Proactive Investors -

- FTSE 100 down 25 points at 7,491

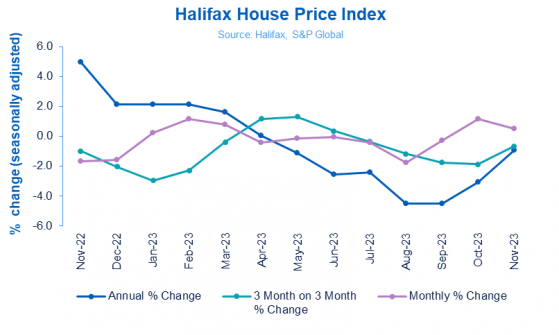

- House prices rise 0.5% in November

- British Airways (LON:ICAG) owner, IAG, falls after JPMorgan (NYSE:JPM) downgrade

Burberry out of fashion as Deutsche cuts target...again

Another blue-chip on the wane include Burberry Group PLC (LON:BRBY), down 2.3%, after Deutsche Bank (ETR:DBKGn) cuts its price target for the second time in two weeks.

The German bank has cut its target to 1,600p from 1,950p after a previous reduction at the end of November from 2,200p.

Deutsche, which has a ‘hold’ rating on the luxury brands retailer has left 2024 forecasts broadly unchanged but cut its 2025 EPS expectations by 11% with a 4% cut to its sales forecast to £3.29 billion and Ebit to £549 million from £616 million.

This flows through into a 14% cut to 2026 EPS forecasts giving adjusted Ebit of £609 million down from £701 million.

British Airways owner, IAG, flies low amid downgrade

The FTSE 100 remains in the doldrums, and leading the fallers is British Airways owner, IAG PLC, down 3.1%.

Shares have fallen after JPMorgan downgraded the airline, after taking a more cautious on the sector, given potential for large capacity increases to bring yields down against a backdrop of weaker economic growth.

The investment bank prefers low cost carriers to the networks due to capacity constraints which could aid pricing.

The long-haul supply picture looks more difficult given network capacity increases in particular on Transatlantic, JPM said.

The broker said lower margins and elevated fuel/ex-fuel cost pressure mean unit revenues are unlikely to grow.

Balance sheets and valuations do not look overly stretched; however, earnings pressure could send stocks lower, in the broker’s opinion.

JPM has moved IAG to ‘underweight’ from ‘neutral’ and Lufthansa and Air-France KLM to ‘underweight’ from ‘overweight’ with its top pick RyanAir (LON:0RYA) – rated ‘overweight’.

It remains neutral on easyJet (LON:EZJ) and Wizz Air (LON:WIZZ).

FTSE 100 follow US and Asian markets lower

The FTSE 100 opened lower, tracking US and Asian markets as investors take stock ahead of Friday’s non-farm payrolls.

At 8:15am, London’s lead index was down 25.50 points, 0.3%, at 7,489.88 and the FTSE 250 was down 115.18 points, 0.6%, at 18,551.55.

Frasers edged 0.6% higher after backing its full-year outlook following a strong first half performance.

Mike Ashely’s retailer highlighted a strong performance at Sports Direct (LON:FRAS) and at its international business but warned of a subdued trading in its Premium Lifestyle arm.

Analysts at Shore Capital said Frasers is a distinctive business carrying a wide range of views amongst investors “but at its heart it is well-run, growing now and set to do so for the foreseeable future.”

“Not all of its operating pistons are firing at this time, particularly Premium Lifestyle, but the group is signaling adjusted pre-tax profit of £500-550 million, and so we keep our £517 million estimate in place for now,” they said.

One notable faller is IAG PLC, the owner of British Airways, which has fallen 3.5%, after being downgraded by JPMorgan to ‘underweight’ from ‘neutral’ in a sector review which also sees downgrades for Germany’s Lufthansa and the Franco-Dutch airline Air France-KLM (LON:0LN7).

Vodafone (LON:VOD) is also under pressure, down 1.4%, after Exane BNP cut the telco to ‘underperform’ with a price target of 68p

But Smart Metering Systems soared 42% after agreeing a £1.3 billion from private equity outfit, KKR.