Proactive Investors -

- FTSE 100 battling to stay flat

- Barclays (LON:BARC) tumbles as impairments hit profits

- UK CPI eases to 10.1% in January, better than forecast

11.37am: Burberry tops the blue-chip risers

Topping the FTSE 100 leaderboard is Burberry PLC, which seems to be getting a boost despite mixed results at fellow luxury fashion stock Kering (LON:0IIH), which owns Yves Saint Laurent, Gucci and Balenciaga.

The French luxury group reported a “très solide” performance for last year but gave a gallic shrug over a fourth quarter that was “contrasté” – or “mixed” in the English translation.

Revenue from Gucci fell more than expected in Q4, down 14% while analysts had forecast an 11% drop.

Analyst Zainab Atiyyah at Third Bridge said: “Kering will be looking east and hoping Chinese revenge travel and spending after COVID drives their growth in 2023. Our experts expect Europe and China to be good markets for Kering as Chinese tourists opt to visit France and Italy, thanks to the weak euro.”

Atiyyah noted that YSL enjoyed sales growth across all regions in 2022, which is “likely to continue, thanks to a strategic decision to focus on local clients and heritage”, while Gucci has a “very different” strategy to embrace big trends.

Burberry shares are up nearly 3%, while Kering's fell 4% in early trade but are now up 5%.

Elsewhere, Coca Cola HBC AG (LON:CCH) is second among the blue-chip risers, helped by positive analyst reaction to its results yesterday.

Credit Suisse (SIX:CSGN) hiked its EPS forecasts 9% and Deutsche Bank (ETR:DBKGn) said the results "should lead to low to high single digit upgrades to consensus EBIT and EPS", which has helped continue the gains for a second day for its still-depressed shares.

Share price rises for housebuilder Persimmon PLC (LON:PSN), after the house price numbers earlier, Ladbrokes (LON:LCL) owner Entain PLC (LON:ENT) rebounding from the MGM rebuff last week, and Rolls-Royce Holdings PLC (LON:RR.), following the big Indian contract yesterday, are not far behind.

The Footsie index has crept back into the green, up just over one point at 7,955. Can it add five more?

11.11am: Oilers supporting FTSE as demand expected to rise

Oil heavyweights Shell (LON:RDSa) and BP PLC (LON:BP) are providing some support this morning, though the London benchmark index is a sliver below where it finished yesterday and around eight points from the 8000 mark it's had in its sights for a few weeks.

Helping things for the fossil fuel producers is a forecast hike from the International Energy Agency (IEA), which predicts demand will increase by 500,000 barrels this quarter more than it previously expected.

Following a modest year-on-year contraction in the last quarter of 2022, the IEA predicted global oil demand will rise by 2mln barrels per day in 2023 to 101.9 mb/d.

Fuelled by a "resurgent China", adding 900,000 barrels a day, the Asia-Pacific region is seen as providing the boost, with the monthly report from the agency saying "the reopening of borders will boost air traffic" to lift jet fuel demand by an expected 1.1 mb/d, 90% of 2019 levels.

Supply has held "largely steady" in January, after a sharp decline at the end of 2022 led by the US and Saudi Arabia, the IEA said.

"We expect global output to grow 1.2 mb/d in 2023, driven by non-OPEC+. Supply from OPEC+ is projected to contract with Russia pressured by sanctions."

Shell shares are up 0.5% and BP 0.2%, which makes a difference as the energy stocks are almost 10% of the FTSE's weighting.

10.20am: Blue chips held back by banks

The FTSE is back into the red, down just a couple of points, with Barclays's 8% decline a big weight stopping the index from climbing above the 8,000-point peak, followed by Natwest (LON:NWG) and Lloyds both down 2%, with HSBC (LON:HSBA) and Standard Chartered (LON:STAN) also in the red.

Lenders are directly linked to the housing market struggles, that the fresh ONS house price figures have outlined.

The "whack" to buyer affordability over the past few months from higher mortgage rates started to weigh more heavily on house prices in December, says economist Gabriella Dickens at Pantheon Macroeconomics.

She noted that, on a seasonally-adjusted basis, prices fell outright for the first time since October 2021, when Stamp Duty was reverted back from its temporary higher level.

Prices have probably continued to fall this year, she added, with Nationwide’s measure of house prices down for the fifth month in a row in January, the longest period of consecutive falls since February 2009, while 68% of homes were sold under the asking price in December, well above the average over the past two years, 35%, according to the NAEA.

"We think house prices will continue to decline over the next six months or so, resulting in a peak-to-trough fall of about 8%," she said.

This is despite mortgage rates coming back down from October’s peaks, but Dickens said they still look set to remain around two and a half times higher than they were at the start of 2022, "meaning someone having to refinance will see the share of their incomes absorbed by repayments jump to around 28%, from 21%".

What's more, a greater number of potential buyers will fail lenders' affordability tests, given that they have become harder to pass since interest rates have risen, not to mention real disposable incomes poised to be hit by the withdrawal of government support for energy bills in the next quarter.

Further ahead, Dickens said prices have "scope to bounce back", if mortgage rates fall substantially and households benefit from lower wholesale energy prices, leading to Pantheon forecasting a 5% recovery in house prices over the course of 2024.

9.59am: Housebuilders up as house prices growth slows

Official UK house price growth slowed to 9.8% in the 12 months to December 2022, down from the 10.6% figure for November and below the consensus forecast of 11.2%.

December was down 0.4% month-on-month and in seasonally adjusted terms, prices fell by 0.2%.

Following its earlier update showing that UK CPI inflation cooled, the Office for National Statistics has just released house price data for December and rents data for January.

The average UK house price was £294,000 in December 2022, which is £26,000 higher than 12 months ago but a slight change from last month's record high of £296,000.

“Annual house price inflation, measured using final transaction prices, slowed again in December across the majority of the nations and regions," said ONS assistant deputy director of prices, Chris Jenkins.

He noted that the East Midlands showed the highest annual growth, while Scotland remains the slowest growing part of the UK.

“Rental prices continue to increase at pace with the largest annual percentage change since UK records began in 2016. London’s rental growth continues to pick up with the strongest growth for over seven years.”

Blue-chip housebuilders are helping the FTSE this morning, with Persimmon PLC (LON:PSN) up over 2%, Barratt Developments PLC (LON:BDEV) and Taylor Wimpey PLC (LON:TW.) over 1% and Berkeley Group Holdings PLC (LON:BKGH) just below that.

The Footsie is currently two points above the plumb-line, at 7,955.86, inches from its big milestone.

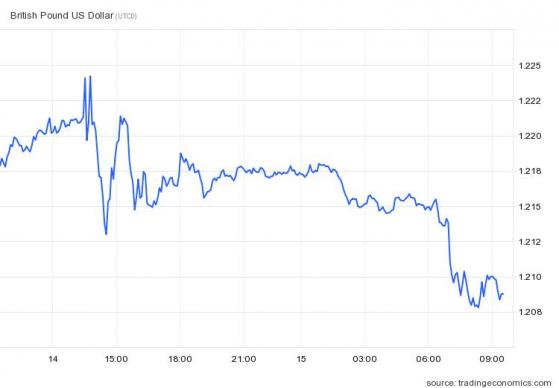

9.34am: Pound falls after weaker-than-expected inflation numbers

Sterling fell over 0.5% against the US dollar further retreating from $1.24 touched early in the month, after fresh CPI figures showed inflation in the UK slowed more than anticipated in January to 10.1%.

Also, the monthly rate actually turned negative for the first in a year, and annual core inflation eased to the lowest in seven months.

The new figures offered some relief that price pressures may be finally easing, raising bets the Bank of England will not need to pursue a more aggressive policy stance.

Money markets are now pricing a 4.55% interest rate peak by September compared to 4.69% before the CPI report.

Meanwhile, the FTSE 100 has settled slightly lower at 7,947.93, down 5.92 points, or 0.074%.

At 9.30am the pound was trading 0.69% lower at US$1.20860.

9.00am: FTSE recovers poise

FTSE 100 recovered its poise after early falls as better-than-expected inflation figures limited the damage caused by falls in the bank and mining sectors.

At 9.00am London’s blue-chip index was at 7,952.85, down 1.00, or 0.013%, after being more than 20 points lower.

Barclays led the FTSE 100 fallers, down 8.3%, dragging NatWest Group PLC (LON:NWG) and Lloyds Banking Group PLC (LON:LLOY) down with it as it highlighted rising bad debt charges due to the current macroeconomic uncertainty.

The high street lender was also hit by litigation charges which saw annual pre-tax profits fall with the overall performance worse than the market expected led by the corporate and investment banking division.

Sophie Lund-Yates, Lead Equity Analyst at Hargreaves Lansdown (LON:HRGV) said: “Barclays has bitterly disappointed the market with its full year numbers.

“Profits have been stunted partly because of a big increase in litigation costs relating to the over-issuance of US securities. This costly mistake has been known about for some time, but these are now the hard consequences biting the bottom line.

“Barclays is more than able to stomach this financially, the wider-reaching difficulties come from reputational damage. The tolerance margin for a similar mistake is now very thin,” she suggested.

Mining stocks were a weak feature on concerns about economic growth. A fund manager survey from Bank of America (NYSE:BAC) yesterday showed the sector was least favoured amongst stock pickers surveyed.

Anglo American PLC (LON:AAL) lost 1% and Rio Tinto PLC (LON:RIO) 0.6%, while not even a US$7.1bn cash return by Glencore PLC (LON:GLEN) could halt its shares slipping 1% as well.

Hargreaves Lansdown PLC was top of the FTSE 100 risers, up 5.3% to 999p, after full-year results which were well ahead of expectations.

Peel Hunt said underlying profits increased by 30% to £212mln, compared to a consensus figure of £179mln.

Coca-Cola (NYSE:KO) HBC AG extended gains following yesterday’s results. Shares rose 2.3% to 2,083.50p as Deutsche Bank (ETR:DBKGn) increased its price target to 2,580p from 2,420p and reiterated a ‘buy’ rating.

Rolls Royce (LON:RR) Holdings PLC rose 1.2% after yesterday’s award of its biggest ever contract for Trent XWB-97 engines from Air India, part of Tata Group.

The bumper agreement won by Derby-based Rolls Royce includes orders for 68 Trent XWB-97 engines, used in the Airbus A350-1000, plus options for 20 more, and 12 Trent XWB-84 engines, used in the Airbus A350-900.

Financial details were not disclosed but the agreement makes Air India the largest operator of the Trent XWB-97 in the world.

8.19am: FTSE heads lower, banks fall after Barclays' numbers

FTSE 100 opened lower as better than expected UK inflation numbers were offset by disappointing results from high street lender Barclays PLC (LSE:BARC).

At 8.15am London's blue-chip index was at 7,930.32, down 23.53 points, or 0.30% while the FTSE 250 was little changed at 20,011.61, down 6.62 points, or 0.033%.

UK CPI rose 10.1% in the year to January, below City expectations for a 10.3% increase, and down from December’s 10.5% rise.

ING Economics said the numbers certainly “throw in a curveball for the Bank of England’s March meeting.”

They highlighted that core inflation was “was also much lower than expected, and slipped below 6% for the first time since last June.”

ING still expects the Bank of England to raise interest rates by 25bps next month but added “if this trend in services inflation persists, then it would be a strong argument in favour of pausing in May.”

Simon French at Panmure Gordon agreed.

He tweeted “An encouraging UK inflation report. There were just signs in the November & December reports that UK was at risk of becoming an outlier.” Less compelling in today's report. Core inflation pressures easing to +5.8% YoY (+6.3% prev.) probably the most pleasing data point.”

But the brighter inflation news was in contrast to disappointing results from Barclays PLC (LSE:BARC) where shares tumbled 7.5% hit by a hefty litigation charge relating to the over-issuance of securities.

The high street lender booked litigation charges of £1,597mln for the year (2021: £397mln) which took pre-tax profits for 2022 to £7.01bn, down 14% from £8.19bn in 2021 and below the City consensus of £7.2bn.

Net income totalled £24.96bn, up 14% from £21.94bn a year ago with fourth quarter net income of £5.8bn, up 12%, from £5.16bn in 2021. Earnings per share were 30.8p compared to 36.5p in 2021.

Credit impairment charges soared to £1.22bn compared to a release of £653mln in 2021 reflecting the deteriorating macroeconomic conditions.

John Moore, senior investment manager at RBC Brewin Dolphin, noted: “While the bank is benefitting from the tailwind of better interest rate economics and has been razor sharp on costs, it has also had to set capital aside for overselling securities and seen fee income drop significantly at its investment banking division.”

“That said, profits may have taken a hit but they remain at a healthy level and are underpinning shareholder returns through an increased dividend and share buyback programme.”

“When Barclays can turn its back on errors and legacy issues, which have been a consistent part of results in recent years, the bank should be the best placed of the major UK lenders in the current environment.”

Other banks fell with NatWest Group PLC down 3% and Lloyds Banking Group PLC down 2%.

8.00am: Inflation eases

Price rises in the UK slowed for a third month in a row but inflation remains near a 40-year high, official figures show.

UK CPI fell to 10.1% in the year to January from 10.5% in December, better than City forecasts of 10.3%, according to the Office for National Statistics (ONS).

On a monthly basis CPI fell by 0.6% in January 2023, compared with a fall of 0.1% in January 2022.

The largest downward contribution to the change came from transport and restaurants and hotels, with rising prices in alcoholic beverages and tobacco making the largest partially offsetting upward contribution to the change.

Food inflation also remained high in January at 16.7% and is one of the main drivers fuelling overall inflation, along with energy bills, according to the ONS.

Core Consumer Prices Index including owner occupiers' housing costs which excludes energy, food, alcohol and tobacco fell to 5.3% in the 12 months to January 2023 from 5.8% in December 2022.

7.53am: Barclays profits fall

Barclays PLC reported a fall in annual pre-tax profits hit by litigation charges relating to the over-issuance of securities.

The high street lender booked litigation charges of £1,597mln for the year (2021: £397mln) which took pre-tax profits for the year to £7.01bn, down 14% from £8.19bn in 2021 and below the City consensus of £7.2bn.

Net income totalled £24.96bn, up 14% from £21.94bn a year ago with fourth quarter net income of £5.8bn, up 12%, from £5.16bn in 2021. Earnings per share were 30.8p compared to 36.5p in 2021.

The FTSE 100 listed bank reported momentum across all business areas and benefited from favourable forex movements notably the stronger dollar against the pound.

Credit impairment charges soared to £1.22bn compared to a release of £653mln in 2021 reflecting the deteriorating macroeconomic conditions.

Returns on equity booked by the international unit which houses Barclays' transatlantic investment bank fell to 10.2% from 14.4% a year earlier, as fees from advising on deals particularly in debt and equity capital markets, plunged by almost two-fifths year on year.

The Tier 1 ratio deteriorated to 13.9% in the year, down 120bps from December 2021, and Barclays expects to operate within a ratio range of 13-14%.

Despite the fall in profits shareholders were rewarded with a 21% increase in the dividend to 7.25p while the lender also announced plans for a new £0.5bn share buy-back.

In 2023, Barclays UK net interest margin is expected to be greater than 3.20% while it is targeting a return on total equity of greater than 10% in 2023.

Barclays said its diversified income streams continue to position the group well for the current economic and market environment including higher interest rates.

Chief Executive CS Venkatakrishnan, commented: “"Barclays performed strongly in 2022. Each business delivered income growth, with group income up 14%.”

“We achieved our RoTE target of over 10%, maintained a strong common equity Tier 1 (CET1) capital ratio of 13.9%, and returned capital to shareholders. We are cautious about global economic conditions, but continue to see growth opportunities across our businesses through 2023."

7.30am: FTSE seen slightly higher

FTSE 100 is expected to slightly higher on Wednesday as investors digest the latest UK inflation numbers and as Barclays kicks off the banking reporting season.

Spread betting companies are calling the lead index up by around 4 points.

Michael Hewson at CMC Markets said: "Unlike the US and Europe, headline CPI in the UK is proving be a lot stickier having fallen only modestly from its October peaks of 11.1%, with today's January CPI number expected to see a fall to 10.3%. This seems fairly modest when compared to the bigger slowdowns we've seen in both the US and Europe, where headline inflation is much lower."

In the US, the Dow closed Tuesday down 157 points, 0.5%, at 34,089, while the Nasdaq Composite added 68 points, 0.6%, to 11,960 and the S&P 500 lost 1 point to 4,136.

It was a choppy day for the benchmarks as investors digested slightly higher-than-expected consumer price index numbers. The 6.4% annual rate figure wasn't a big surprise, but the question remains how long it will take for inflation to fall to normal levels.