Welcome to the Investing.com UK weekly FTSE 100 latest update, designed to keep investors informed on the newest UK stock market movements and key developments. In this weekly report, you'll find a summary of the last week's significant news, and trends affecting the FTSE 100 index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday during London Stock Exchange (LSE) market opening times between 8:00am-4:30pm UK local time (GMT+1).

FTSE 100 Share Price Opening 7th October 2024

The closing share price for the start of this week, Monday 7th October, was 8,303.62, which sat +0.28% higher than at close on Friday 20th September, suggesting a modestly positive start in an attempt to make up for the previous week’s losses.

Investor Sentiment This Week For FTSE 100 Predictions

The FTSE 100 started the week with a +0.28% boost on Monday, but the improvements have been short-lived despite a valiant boost on Wednesday. After a surprisingly solid September (when compared to previous years), October is off to a somewhat lacklustre start.

FTSE 100 Sees Oil Giants Boost as Prices Rise

The FTSE 100’s lifts this week were largely thanks to strong performances from oil heavyweights Shell and BP (LON:BP). Shell PLC (LON:SHEL) and BP PLC were among the top gainers on Monday morning, contributing to a 16-point increase for the FTSE 100 index. Shell added 1.5% and BP rose by 1.3%, following NatWest Group PLC (LON:NWG) as some of the biggest winners by late morning.

While Shell recently adjusted its third-quarter guidance due to lower refining margins—blamed on weak global demand—BP made headlines with reports of potentially scrapping its plan to cut oil and gas output by 2030. Meanwhile, Brent crude oil prices saw a 2.6% climb to US$79.48 a barrel amid growing tensions in the Middle East, boosting investor confidence in these companies.

Inflation Expected to Fall Below 2%

Inflation in the UK is likely to have dipped below 2% in September, with Deutsche Bank (ETR:DBKGn) analysts forecasting a consumer price index increase of around 1.8%. This follows an unchanged 2.2% rate for August. However, core inflation, which includes energy and food prices, is expected to rise from 3.1% to 3.4%.

September's figures could represent a cyclical low in inflation, as Deutsche Bank warns of rising inflation in the coming months. Factors like increasing pump prices and a 10% hike in dual fuel bills, combined with potential duty increases in the upcoming Budget, could push inflation higher. Investors should keep an eye on the official figures due from the Office for National Statistics on October 16.

Business Confidence Dips Ahead of Crucial Budget

As the UK prepares for the Autumn Budget on October 30, business confidence has taken a hit for the first time in a year. According to the ICAEW’s Business Confidence Monitor, confidence fell from 16.7 to 14.4 in the third quarter. While still above pre-pandemic levels, the drop suggests businesses are becoming wary of potential tax hikes and a predicted £22 billion gap in public finances.

Despite the gloomy outlook, some optimism remains as firms expect growth in domestic and export sales, albeit at a slower rate than last quarter. Concerns around investment reluctance and reduced export growth to 2.7% from 3% cast a shadow over the positive company performance.

IPO Activity Predicted to Increase

After a quiet third quarter with only two companies listing in London, experts believe that IPO activity may see an uptick as we move into the final quarter of the year. More action in the market is likely to follow modest third-quarter floats by Rosebank Industries PLC (LON:ROSE) and Aberforth Geared Value & Income Trust PLC. Together, these listings raised £64.8 million, which came as a significant drop from £359.8 million in the same period last year. This highlights a potential turnaround opportunity for new investors.

September’s volatility seemed to lack teeth this year, which has prompted a continued bullish outlook especially from long-term investors, who (as always) are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to an additional 10% off your 1-year plan!

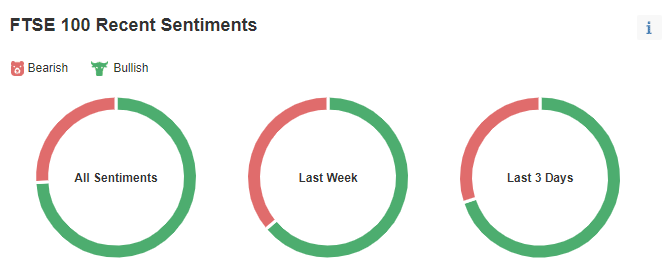

We can see that the Investing.com UK community’s sentiment towards the FTSE 100 index has been more consistent this week with a continued 30-70 Bearish-Bullish split.

Notable FTSE 100 Movements & Stock Market News

Here are some of the top stories from the footsie 100 constituents over the past 5 days.

Diageo Faces Headwinds from New Chinese Import Rules

Investors saw Diageo PLC (LON:DGE) shares drop by 1.8% on Tuesday, aligning with other beverage companies struggling under new Chinese import regulations. Starting October 11, European brandy makers are required to pay security deposits up to 39% when importing to China. This move is part of China’s anti-dumping measures, aimed at protecting its domestic brandy industry from what it describes as damaging European imports. Interestingly, this development follows the EU’s decision to impose tariffs on Chinese electric vehicles, showcasing the ongoing trade tensions.

Rio Tinto Expands Into Lithium with Major Acquisition

In a significant move, Rio Tinto PLC (LON:RIO) has announced its acquisition of Arcadium Lithium for $6.7 billion in cash. This deal will position Rio Tinto as the world's third-largest lithium producer. Through this acquisition, the company gains access to global lithium mines and facilities, serving major clients like Tesla, BMW, and General Motors (NYSE:GM). This strategic expansion highlights Rio Tinto's commitment to supporting the rapidly growing electric vehicle industry.

Informa’s Structural Changes Receive Mixed Reception

Informa PLC (LON:INF) shared a lukewarm response from the market despite confirming steady trading in line with guidance and introducing a new corporate structure after acquiring Ascential (LON:ASCL) PLC. The FTSE 100 company, known for events and exhibitions, remains on track to meet its full-year targets, including substantial revenue growth and profit goals. Looking ahead, Informa plans to organize its ventures into three main event-focused businesses, potentially fuelling growth from 2025 onward. CEO Stephen Carter highlighted the importance of building strength in B2B sectors as the market matures.

Unilever Exits Russian Operations amid Political Pressure

Unilever PLC (LON:ULVR) completed the €520 million sale of its Russian business to Arnest Group, following criticism for continuing operations there after the Ukraine invasion. The sale includes four factories in Russia and its operations in Belarus. Unilever faced backlash for continuing business in Russia, with accusations of financially supporting the conflict. The company, operating in Russia since 1991, extracted €200 million from its Russian ventures over the past year, highlighting the complex nature of divesting from the region.

Today's FTSE 100 Close

The above investor sentiment and factors driving this week's ‘Footsie’ volatility meant that today the FTSE 100 is likely to close at a price which sits slightly lower than the weekly FTSE 100 opening price of 8,280.63.

Best FTSE 100 Shares To Buy

Investors can also use our free stock screener to filter top FTSE 100 companies according to their investment strategy, and add them to a watchlist today.