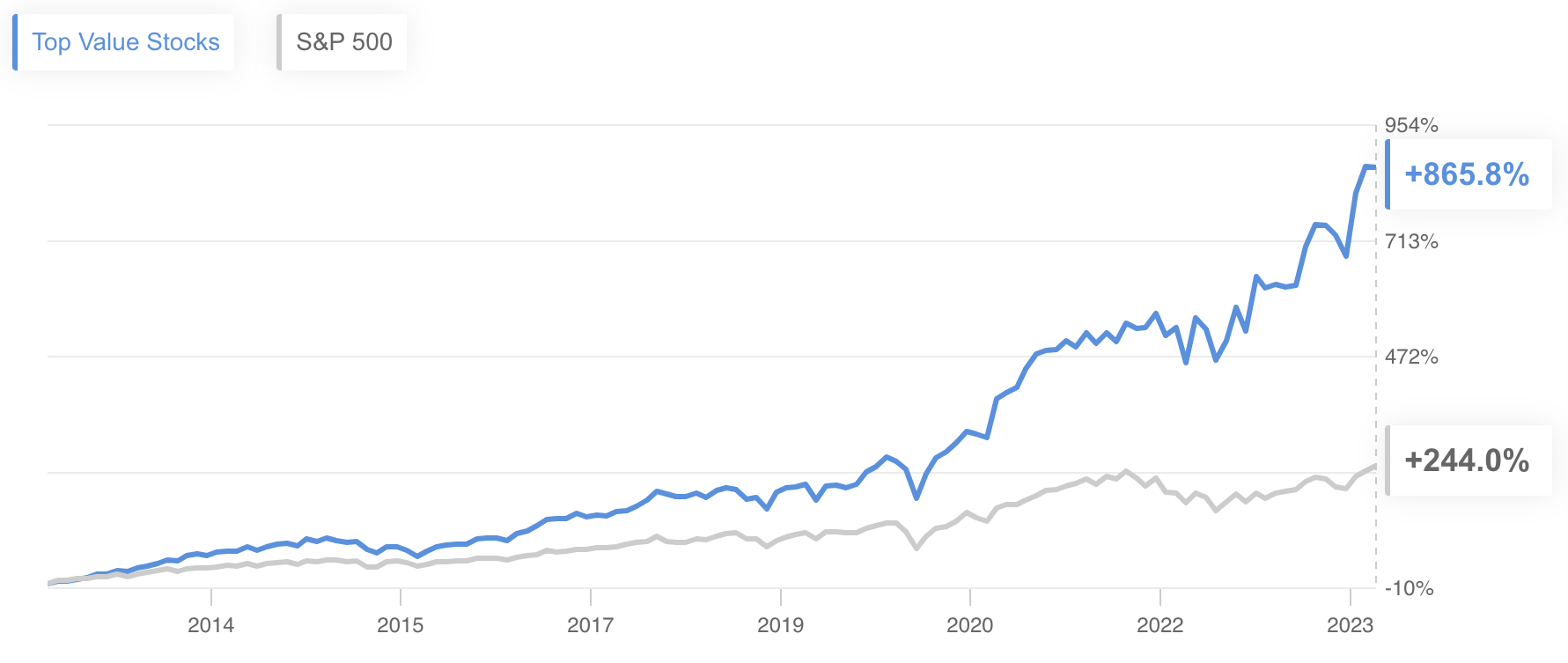

Top Value stocks strategy focuses on identifying up to 20 undervalued U.S.-listed stocks, each with solid earnings that are primed for growth. These companies are usually trading lower than their perceived intrinsic value - which means they're also a potentially huge bargain. This strategy outperformed the market by 621.8% over the last decade.

Cirrus Logic

Cirrus Logic (NASDAQ:CRUS), renowned for its low-power, high-precision mixed-signal processing solutions that enhance user experiences across top mobile and consumer applications, has experienced a notable uptick following its release of better-than-expected Q3 financial results earlier this month. The company was added to our Mid-Cap Movers strategy at the beginning of February. Since then the stock gained a solid 16%.

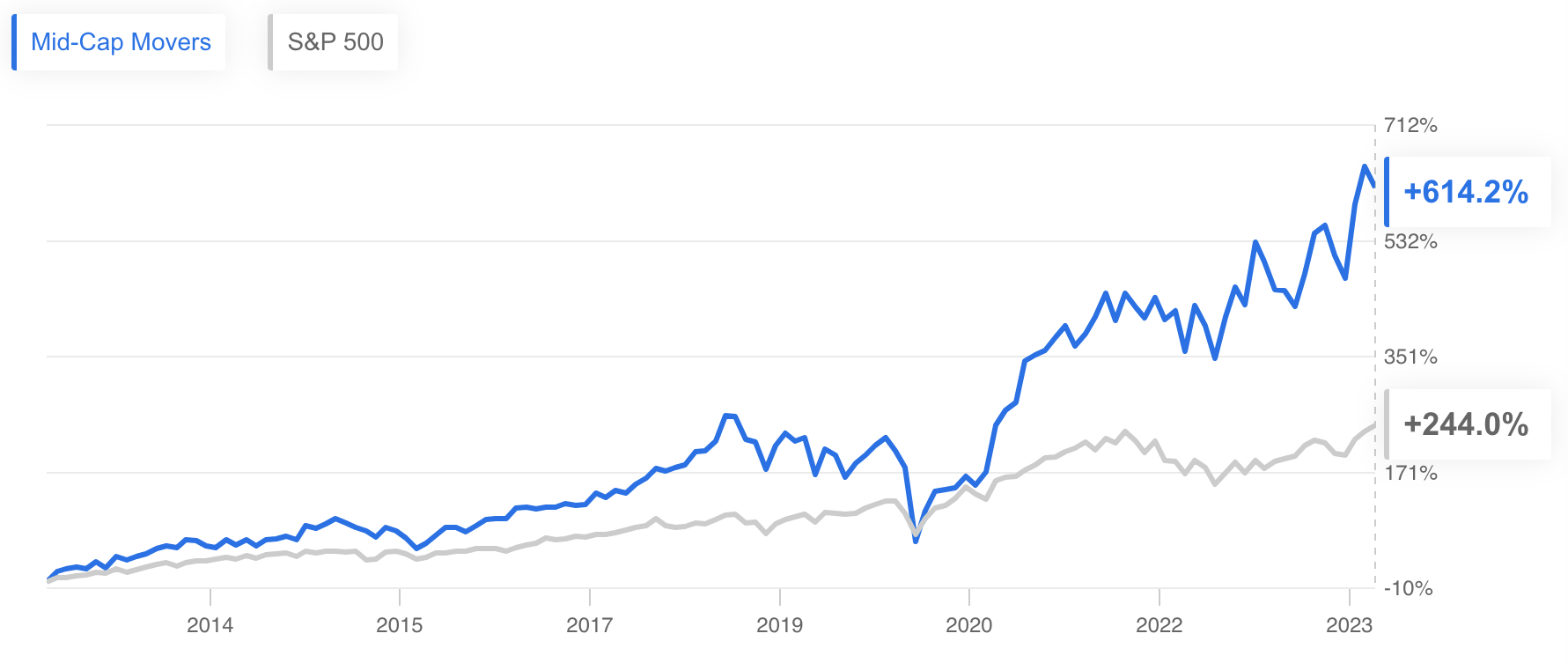

Subscribing to ProPicks grants you access to a curated list of 20 stocks in our Mid-Cap Movers strategy, each chosen for their promising growth prospects and solid fundamentals. This strategy outperformed the market by an impressive 370.2% over the last decade.

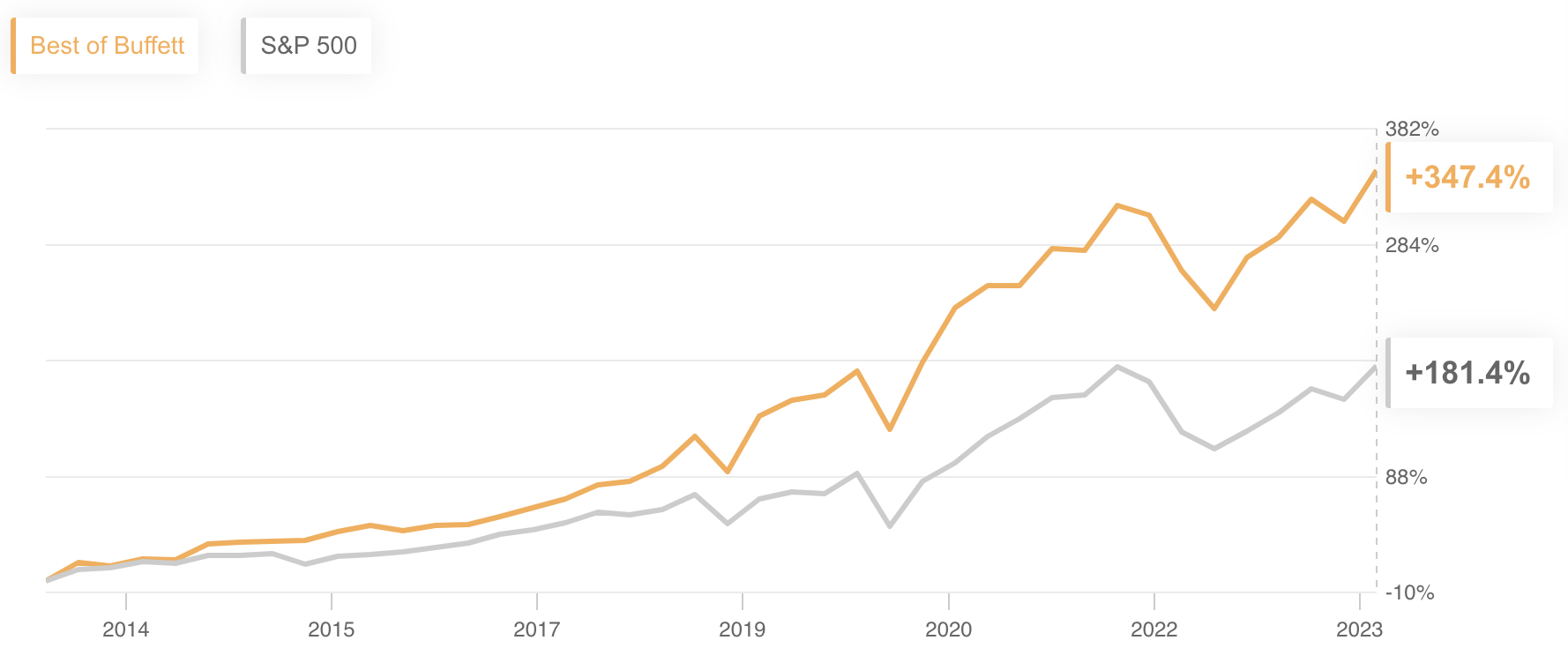

Concluding our suite of six strategies is the Best of Buffett strategy, which meticulously selects only the best stocks within Berkshire Hathaway (NYSE:BRKa) 's (NYSE:BRKb) portfolio. These stocks are evaluated then every quarter (every time Buffett's quarterly 13F holdings are disclosed) to ensure up-to-date accuracy.

This refined selection process has demonstrated its superiority by outpacing the S&P 500 by an impressive 174.3% over the past decade.

And these are just a few stocks from a robust selection of 70+ companies distributed across six market-beating strategies. Want to see all our market-beating picks? Join the elite circle of ProPicks users and start outperforming the market today. Remember, it's not just about the stocks you pick; it's about picking the right tool for the job. And with ProPicks, you're always one step ahead.

Subscribe here and never miss a bull market again!