Proactive Investors -

- FTSE 100 closes up 11 points at 7,733

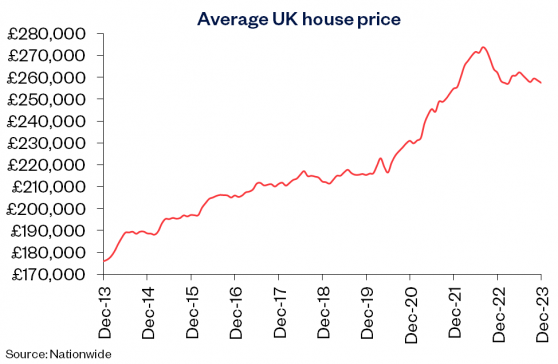

- House prices fall 1.8% in 2023, says Nationwide

- Harland & Wollf jumps on credit green light

Upbeat end to subdued year

That is it for 2023.

The FTSE 100 has closed up 10.50 points, 0.1% at 7,733.24 while the FTSE 250 closed down 29.53 points, 0.2%, at 19,689.63.

That marks the best closing level since May and means the blue-chip index has climbed 2.4% during 2023.

Susannah Streeter, head of money and markets, Hargreaves Lansdown (LON:HRGV) said: "The FTSE 100 has stumbled over the line, eking out a modest gain for the year but failing to shoot the lights out."

She described the FTSE's rise as "paltry" when compared to its international peers, "especially when you look at just how high the S&P 500 has climbed, up 25% over the year, while the DAX in Frankfurt has jumped by around 20%."

The FTSE 100's performance was better than the 0.9% eked out in 2022, but below the stellar gains witnessed in 2021 of 14.3% - the best showing by the FTSE 100 since 2016.

Those bumper gains reversed similar losses in the year Covid came, 2020, (14.3%), which came on the back of a strong 2019, up 12.1%.

Before that, three further years of big movements in markets saw the FTSE 100 drop 12.5% in 2018, rise 7.6% in 2017 and soar 14.4% in 2016.

Where we end in 2024 awaits to be seen.

On behalf of Proactive, we wish you all a very happy New Year.

US stocks expected to open higher

US stocks are expected to make a bright start to the last trading day of a what has been a bumper year.

In pre-market trading, futures for the Dow Jones Industrial Average were up 0.1%, while those for the S&P 500 were 0.1% higher and contracts for the Nasdaq 100 futures climbed 0.1%.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, noted the biggest takeaway of this year is the birth of ChatGPT which “propelled AI right into the middle of our lives.”

She pointed out this has driven Nasdaq 100 stocks to an all-time high with Nvidia the biggest winner of the AI rally.

Besides Nvidia, she highlighted the rest of the so-called Magnificent 7, Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Meta, Google (NASDAQ:GOOGL) and Tesla, which together with Nvidia, have generated almost all of the S&P500 and Nasdaq100’s returns this year.

As for 2024, she said the general expectation is “a cool down in the technology rally, and a rebalancing between the big tech stocks and the S&P493.”

Interest rates will be another key factor with the S&P500 typically rising after the first rate cut, “but the sustainability of the gains will depend on the underlying economic fundamentals.”

Back in London, and approaching the close, the FTSE 100 is 18 points.

Travel and entertainment thrive, but card spending growth slows

The growth in consumer card spending slowed sharply in 2023 as shoppers cut back wary of the tough economic climate, according to new figures.

Data from Barclays (LON:BARC) showed card spending rose just 4.1% year-on-year in 2023 – noticeably lower than the growth seen in 2022 (10.6%) – as consumers cut back on buying new clothes, eating out and investing in home improvements amid rising inflation and household bills.

However, Barclays said consumers continued to prioritise “moments of joy and shared experiences,” boosting travel (+15.2%), entertainment (+7.5%), and pubs & bars (+5.9%).

The report also showed an increased awareness of “skimpflation” and “shrinkflation” with 76% of consumers noticing examples of shrinkflation when shopping, with chocolate (48%), crisps (41%) and packs of biscuits (38%) the most cited products impacted.

Ti offset mounting bills, Brits spent less on eating out in 2023, with restaurants seeing a 6.7% decline compared to 2022, the report showed.

But the entertainment sector saw spending jump 7.5% boosted by the release of ticket sales for major events including the Eurovision Song Contest, Taylor Swift’s ‘Eras’ tour, and Beyoncé’s ‘Renaissance’ tour.

Blockbuster hits including ‘Barbie’, ‘Oppenheimer’ and ‘Avatar: The Way of Water’ fuelled a 6.3% increase in cinema spending.

The travel sector continued to thrive with both travel agents (10.4%) and airlines (30.8%) seeing robust growth.

Read more on Proactive Investors UK