Proactive Investors -

- FTSE 100 up 15 points at 7,467

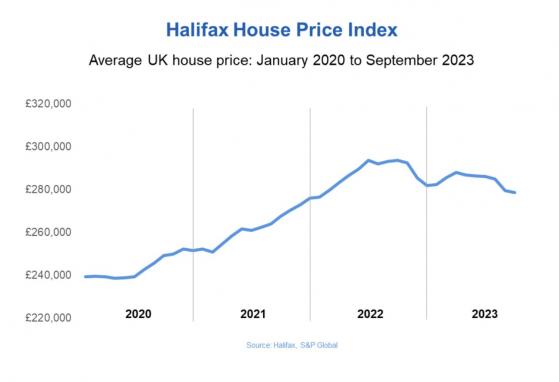

- House prices fall for sixth month in a row

- Aviva (LON:AV) soars on bid speculation

Metro Bank mulls mortgage book sale

Metro Bank PLC (LON:MTRO) has begun a process to sell a £3 billion chunk of its mortgage book to shore up its finances, Sky News reported.

The under pressure lender as sized up high street banking neighbours as possible buyers, including Lloyds Banking Group PLC (LON:LLOY) and NatWest Group PLC (LON:NWG), Sky News reported, citing City sources.

The measures would form part of a wider capital raising plan, which Sky News reported would include a £100 million equity raise and a refinancing of £350 million worth of debt which is due roughly this time next year.

The Financial Times had that Metro Bank's possible balance sheet boosting efforts would be worth £600 million, £250 million in equity funding and £350 million in debt.

On Thursday, Metro Bank said it "continues to consider how best to enhance its capital resources." In particular, it noted its £350 million senior non-preferred notes due in October 2025.

"The company is evaluating the merits of a range of options, including a combination of equity issuance, debt issuance and/or refinancing and asset sales. No decision has been made on whether to proceed with any of these options," it said.

Aviva jumps on talk of £6 a share bid

Aviva continues to drive higher, up 7.6% now.

Bid rumours continue to circulate around the insurance giant with The Times stating City sources are insisting that at least two potential suitors are running a "slide rule over the business," attracted by its excess capital and strong cash flow.

The report said "talk is that the likes of Allianz (ETR:ALVG) of Germany, Intact Financial (TSX:IFC) Corporation of Canada and the Scandinavian group Tryg are considering their options, with at least one mulling a £6 a share proposal."

An American insurer is also rumoured to be interested in the business, The Times said.

Decline in footfall worsens in September - BRC

The decline in UK retail footfall worsened last month, in a "subdued" end to the third-quarter, figures showed, with the focus now turning to the vital Christmas period.

According to the latest British Retail Consortium-Sensormatic IQ tracker, UK retail footfall fell 2.9% on-year in September, worsening from a 1.6% fall in August.

"During the warmer-than-expected weather, footfall slowed in September, with fewer shoppers across all shopping locations," BRC chief executive Helen Dickinson said.

In high street alone, footfall decreased by 1.7% annually in September, after a 0.9% fall in August. Retail parks suffered a 2.4% footfall decline. Footfall in retail parks had been flat on-year in August. Shopping centre footfall fell 4.0% yearly last month, worsening from a 3.8% decline previously.

FTSE climbs, Aviva leads insurers higher

The FTSE 100 continues to push higher with Aviva PLC top of the pile.

The insurance company, run by Amanda Blanc, is up 6.3% in early exchanges with dealers reporting vague bid rumours as a possible reason for the jump.

Earlier in the week financial blog Betaville flagged the company as a potential target of takeover interest.

It has dragged others in the sector higher, with Legal & General Group PLC and Prudential PLC (LON:PRU) up.

Imperial Brands (LON:IMB) is up 1.3% as it kicks off its share buy-back and as Citi upgrades to buy.

Bunzl (LON:BNZL) is up 0.7%, benefiting from an upgrade by Barclays (LON:BARC) to equal weight from underweight.

Elsewhere, Metro Bank is up 3.1% after reports it is considering selling part of its mortgage portfolio to shore up its finances.

Boohoo (LON:BOOH) is another stock on the rise, up 1.5%, to 30.46 after Mike Ashley’s Frasers Group picks up more stock, taking its holding to 13.4% from 10.4%.