Benzinga - by Piero Cingari, Benzinga Staff Writer.

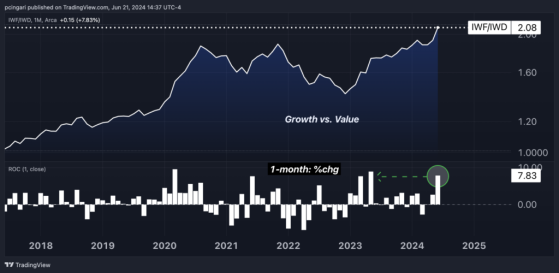

Growth stocks are experiencing a remarkable resurgence, posting their best month in over a year when compared to value stocks, as the rally in tech and mega caps continues to dominate market dynamics.

The iShares Russell 1000 Growth ETF (NYSE:IWF) has surged by 6.5% so far in June 2024. This gain puts it on track for its seventh month of increases in the last eight.

Investors have shown elevated confidence in growth-oriented sectors, particularly technology, which continues to benefit from strong earnings reports, heightened expectations for future cash flows and positive market sentiment, especially towards AI-related industries.

In stark contrast, the iShares Russell 1000 Value ETF (NYSE:IWD), representing the other major equity style, has declined by 1.4% in June.

This divergence highlights the challenges facing value stocks, which typically encompass sectors like financials, energy, utilities, and consumer staples. These sectors have struggled to attract investor interest due to their less impressive performance and subdued earnings expectations.

The performance gap between growth and value in June 2024 stands at a striking 7.9 percentage points, marking the most substantial monthly performance difference since May 2023.

With one trading week remaining in the month, if the gap exceeds 9.6 percentage points, previously reached in March 2020, it will mark the largest one-month outperformance of growth over value ever recorded.

4 Key Factors Driving Growth’s Outperformance Over Value Technology Sector’s Dominance in Growth ETFs: The technology sector’s heavy weighting in growth-related ETFs has been the main driver of their outperformance. In the Russell 1000 Growth ETF, tech stocks comprise a substantial 47% of the portfolio. In stark contrast, the Russell 1000 Value ETF allocates only 9.5% to tech stocks.

Impact of Chipmakers on Growth Performance: Within the tech sector, the substantial weighting of chipmakers in growth funds has been another critical factor, as they have been the main beneficiaries of the current AI-driven rally. The semiconductor sector represents 17% of the growth ETF, compared to a mere 4.2% in the value ETF.

Absence of Nvidia, Magnificent 6 In Value ETFs: Notably, “The Magnificent 6” – as named by Bank of America – Nvidia Corp. (NASDAQ:NVDA), Microsoft Corp. (NYSE:MSFT), Apple Inc. (NASDAQ:AAPL), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon Inc. (NASDAQ:AMZN), and Meta Platforms Inc. (NASDAQ:META) – are absent from the value-linked ETF but collectively hold a 50% weight in the growth ETF.

Stock Concentration and Market Breadth Differences: The higher stock concentration in growth-related ETFs compared to value socks is another crucial factor, especially in the current context of poor market breadth. The top 10 stocks in the Russell 1000 Growth ETF comprise 57% of the overall portfolio, whereas the top 10 in the value-related ETF account for only 17% of the total weight.

Top 7 Performing Growth Stocks In June

| Name | Price Chg. % (MTD) |

| Broadcom Inc. (NASDAQ:AVGO) | 26.85% |

| Texas Pacific Land Corporation (NYSE:TPL) | 22.95% |

| Sarepta Therapeutics, Inc. (NASDAQ:SRPT) | 22.88% |

| Adobe Inc. (NASDAQ:ADBE) | 19.95% |

| Oracle Corporation (NYSE:ORCL) | 19.91% |

| CrowdStrike Holdings, Inc. (NASDAQ:CRWD) | 19.48% |

| Autodesk, Inc. (NASDAQ:ADSK) | 19.04% |

Top 7 Performing Value Stocks In June

| Name | Price Chg. % (MTD) |

| Coherent Corp. (NYSE:COHR) | 24.68% |

| DC Technology Company (NYSE:DXC) | 20.23% |

| Guidewire Software, Inc. (NYSE:GWRE) | 19.58% |

| Universal Display Corporation (NASDAQ:OLED) | 18.71% |

| Ollie’s Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) | 18.52% |

| Zillow Group, Inc. (NYSE:ZG) | 17.88% |

| Hewlett Packard Enterprise Company (NYSE:HPE) | 16.29% |

Read now: 5 Charts Expose Troubling Weaknesses In Record-High Stock Market: ‘This Is Not Normal’

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga