Proactive Investors -

- FTSE 100 nurses heavy losses, down 70 points

- Bank's Catherine Mann sees further rate rises

- UK construction sector declines in January - PMI

10.15am: Car registrations jump 14.7% in January

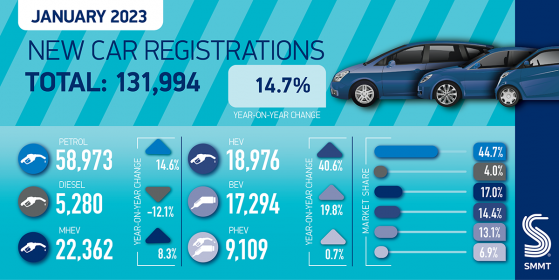

Car registrations rose by 14.7% in January, with 131,994 new cars hitting the road, according to industry body the SMMT.

This was the best start to the year since January 2020, when 149,279 units were registered, and was the sixth monthly increase in a row.

Sales of battery-powered electric cars jumped by 19.8% to 17,294, while petrol car sales were 14.6% higher at 58,973. Motorists continued to shun diesel, though with sales down by 12.1% to 5,280.

The SMMT predicted the car market will grow by 11.1% this year, to reach 1.79mln units, “despite straitened economy and strained supply chains”.

9.44am: UK construction sector contracts further in January - PMI

UK construction companies reported another downturn in business activity during January, largely reflecting weaker client demand and fewer new projects starts in recent months, according to the S&P Global/CIPS construction PMI.

But in contrast, business expectations regarding the year ahead rebounded considerably since December 2022, with confidence reaching its highest level for six months.

The headline PMI index was 48.4 in January, compared to 48.8 in December, below the 50.0 neutral threshold for the second month running.

UK S&P Global/CIPS Construction PMI Jan: 48.4 (est 48.5; prev 48.8)— LiveSquawk (@LiveSquawk) February 6, 2023

The latest reading signalled a modest reduction in overall business activity and the rate of decline was the fastest since May 2020, the report said.

The house building index, at 44.8, was the weakest-performing category of construction output in January, with the rate of contraction the steepest since May 2020.

Tim Moore, economics director at S&P Global Market Intelligence, said: "A sharp and accelerated decline in house building activity led to the weakest UK construction sector performance for just over two-and-a-half years in January.”

"However, there were positive signals for longer-term prospects across the construction sector, with business activity expectations staging a swift rebound from the low point seen last December.”

9.17am: Rates more likely to rise rather than fall - Bank's Catherine Mann

The Bank of England is more likely to raise interest rates again than to start cutting them, according to Bank of England (BoE) policymaker Catherine Mann.

Mann, who is one of the more hawkish members of the BoE's Monetary Plicy Committee (MPC), has fears that there are “material upside risks” to the BoE’s inflation outlook.

Speaking at the Lámfalussy Lectures Conference in Budapest, Hungary today, Mann cautioned that the stabilization of headline UK inflation is not yet “the harbinger of a turning point towards a sustainable return to the 2% target”, given food prices and services inflation are surging.

Mann said that the BoE should ‘stay the course’, after it raised interest rates to 4% last week.

It would be more of a mistake to stop tightening too soon, than too late, she stated, saying: “I am looking for a significant and sustained deceleration in higher frequency price increases and in the underlying inflation measures and expectations towards inflation rates that are consistent with achieving the 2% target.”

“Uncertainty around turning points should not motivate a wait-and-see approach, as the consequences of under tightening far outweigh, in my opinion, the alternative.”

“We need to stay the course, and in my view the next step in Bank Rate is still more likely to be another hike than a cut or hold.”

9.00am: US/Chinese tensions add to the downbeat mood

Rising tensions between the US and China have added to the downbeat mood with the FTSE 100 now down over 50 points.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) said: ’It’s glass half empty time on financial markets as unease spreads about a deteriorating geo-political backdrop and realisation that more interest rate hikes are set to be inflicted on economies.”

The concerns follow the shooting down a suspected Chinese spy balloon by the US.

Streeter added: “There is a chance this could be a short-lived wobble, given that the US State Department appears to have kept the diplomatic doors open, suggesting a planned visit to China by US State Secretary Anthony Blinken could happen as soon as conditions allow.”

But the concerns knocked the Hang Seng which fell 2% hitting Asian focused stocks in London with Prudential PLC (LSE:LON:PRU) down 2.7% and Burberry Group PLC (LON:BRBY) down 1.33%.

Croda International PLC (LSE:CRDA)’s £232mln South Korean acquisition, (see 7.30am update), received the thumbs up from the market with the stock a rare riser in a falling market.

Chief executive, Steve Foots, called the deal a “strategic bullseye.”

NatWest Group PLC (LON:NWG) fell 1.3% as Barclays (LON:BARC) Capital downgraded its rating to equal weight, the bank prefers Lloyds Banking Group PLC (LON:LLOY), upgraded to overweight.

8.15am: Pause for breath

The FTSE 100 started the week on the back foot after the euphoria of Friday when London’s blue-chip index hit an all-time high.

At 8.15am London’s blue-chip index was down 44 points at 7,853 while the FTSE 2500 gave up 107 points to 20,484.

JP Morgan suggested quarter one “will likely mark a high-water mark for the market” but remained overweight on the FTSE 100.

In an update on its global equity strategy the broker pointed out that some of the equity market supports that it was highlighting in quarter four, peaking bond yields, China reopening, lower European gas prices, “are not exhausted, but a lot has repriced.”

“We argued that supportive seasonals at the start of the year and light positioning would still be helping as we move through quarter one, but positioning is quickly normalizing,” the bank said.

“Crucially, we think the fundamental confirmation for the next leg of the rally will end up lacking,” JPM predicted.

“The cushion of consumer excess savings has been eroded, and money supply in the US and Europe keeps contracting,” it said

“Profit margins are at a record, currently much higher than preCOVID-19, and pricing power is likely to deteriorate from here,” according to JPM.

“International markets continue to screen as much more interesting than the US: stay long Europe vs S&P 500, keep overweight FTSE100 and keep overweight MSCI China,” was JP Morgan’s recommendation.

In London, it was a fairly quiet day for corporate news but Vesuvius Plc (LON:VSVS) fell 2.4% after reporting it had been hit by a cyber attack.

Virgin Money UK PLC (LON:VMUK) was another early faller as Barclays Capital downgraded its rating to equal weight following strong share performance over the last six months while BAE Systems (LON:BAES) weakened 1% after a report by Sky News that the Treasury was signalling there was no money for defence despite recognizing the urgent need to rearm in the wake of Russia's war in Ukraine.

7.52am: EY confirms Australian firm as preferred bidder for Britishvolt

The deal to save Britishvolt has also been confirmed today with administrators, EY, selecting a rival battery start-up based in Australia as its preferred bidder, according to multiple reports.

The Financial Times broke the news on Friday and reports today said EY has chosen Recharge Industries, owned by US investment firm Scale Facilitation Partners, to acquire the "majority of the business and assets" of Britishvolt following its demise last month.

Reporting the news, Sky said it was unclear, at this stage, what Recharge had agreed to buy but its plans potentially included taking on construction of Britishvolt's gigafactory on the site of the old coal-fired power station at Blyth in Northumberland.

Britishvolt to be bought by Australian rival Recharge - which wants to make the UK's first gigafactory 'a reality' https://t.co/ffj9UEfb3w— Telegraph Business (@telebusiness) February 6, 2023

David Collard, founder of Recharge Industries and chief executive of its parent Scale Foundation, said the Australian company was “thrilled” and “can’t wait to get started making a reality of our plans to build the UK’s first gigafactory” according to the Telegraph.

He added: “After a competitive and rigorous process, we’re confident our proposal will deliver a strong outcome for all involved.”

7.37am: Vesuvius hit by cyber attack

Vesuvius Plc, a global leader in molten metal flow engineering and technology, is currently managing a cyber incident, it said today.

“The incident has involved unauthorised access to our systems” the company said in a statement.

The FTSE 250-listed company said it has taken “the necessary steps to investigate and respond to the incident, including shutting down affected systems.”

“We are working with leading cyber security experts to support our investigations and identify the extent of the issue, including the impact on production and contract fulfilment,” Vesuvius added.

It is the latest cyber incident to hit some of the UK’s biggest names with Royal Mail (LON:IDSI), the Guardian and JD Sports all hit recently.

7.30am: "Strategic bullseye" for Croda

A couple of small(ish) deals to kick off Monday morning.

Croda International PLC is up first, in a deal, chief executive Steve Foots called a "strategic bullseye."

It has agreed to acquire Solus Biotech, a global leader in premium, biotechnology-derived beauty actives, from Solus Advanced Materials for around £232mln.

The debt-free, cash deal will significantly strengthen Croda's Beauty Actives portfolio and increases its exposure to targeted prestige segments, the FTSE 100-listed group said.

Located in South Korea, Solus expands Croda's Asian manufacturing capability and will create a new biotechnology R&D hub in the region, the company added in a statement.

Croda said the deal would strengthen its pharma presence in Asia and enable collaborative R&D with its Avanti business for the supply of lipid systems for drug delivery.

Foots said: "This is a strategic bullseye for Croda, consolidating our position as a global leader in supplying sustainable, natural actives for personal care across three critical technology platforms of peptides, ceramides and retinol.”

Elsewhere and Diageo PLC (LON:DGE), the owner of Johnnie Walker and Guinness, has confirmed the terms of a partial tender offer to increase its stake East African Breweries (EABL).

The deal, conducted through Diageo Kenya Limited will see the FTSE 100-listed spirits company up its holding from the current 50.03% to a maximum of 65%.

The tender offer price is Kenyan Shillings 192.00 per ordinary share and the maximum number of shares subject to the tender offer is 118,394,897.

The tender offer period will run from 6 February 2023 to 17 March 2023.

Diageo Kenya received regulatory approval to buy the extra shares on January 27.

The holding goes back to 1990 when the Irish brewer Guinness bought a minority stake in EABL and has been majority owned by Diageo since 2000.

7.05am: FTSE to retreat from new highs

FTSE 100 is expected to open lower on Monday retreating from its new recoed levels established on Friday.

Spread betting companies are calling the lead index down by around 30 points.

Forecast busting non-farm payrolls and a surprisingly strong ISM services reading in the US on Friday sent the US dollar higher and dollar earners in London’s blue-chip index took off as a result sending the FTSE 100 to a fresh peak.

Traders took the view the numbers could be the prelude to soft landing in the world’s largest economy reducing the possibility of any rate cuts by the Federal Reserve later in the year and probably keeping rates at inflated levels for longer.

Concerns over interest rates saw US markets lose steam at the close on Friday with the Dow 0.4% lower at 33,926 points, the S&P 500 down 1% at 4,136 and the Nasdaq losing 1.6% at 12,007.

Back in London, and Darktrace PLC (LON:DARK) has been facing intense scrutiny ahead of its second-quarter trading update as a result of claims from a US-based short seller. The company attached the research last week and there may be said today.