Proactive Investors -

- FTSE 100 up 57 points at 7,717

- Lower food prices drive surprise fall in inflation

- BoE rate decision seen a 50/50 call

Car bosses criticise potential delay to petrol car ban

The UK car industry has strongly criticised prime minister Rishi Sunak for considering delaying a ban on new petrol and diesel cars until 2035, saying it threatens the UK’s international leadership and the industry’s efforts to pivot to EVs.

“Ending emissions from road transport is the only way you will achieve net zero,” Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, told BBC Radio 4’s Today programme.

The delay would cause “confusion” among motorists, many of whom would delay switching to EVs just as carmakers invest billions in new models, he warned.

Ford's UK chairman Lisa Brankin said: "Our business needs three things from the UK government: ambition, commitment and consistency. A relaxation of 2030 would undermine all three."

"We need the policy focus trained on bolstering the EV market in the short term and supporting consumers while headwinds are strong: infrastructure remains immature, tariffs loom and cost-of-living is high."

Goldman joins calls for UK rate pause

Goldman Sachs (NYSE:GS) is the latest top bank to call on the Bank of England to leave interest rates unchanged on Thursday after today’s inflation figures surprised “meaningfully to the downside.”

“Combined with their recent dovish commentary, we now expect the MPC to keep Bank Rate unchanged tomorrow and lower our forecast for the terminal policy rate to 5.25% (from 5.5% before),” the investment bank said.

Goldman now expects core and headline inflation to be 5.5% (vs 6.0% previously) and 4.4% (vs 4.7% previously), respectively, by the end of the year.

“With today's data, two out of the three indicators that the MPC has set out to monitor inflation persistence have now shown notably more progress than anticipated since the August meeting,” the bank pointed out.

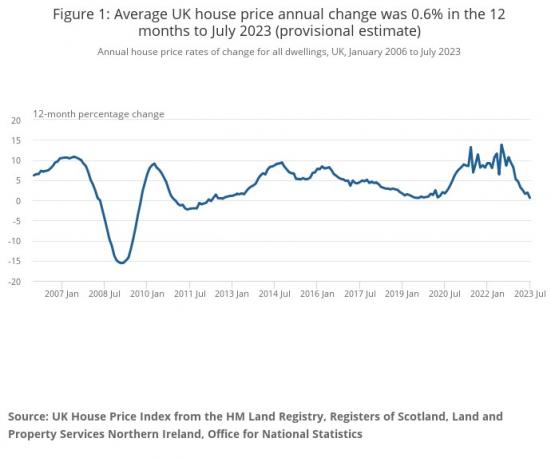

House prices grow at slowest pace in four years

Average UK house prices increased by 0.6% in the 12 months to July, the slowest increase since July 2019, and down from a revised 1.9% rise in June, according to figures from the Office for National Statistics.

The average UK house price was £290,000 in July 2023, which is £2,000 higher than 12 months ago, but £2,000 below the recent peak in November 2022.

Gabriella Dickens at Pantheon Macroeconomics explained the official index is based on completed transactions, which depend on mortgage offers made over the previous few months.

"As a result, further declines in the official index over the coming months look likely, given that timelier measures point to further weakness," she thinks.

She doubts prices will pick up later this year either, "given that the drop back in mortgage rates over the last month or two has been fairly minimal."

"Consumers’ confidence is still very weak by past standards and expectations of further house price falls remain entrenched," she pointed out.

"On balance, then, we expect a peak-to-trough fall of around 6%, with the nadir coming at the end of the year," she said.9:50am: Oil price dips

Oil price dips but Goldman ups Brent forecast to $100/barrel

Goldman Sachs has raised its 12-month forecast for Brent oil from from $93/bbl to $100/bbl as it now expects modestly sharper inventory draws.

The key reason behind the change is that significantly lower OPEC supply and higher demand more than offset significantly higher US supply, it said.

Overall, we believe that OPEC will be able to sustain Brent in an $80-$105 range in 2024 by leveraging robust Asia-centric global demand growth and by exercising its pricing power assertively.

Specifically, Goldman assumes Saudi Arabia unwinds the extra 1mb/d cut gradually starting in the second quarter of 2024, but that the 1.7mb/d cut with 8 other OPEC+ countries remains fully in place next year.

Goldman thinks that most of the rally in the oil price is behind, and that Brent is unlikely to sustainably exceed $105/bbl next year.

First, while US supply is more capital disciplined than a decade ago, the upward trend in capex and supply beats over the past three years, and the recent inflection in rigs confirms its dynamism.

Second, high spare capacity and the return to growth in offshore projects limit the upside to long-dated oil prices.

Third, OPEC is unlikely to push prices to extreme levels, which would destroy its long-term residual demand.

The oil price has taken a breather today, with Brent down 1.4% at $93.01.

Read more on Proactive Investors UK

***

Webinar Alert!

21.09.2023 09:30BST

Join us while our Senior Financial Analyst Jesse Cohen delving into the age-old debate of Growth vs. Value stocks. Gain valuable insights that will help you make informed investment decisions in today's dynamic market.