Benzinga - by Zacks, Benzinga Contributor.

Gold futures for August delivery are currently around $2,343 per ounce, delivering a year-to-date rise of 13.5%. Gold is currently at two-week highs, buoyed by lackluster U.S. economic data that has led to expectations of interest rate cuts by the Federal Reserve this year. So far in 2024, gold has been consistently above the $2,000-per-ounce mark, surging to an unprecedented high of $2,449.50 in May. Several factors have contributed to this upward trajectory, including increased geopolitical tensions, a depreciating U.S. dollar, the potential for monetary policy easing and continuous purchasing by central banks.

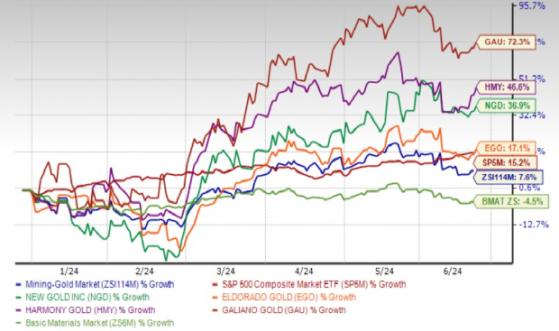

The prospects for the Zacks Mining - Gold industry look optimistic, supported by the momentum in gold prices. We suggest keeping a tab on companies like Harmony Gold (NYSE: HMY), Eldorado Gold (NYSE: EGO), New Gold Inc. (AMEX:NGD) and Galiano Gold (AMEX:GAU), as these are well-poised for improvement, backed by their strong balance sheets, efforts to lower costs and growth initiatives.

Weak U.S Data Work in Favor of Gold Per the U.S. Census Bureau's latest report, retail and foodservices sales in the United States inched up 0.1% in May 2024 from April 2024. On a year-over-year basis, sales rose 2.3%. This weaker-than-expected performance indicates that consumers are grappling with stubbornly higher levels of inflation. The market is currently pricing in about a 66% chance of a Fed rate cut in September, which has aided gold prices lately.

The Institute for Supply Management's manufacturing index languished in contraction territory for a consecutive 16 months until February 2024. Even though it saw a slight uptick to 50.3% in March, the index slipped to the contraction territory again in April with a 49.2% reading. It further decelerated to 48.7% in May. This continued weakness in the manufacturing sector has contributed to heightened economic uncertainty, boosting investor interest in gold as a safe-haven asset and thereby hiking gold prices.

Demand & Supply Imbalance to Support Prices Central banks, particularly China, have been ramping up reserves held in gold due to currency depreciation, and geopolitical and economic risks. In 2022, central banks added 1,082 tons of gold, marking the highest annual purchase on record. This was followed by 1,037 tons of gold purchases in 2023, which was the second highest.

According to the 70 responses to the 2024 Central Bank Gold Reserves survey, 29% of central banks have plans to increase their gold reserves in the next 12 months. This is the highest projection since the initiation of the survey in 2018.

The use of gold in energy, healthcare and technology is rising. India and China account for around 50% of consumer gold demand. Economic strength in India is yielding wealth-driven buying. Physical demand has also been strong in China of late since the weaker yuan, volatile stock market and comparatively low deposit rates have led investors to explore alternatives for their savings.

Meanwhile, depleting resources, declining supply in old mines and the lack of new mines have been inherent threats to the industry. Therefore, this will eventually create a demand-supply imbalance, which is likely to drive gold prices.

4 Gold Stocks to Buy We have handpicked four gold-mining stocks, which currently sport a Zacks Rank #1 (Strong Buy) or #2 (Buy) and have solid growth potential.

The chart below shows the price performances of these stocks year to date. These stocks have outperformed the industry as well as the broader Basic Materials sector and the S&P 500.

Image Source: Zacks Investment Research

New Gold: In the first quarter of 2024, the company's New Afton mine delivered a strong performance, producing 18,179 ounces of gold and 13.3 million pounds of copper. Both gold and copper productions were in line with the company's guidance. The Rainy River mine produced 52,719 ounces of gold. At Rainy River, the underground Main Zone is on target to produce its first ore in the fourth quarter of 2024. The company is on track to meet the 2024 consolidated production forecast of 310,000-350,000 ounces of gold and 50-60 million pounds of copper at all-in-sustaining costs of $1,240-$1,340 per gold ounce sold. Rainy River gold production is likely to expand dramatically over the next three years as underground mill feed increases.

NGD recently signed an agreement relating to its strategic partnership with the Ontario Teachers' Pension Plan for the New Afton Mine that will increase its effective free cash flow interest in the mine to 80.1%. This transaction is projected to result in a significant increase in attributable life-of-mine cash flow, while keeping New Gold's balance sheet strong and financially liquid. Continued focus on operational discipline and investment in growth projects will aid the company.

The Zacks Consensus Estimate for the Toronto, Canada-based company's 2024 earnings has moved up 50% over the past 60 days. The consensus estimate indicates year-over-year growth of 71%. NGD currently sports a Zacks Rank #1.

Eldorado Gold: The company produced 117,111 ounces of gold in the first quarter of 2024, up 5% year over year, reflecting higher gold production at most sites, notably at Lamaque (up 12%) and Olympias (up 14%). EGO expects production between 505,000 to 555,000 ounces of gold in 2024. The mid-point of the range suggests a 9% year-over-year increase. Project costs and schedule are on track for its development project, Skouries, with commercial production expected to commence at the end of 2025.

March 2024 marked five years since the start of commercial production at the Lamaque Complex in Quebec. The complex has produced 848,014 ounces of gold, which exceeded EGO's expectations by 32% compared with the initial pre-feasibility study of 644,100 ounces. With the inaugural reserve expected at Ormaque later this year, the prospects of the Lamaque Complex are solid.

Eldorado Gold is based in Vancouver, Canada. The Zacks Consensus Estimate for the company's fiscal 2024 earnings has moved up 49% over the past 60 days. The estimate indicates year-over-year growth of 91.2%. The company has an estimated long-term earnings growth of 50.8%. EGO has a trailing four-quarter earnings surprise of 430.7%, on average. The company currently carries a Zacks Rank #2.

Galiano Gold: In March 2024, GAU acquired Gold Fields Group's 45% interest in the Asanko Gold Mine. With this move, Galiano Gold established itself as a growing gold producer with solid financial strength, owning and operating one of the largest gold mines in West Africa. The mine produced 30,386 ounces of gold in the first quarter of 2024. Output is expected to increase in the second half of 2024 after the completion of waste stripping at the Abore deposit, and the company expects to achieve 2024 production guidance of 140,000-160,000 ounces.

GAU recently announced an upgrade to the Mineral Resources at Abore by 38%. The company's planned exploration programs for 2024 include drilling at Midras South to advance the deposit toward a potential maiden Mineral Reserve estimate, infill drilling at Adubiaso, early-stage drill testing at Target 3 and extension drilling at Gyagyatreso. A property-wide reconnaissance program has also been designed to identify new target areas of interest.

Headquartered in Vancouver, Canada, Galiano Gold has an expected earnings growth of 117% for the current year. The Zacks Consensus Estimate for the company's fiscal 2024 earnings has moved up 37% over the past 60 days. GAU currently carries a Zacks Rank #2.

Harmony Gold: The company produced 1,182,405 ounces of gold in the first nine months of fiscal 2024, which marked a 10% year-over-year improvement. With this performance, the company raised its production target to 1.55 million ounces from the prior expectation of 1.38-1.48 million ounces of gold in fiscal 2024. The operating free cash flow surged 171% year over year to $468 million in the period, driven by operational excellence and higher recovered grades. The company's all-in sustaining costs declined 2% year over year to $1,457 per ounce in the period.

HMY continues to move down the industry cost curve. The company's efforts to reduce its debt levels appear encouraging and its flexible balance sheet continues to support its investments in its solid growth pipeline.

The Zacks Consensus Estimate for earnings for the Randfontein, South Africa-based company's fiscal 2024 has been revised upward by 5.6% over the past 60 days. The consensus mark indicates year-over-year growth of 109%. HMY currently carries a Zacks Rank #2.

To read this article on Zacks.com click here.

Read the original article on Benzinga