Proactive Investors -

- FTSE 100 at session highs after US data

- US non-farm payrolls rise 223,000, average earnings weaker than forecast

- EU CPI falls to 9.2% in December but core rate rises

1.40pm: US non-farm payrolls rise 223,000

US non-farm payrolls rose 223,000 in December, stronger than the 200,000 expected by analysts as the US job market continued to show its resilience.

There was also good news on average earnings which although 4.6% higher in December on an annual basis were lower than the 5% forecast while there were also downward revisions to November's numbers.

The news sent US futres higher with Dow futures now up 290 points, S&P futures up 35 poinmts and Nasdaq futures up 96.

Back in London and the FTSE 100 is now up 48 points, at its best levels for the day.

US Change In Non-Farm Payrolls Dec: 223K (exp 202K, R prev 256K)-Unemployment Rate Dec: 3.5% (exp 3.7%, R prev 3.6%)

— LiveSquawk (@LiveSquawk) January 6, 2023

US Average Hourly Earnings (M/M) Dec: 0.3% (exp 0.4%, R prev 0.4%)-Average Hourly Earnings (Y/Y) Dec: 4.6% (exp 5.0%, R prev 4.8%)

— LiveSquawk (@LiveSquawk) January 6, 2023

12.42pm: Bet365 boss hits the jackpot

The Bet365 boss Denise Coates continued to win big netting more than £260mln in salary and dividends in the year to March 2022, according to the company accounts published on Friday.

The best-paid Bet365 director, thought to be Coates, received remuneration of £213mln for the year, about 15% lower than the £250mln awarded in the previous year.

As the company’s controlling shareholder she is also entitled to at least 50% of the £100mln dividend paid for the year.

The mammoth figure places her amongst the world’s top earners although it was £35mln lower than the previous year reflecting as the betting giant invested heavily in expansion.

12.15pm: Pound falls ahead of US jobs numbers, Goldman sees 225,000 rise in payrolls

The pound has fallen to its lowest level since mid-November as investors braced for US jobs data due later today that will help chart the path forward for Federal Reserve monetary tightening.

Sterling has slipped by 0.4% today to US$1.185 after data yesterday suggested the US labour market has held up more strongly than hoped, raising the prospect of the US Federal Reserve continuing to increase interest rates in a bid to tame inflation.

Looking ahead to those non-farm payrolls numbers now and Goldman Sachs (NYSE:NYSE:GS) estimates an increase of 225,000 in December above the consensus for an increase of around 200,000.

“We believe still-elevated labour demand and favourable seasonal factors will more than offset an uptick in layoffs and a 36,000 drag from a strike at the University of California” it said.

Despite further declines in online job postings, there were still 10.5mln unfilled positions in late 2022, and Big Data employment indicators are consistent with strong December job growth, it noted.

“We also expect another large rise in healthcare payrolls (we assume +75,000 month on month seasonally adjusted), reflecting sing hospital utilization and 2mln job openings in that sector” Goldman added.

11.40am: US markets eye key jobs data

Wall Street is expected to start mixed as the first trading week of 2023 draws to a close, with traders sitting on the fence ahead of a key employment report due for release before the market opens.

Futures for the Dow Jones Industrial Average rose 0.2% in Friday pre-market trading, while those for the broader S&P 500 index gained 0.1% and contracts for the Nasdaq-100 shed 0.1%.

Ahead of the much-watched non-farm payrolls data, a stronger-than-expected ADP (NASDAQ:ADP) jobs report and weaker jobless claims numbers weighed on equity markets yesterday, with both signalling that the employment market remains robust.

At the close the DJIA was down 1% at 32,930, the S&P 500 fell 1.2% to 3,808 and the Nasdaq Composite dipped 1.5% to 10,305.

A lack of progress on Capital Hill as House Republican leader Kevin McCarthy suffered defeat in the 11th round of voting to elect a speaker for the House of Representatives contributed to the negative sentiment, said James Hughes, chief market analyst at Scope Markets.

“Attention will now be very much on today’s non-farm payrolls and accompanying employment data, most notably wage growth readings,” Hughes added.

“Assuming these continue to lag inflation, it’s going to add to concerns that the Federal Reserve will struggle to ensure the US economy avoids sliding into recession.”

Analysts expect the US economy to have added 200,000 jobs in December, down from 263,000 in November, with unemployment likely to remain at a 50-year low of 3.7%.

“The ADP private employment report this week topped estimates in December, potentially paving the way for a better-than-expected jobs report later today,” commented Victoria Scholar, head of investment at interactive investor. “It is a case of good news is bad news for the markets in the sense that any signs of strength in the labor market could bolster inflation expectations, prompting the need for a more hawkish policy response from the US Federal Reserve.”

11.12am: Rise in core inflation enough to keep ECB hiking rates

Economists noted there was something for both hawks and doves in today’s Eurozone inflation numbers which showed a fall in the headline inflation rate to 9.2% year-over-year in December, from 10.1% in November, below the consensus, of 9.7% while core inflation increased to 5.2%, above the consensus, 5.0%.

ING Economics said it “is likely that the peak in inflation is behind us now, but far more relevant for the economy and policymakers is whether inflation will structurally trend back to 2% from here on.”

Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics said “The doves will rightly point out that these numbers, and what now appears to a peak in the headline, suggests that the upwardly-revised December inflation forecasts are way too high.”

“The hawks, by contrast, will note that underlying core inflation is still far too high for comfort, and that it shows no signs of abating.“

ING pointed out core inflation continues to show little sign of relief for now and suggested the next two months will be “critical” as many businesses traditionally change prices at the start of the year. It could therefore be that core inflation rises further from now.

On rates, Vistesen said “We doubt that the inflation data in the next few months will change the overall message from the December meeting of further significant hikes in the first half of the year. “

“We still see 50bp in February and March.”

ING agreed. Although it suggested 2% inflation could be reached much sooner than expected it thinks rising core inflation will be enough for the ECB to continue to hike by 50bp in February and March.

10.56am: Housing market foundations under pressure

Housing market activity looks to be correcting significantly, which is likely to weigh on house building.

That was the verdict of the EEY ITEM Club following the latest UK construction PMI figures.

It noted that cost pressures facing construction businesses have continued to ease but remain elevated by past standards while still-high inflation and falling household real incomes are likely to discourage spending on home improvements.

Martin Beck, chief economic advisor to the EY ITEM Club, said: “A fall in construction activity wasn’t surprising. With a slowdown in the housing market and an expected outright fall in house prices, it’s likely the appetite for new home construction has deteriorated.”

He also noted the survey wasn’t entirely lacking in positives.

“The costs facing construction businesses continue to rise, but cost price inflation eased to the lowest in two years.”

“Meanwhile, government intervention to limit rises in businesses’ energy bills is of particular help to the relatively-energy intensive construction sector.”

“And construction is likely to continue to be aided by the more targeted scheme which is expected to replace current support in April” he suggested.

“No doubt, the sector faces a difficult period ahead. But as a relatively cyclical industry, construction could be among the first to benefit when the economy begins to recover.”

10.23am: EU inflation falls to 9.2% in December

Mixed news on inflation in Europe today with Eurozone CPI falling 0.3% in December, better than market expectations for a 0.1% decline, with the annual CPI number down to 9.2% in December from 10.1% in November and again ahead of the 9.5% forecast.

But the figures from Eurostat also showed that the core figure, excluding food and energy costs, rose to 5.2% from 5% in November which may be seen as a vindication by the ECB for its pledge to keep raising interest rates. Market expectations were for an increase to 5.1%.

Euro area #inflation at 9.2% in December 2022, down from 10.1% in November. Components: energy +25.7%, food, alcohol & tobacco +13.8%, other goods +6.4%, services +4.4% - flash estimate https://t.co/ZUdAkzeGNX pic.twitter.com/lGVVf1tGi8— EU_Eurostat (@EU_Eurostat) January 6, 2023

The statistical office of the EU said that energy prices grew at a slower rate in December (25.7%, compared with 34.9% in November), followed by food, alcohol & tobacco (13.8%, compared with 13.6% in November), non-energy industrial goods (6.4%, compared with 6.1% in November) and services (4.4%, compared with 4.2% in November).

John Leiper, chief investment officer at Titan Asset Management said: “The recent moderation in inflation across the UK, US and Europe continues into December with headline eurozone inflation coming in on the weaker side".

"That said, core inflation actually rose over the year. Markets are pricing in a terminal deposit rate just shy of 3.5% by the summer but risks remain on the magnitude (upside) and duration (for longer). That scenario looks increasingly consistent, and coordinated, across the globe subjecting the economy to growing recessionary risks.”

9.58am: UK construction PMI contracts in December

The UK's construction sector recorded a fall in business activity during December, ending a three month sequence of growth, with the rate of decline the fastest since May 2020.

At 48.8 in December, down from 50.4 in November, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered below the 50.0 mark to signal the first contraction in construction sector output since last August.

???????? UK #construction activity fell for the first time since August, as the #PMI reaches 48.8 in Dec (Nov: 50.4) amid contractions in residential and civil engineering sectors. Firms gave a negative outlook for only the 6th time in the survey's history: https://t.co/ZynRTq3tBW pic.twitter.com/38V8uWQw9z— S&P Global PMI™ (@SPGlobalPMI) January 6, 2023

A similar trend was observed for new orders, which saw a renewed fall that was the strongest for over two-and-a-half years.

Concurrently, sentiment amongst firms towards the year ahead outlook for activity dipped into negative territory for only the sixth time on record, reflecting fears around the near-term economic outlook.

9.30am: Shell (LON:RDSa) update mixed with strong gas performance offset by weak Chemicals showing

Analysts at UBS have been digesting Shell’s trading update today which it described as mixed against its expectations.

On the positive side, Shell flagged that Integrated Gas trading is expected to be significantly higher quarter on quarter with the comments suggesting the performance could have been better than UBS expected in the fourth quarter.

LNG liquefaction volumes were cut to 6.6-7.0mln tonnes from the previous guidance at 7.0-7.6mln tonnes although UBS said this should not come as a surprise given the recent outage at QC LNG in Australia.

Integrated Gas production was cut marginally to 900-940,000 boe/day from previous guidance of 910-960,000 while upstream production was raised slightly to 1,825-1,925,000 boe/day from previous guidance at 1,750-1,950,000 boe/day.

UBS pointed out that guidance for total production is thus “virtually unchanged” at the mid-point at 2,795,000 boe/day.

But the bank said the update on the Downstream side was more negative.

Trading and optimisation results are expected to be significantly lower than the third quarter and Chemicals results are expected to be down quarter on quarter as well, against an expected increase.

This is driven by the start-up of the Pennsylvania Chemicals project, which has started to be depreciated but is still in ramp-up phase, UBS explained.

A working capital inflow of around US$4bn was ahead of the US$3.1bn UBS expected while the estimated windfall tax of US$2bn was in line with their forecasts.

The broker retained a buy rating and 2,650p price target with shares up 1% in early trading.

9.00am: Credit Suisse (SIX:CSGN) downgrades Next

FTSE 100 holding higher looking ahead to some key economic data later today with EU inflation and US non-farm payrolls numbers due later today.

Retailers remained in focus with Next PLC (LSE:NXT) giving back some of yesterday’s strong gains after its upbeat trading statement.

Credit Suisse has downgraded the FTSE 100 listed group to underperform from neutral despite upping its price target to 6,100p from 5,200p.

“Next PLC (LSE:NXT) shares have risen almost 50% from the October lows, and on 13.2x 23/24E PER do not look cheap vs its history, retail peers, or the UK market” the bank noted.

“While Xmas trading was strong for most retailers, we see downside risk to demand in the spring, given tough comps, and as UK property prices and employment soften, while the outlook for opex remains challenging” it continued.

The broker has a preference for Marks & Spencer PLC (outperform, price target 150p), JD Sports Fashion PLC (LSE:JD.) (outperform, price target 190p) and Associated British Foods PLC (LSE:LON:ABF) (outperform, price target 2,150p).

Meanwhile the owner of Sports Direct (LON:FRAS) and House of Fraser has reduced its stake in Hugo Boss after previously upping its investment into the luxury fashion house.

Frasers Group PLC said it now owns 3.9% of Hugo Boss's total share capital, a decline from the 4.3% that it previously owned.

The retail empire, headed up by billionaire entrepreneur Mike Ashley, has been pursuing ambitious growth and expansion plans in recent months.

Diageo PLC (LON:DGE) fell 1.1% on a read across from Constellation Brands (NYSE:STZ) weaker than expected quarter three and outlook in the US while Standard Chartered PLC (LON:STAN) slipped nearly 2% after its strong gains yesterday fuelled by bid speculation after Abu Dhabi Bank revealed it had been eyeing a move for the Asian focused bank before deciding not to proceed.

8.20am: FTSE continues upward path

FTSE 100 continued to shrug off disappointing macro data and forge ahead as investors hope that falling energy prices will see inflationary forces ease reducing the pressure on central banks to continue hiking interest rates.

At 8.15am, the FTSE 100 was up 28 points to 7,662, while the FTSE 250 slipped 44 points to 19,419.

Richard Hunter, head of markets at interactive investor said the fall in sterling has also helped, noting: “The FTSE100, meanwhile, has been helped along by some sterling weakness which translates into higher overseas earnings values for many of its constituent companies, and has added 2.7% so far this week.”

“In early exchanges, the medium-term hopes for a Chinese recovery were again in evidence, as the miners edged towards the top of the leader board, with the likes of Rolls-Royce (LON:RR) and Prudential (LON:PRU) also in pursuit.”

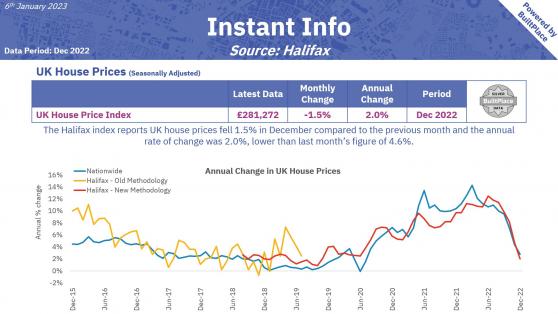

The further gains came despite another downbeat survey on the UK housing market with the Halifax house price index showing house prices fell 1.5% in December pulling the annual growth rate down to 2%, from 4.6% a month earlier.

Shell PLC was little changed after it said it would pay US$2bn in EU and UK windfall taxes.

The company revealed the figure in an update on its fourth quarter performance, in which it said gas trading results are expected to be "significantly higher" than in the previous quarter.

Shipping services provider Clarkson PLC (LON:CKN) soared around 9% higher after it reported strong trading throughout its final quarter, particularly from its Broking division.

It now expects its results for 2022 to be ahead of market expectations, with underlying pre-tax profits anticipated at no less than £98mln.

Analysts at Peel Hunt noted that this was “17% ahead of our £83.6m forecast and YoY growth of 41%.”

“This is clearly encouraging news and we expect the stock to react positively” they added.

7.55am: House prices fall further in December - Halifax

UK house prices fell last month as the cost of living crisis, and rising interest rates, hit demand for property.

High street lender Halifax reported that the average house price fell by 1.5% in December, following a 2.4% drop in November pulling the annual growth rate down to 2%, from 4.6% a month earlier.

Annual growth slowed across all nations and regions during December, Halifax reports, pulling the price of the average UK property down to £281,272.

Kim Kinnaird, director of Halifax Mortgages: “As we’ve seen over the past few months, uncertainties about the extent to which cost of living increases will impact household bills, alongside rising interest rates, is leading to an overall slowing of the market.”

“As we enter 2023, the housing market will continue to be impacted by the wider economic environment and, as buyers and sellers remain cautious, we expect there will be a reduction in both supply and demand overall, with house prices forecast to fall around 8% over the course of the year.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown (LON:HRGV) said it was a “miserable December for house prices, as the rot set in, and prices slumped again. “

“We saw a fourth consecutive monthly price drop, and average prices are now up just over £5,000 in a year. While this month’s fall was less spectacular than November, it was more comprehensive – as prices fell in every region across the UK” she noted.

7.50am: Shell to pay US$2bn in windfall taxes

Shell PLC said it expects to fork out around US$2bn in additional taxes in the fourth quarter due to the windfall taxes imposed in the EU and the UK.

But in a trading update the FTSE 100 index heavyweight noted these would be reported as identified items and therefore will not impact quarter four adjusted earnings and will have only a limited cash impact in the quarter given the expected timing of payments.

Europe's largest oil and gas company said gas trading results are expected to be "significantly higher" than in the previous quarter but that its liquefied natural gas production in the quarter will be hit by prolonged outages at two major plants in Australia.

Marketing results are forecast to be lower in quarter four than in the previous quarter while Chemicals results are also expected to be lower than the previous in part due to the commencement of depreciation for Shell Polymers Monaca, its Pennsylvania Chemicals project.

Shell estimated a working capital inflow of around US$4 billion for the quarter although it stressed these forecasts are inherently uncertain and exacerbated by current market volatility.

7.45am: USD surges on strong employment data, EUR hawks encourage spike against GBP

Few will argue that low unemployment is a bad thing, but it also poses a conundrum for the US Federal Reserve.

Despite recession either coming soon or bring already here, depending on who you ask, the US added 135,000 more jobs in the private sector in December than expected, per yesterday’s ADP data reading.

Cue the Fed hawks sharpening their talons as they back more interest rate rises in the months to come.

According to recently released Federal Open Market Committee minutes, officials said they need to see “substantially more evidence” of easing inflation before loosening their grip on the economy while warning that an “unwarranted easing in financial conditions … would complicate the committee’s effort to restore price stability”.

The US Dollar Index (DXY) salivated over the prospect of a higher peak rate, adding 0.8% to close at a four-week high of 104.805.

DXY’s momentum continued in this morning’s Asia trading window, having climbed to 104.94 at the time of writing.

GBP/USD consequently dipped nearly 150 pips to close Thursday at 1.190, with more downside expected in today’s session, although much will depend on the US December non-farm payrolls report from the Bureau of Labor.

GBP/USD falls back, encouraged by Fed hawks – Source: capital.com

The euro retreated to three-week lows against the greenback, with the EUR/USD pair currently changing hands at 1.051.

Indicative of the European Central Bank’s persistent hawkishness, despite surprisingly soft German and Italian inflation data, the EUR/GBP pair showed strength by closing 0.4% higher at 88.33p on Thursday. The pair remained on the upside in this morning’s Asia session, inching higher to 88.34p.

A clearer picture of European inflation will come later this morning when flash inflation for the whole Euro Area is read.

Consensus estimates are 9.7%. Anything softer could encourage a retreat on recent euro gains against the pound.

7.00am: FTSE 100 progress expected

The FTSE 100 is expected to make further progress when trading opens on Friday ahead of EU inflation and US non-farm payrolls figures due later today.

Spread betting companies are calling the lead index up by around 28 points.

Michael Hewson chief market analyst at CMC Markets UK noted: “It’s been a generally positive start to 2023 for European markets as optimism that inflation has peaked, along with lower oil and gas prices prompts optimism that central banks may not have to tighten as aggressively as feared at the end of 2022.

“Today’s EU flash CPI for December could add further fuel to this peak inflation narrative if as expected headline inflation falls to 9.5% from the 10.1% seen in November, although any resilience in the core numbers would take some of the edge of this.”

On the US figures, Hewson said: “Today’s December number is expected to show a slowdown to 203k; however, this could be understating things given that most of the estimates in recent months have come in below the actual numbers.”

In the US yesterday, markets closed lower after a strong ADP jobs report and hawkish comments from Esther George, president and chief executive of the Federal Reserve Bank of Kansas City, who told CNBC that she favoured holding rates above 5% for some time.

At the close the Dow Jones Industrial Average was down 340 points, or 1.02%, at 32,930, the S&P 500 fell 45 points, or 1.16%, to 3,808 and the Nasdaq Composite dipped 154 points, or 1.47%, to 10,305.

Read more on Proactive Investors UK