(Reuters) -Bloomsbury Publishing forecast annual profit and revenue "significantly ahead" of market expectations on Wednesday, partly buoyed by robust sales of the latest fantasy title in the Crescent City series by Sarah J. Maas.

Shares in the FTSE Small Cap firm rose about 9% to a record high of 534 pence in early trade.

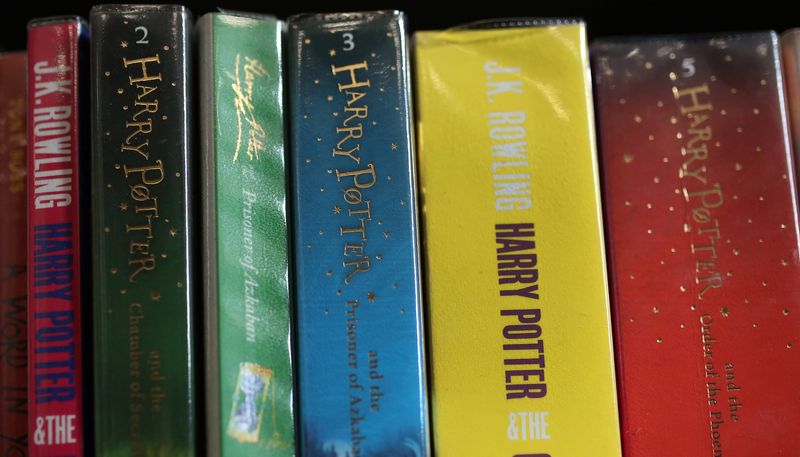

The publisher has benefited from the popularity of fantasy fiction around the world in recent years as readers increasingly pick up novels by popular authors in the genre such as Maas and J.K. Rowling.

Bloomsbury (LON:BLPU), best known for picking up Rowling's Harry Potter series in 1997 after it was rejected by a dozen other publishers, said Maas' novel "House of Flame and Shadow" has become the top seller in the United States, Britain, Australia and many markets around the world.

The publication of the novel last month had also driven demand for Maas' previous 15 books, which Bloomsbury has published throughout the world in English, the company said in a statement.

"House of Flame and Shadow" is the story of a half-fairy, half-human woman, and is the third book in the Crescent City series.

"The cash generation of previous periods has underpinned ongoing investment to support content that should deliver further profitable growth in the years to come," Investec analysts wrote in a note.

Bloomsbury also publishes fantasy bestselling authors Samantha Shannon and Cixin Liu, whose "Three Body Problem" trilogy, the film adaptation of which will be released on Netflix (NASDAQ:NFLX) next month.

The London-headquartered firm said the consensus market expectations for the year ending Feb. 29, 2024, was for revenue of 291.4 million pounds ($366.4 million) and profit before taxation and highlighted items of 37.2 million pounds.

It had reported a profit of 25.4 million pounds on revenue of 264.1 million pounds in the 2023 fiscal year.

($1 = 0.7954 pounds)