Proactive Investors -

- FTSE 100 extends gains, up 45 points

- Retailers Next, Greggs and B&M all advance after trading updates

- Airlines fly high as RyanAir raises profit forecast

1.05pm: Boots sales up as jabs boost footfall

More positive news from the UK’s high streets with Boots UK reporting sales were up around 15% in December, compared with a year earlier.

The health and beauty retailer and pharmacy chain, part of the Walgreens Boots Alliance (NASDAQ:WBA), said gifting, beauty and fragrance lines all performed “extremely well” while there was also an uptick in sales of over-the-counter medicines for “colds and immunity.”

Footfall at its stores rose by about 8% as it administered more than 1.4mln flu vaccinations and over 220,000 Covid jabs while a further boost came as city centre stores benefitted from the return to the office, the group said.

Boots UK also reports a “record-breaking Black Friday” with boots.com recording its biggest ever day of sales.

Like-for-like sales in the September-November quarter were up 8.7% year-on-year.

Sebastian James, managing director of Boots UK & ROI, said it was “another positive quarter” for the group.

12.40pm: Airlines lift off as RyanAir lifts profit forecast

Shares in UK listed airlines airlines took off taking heart from news that Ryanair (LON:RYA) had increased its profit forecast for the year.

The Irish carrier celebrated a strong Christmas, the first with no hit from Covid-19 in three years, with the number of passengers rising by more than a fifth to 11.5mln in December.

The strong trading prompted the company to raise its March 2023 forecast for net profit to be between €1.325bn and €1.425bn, 25% better than the previous guidance range.

This sparked gains across the airline sector with International Consolidated Airlines Group (LON:ICAG) SA, the Anglo-Spanish company which owns British Airways, rising 3.2%, while Hungarian company Wizz Air (LON:WIZZ) Holdings plc soared 9.64% and easyJet plc (LON:EZJ) flew 6.6%.

12.00pm: Modest gains seen across the pond

Wall Street is expected to open higher as traders continue to digest minutes from the latest Federal Open Market Committee meeting, while Republicans remain deadlocked over the election of a speaker for the US House of Representatives.

Futures for the Dow Jones Industrial Average rose 0.1% in Thursday pre-market trading, while those for the broader S&P 500 index also gained 0.1% and contracts for the Nasdaq-100 added 0.2%.

Minutes of the December meeting show Federal Reserve officials remain committed to fighting inflation and expect higher interest rates to stay in place until more progress is made. After initially declining on the release of the minutes, stocks turned around to end Wednesday higher.

At the close the DJIA was up 0.4% to 33,270, the S&P 500 rose 0.8% to 3,853 while the Nasdaq Composite advanced 0.7% to 10,459.

As well as the Fed’s hawkish stance, traders are also contemplating the possibility of another upbeat set of non-farm payrolls tomorrow, commented James Hughes, chief market analyst at Scope Markets.

“However, the literal elephant in the room here is the ongoing tussle by Republicans in Washington to elect a house speaker,” Hughes said. “Whilst common consensus may be that political gridlock is good because it prevents businesses being blindsided by policy change, the US debt ceiling needs to be lifted again by the summer so lawmakers need to get down to business.”

House GOP leader Kevin McCarthy has sufferered defeat in six rounds of voting across two days, with the House approving a motion to adjourn until noon today. The House can't kick off the new Congress or swear in new members until a speaker is elected.

Hughes noted that ADP (NASDAQ:ADP) Payroll data is due before the opening bell today, while two Fed policymakers are due to give speeches later in the session.

“Any nuance here over the extent of policy tightening is likely to be closely followed, with risk potentially on the upside if any dovish tones emerge,” he added.

11.45am: RWE and Equinor in hydrogen push

Germany has made another push to reduce its dependency on Russian gas by signing a deal to build new hydrogen power plants.

The energy giant RWE has agreed with its Norwegian rival Equinor to make joint investments in hydrogen-ready gas-fired power plants in Germany, which will have a total capacity of 3 gigawatts by 2030.

The German and Norwegian energy companies @RWE_AG and @Equinor just announced to jointly develop large-scale value chains for low-CO2 hydrogen. They aim to replace German coal-fired power plants with hydrogen-compatible gas-fired power plants: https://t.co/kUGKzwR5up— AHK Norwegen (@AHKNorwegen) January 5, 2023

The agreement also includes the construction of a pipeline to carry hydrogen from Norway to Germany together with the joint development of offshore wind farms that will enable production of renewable hydrogen as fuel for power and other industrial customers in the future.

The project will initially focus on low-carbon “blue” hydrogen, with a target of generating fully-renewable “green” hydrogen in the future.

“The collaboration has the potential to develop Norway into a key supplier of hydrogen to Germany and Europe” said Anders Opedal, Equinor’s CEO and president.

“In order to make progress in the conversion from fossil fuels to hydrogen, there is an urgent need for a rapid ramp up of the hydrogen economy. Blue hydrogen in large quantities can make a start, with subsequent conversion into green hydrogen supply” said Dr Markus Krebber, CEO of RWE.

11.20am: UK hiring outlook positive but slowing according to Manpower

Global recruiter ManpowerGroup has found that the net employment outlook for UK employers – a measure of hiring optimism - remained positive for the first quarter of 2023 at +19%.

The survey of 2,030 UK employers did show however that the overall intention to hire is slowing down for a third quarter running, with many UK employers currently recruiting just to retain talent and maintain position in the context of today’s challenging economic circumstances.

"Talent retention is going to be a battle for most employers this year" said Chris Gray, director at ManpowerGroup UK. “We’re seeing hiring cool for the third quarter running, but the demand for skilled talent is still outstripping supply.”

“This situation can be likened to a leaky bucket – employers have to keep hiring at pace just to maintain position and not lose out amidst an ongoing skills shortage" Gray added.

In terms of sector demand, IT led the pack with a net employment outlook of +34%, level with the last quarter, as 80% of IT firms struggled to find talent, and 58% of tech firms reported IT and data skills are the most difficult to find.

10.45am: One in six UK companies affected by strike action

One in six UK companies have been hit by the industrial action currently engulfing the country.

The latest survey of British firms from the Office for National Statistics (ONS) found that 16% of businesses had been affected by strikes with a quarter of those firms unable to obtain necessary goods for their business.

One in 20 companies with at least 10 employees are planning to make redundancies over the next three months, the ONS found, with two-thirds taking action to cut staff costs.

Yet, almost a third of businesses with 10 or more employees reported they were experiencing a shortage of workers, including half of firms in the human health and social work activities industry.

And looking ahead to this month, more than one in five businesses reported energy prices were their main concern, followed by input price inflation (15%) and falling demand of goods and services (14%).

10.04am: JP Morgan upbeat on food retailers

JP Morgan has made bullish comments on the UK food retailers ahead of their trading updates next week.

“Following yesterday’s stronger than expected Christmas performance of the traditional grocers published by Kantar and supportive UK consumer survey results over the key festive weeks we believe both Tesco (LON:TSCO) and Sainsbury to be well placed to over-deliver on current market expectations into their upcoming trading updates” the broker commented.

As a result JPM has upped its expectations for this year top-line and earnings by 1% for Tesco, reitered its overweight rating with an unchanged price target of 270p.

On Sainsbury, the broker has raised its price target by 3% to 213p although it has kept an underweight rating.

“We continue to see in Tesco a safer way to play the theme given the markets’ more realistic expectations into next year and its cheaper valuation vs Sainsbury” it said.

9.55am: Pearson (LON:PSON) hit by Bank of America (NYSE:BAC) downgrade

Plenty of broker comment moving stocks today as analysts come back from the Christmas break full of fresh thinking.

One share heading downwards is Pearson which has fallen 4.9% following a downgrade by Bank of America to underperform from neutral with a 865p price target.

But shares in Hikma Pharmaceuticals (LON:HIK) PLC rose 1.1% as analysts at Citi revised their net present value (NPV)-based price target to £19.20 with a £28-£11 bull-bear valuation range for the stock.

Analysts pointed out: "The launch of gXyrem this week and further expansion of the MENA biosimilar collaboration with Celltrion are incremental positives. Updated forecasts reflect upgrades at US Generics, though note we remain extremely conservative, as well as better margin resilience at Injectables. Higher net financial charges and FX provide a partial offset."

9.45am: UK service sector PMI improves in December

The UK service sector remained inside contraction territory, but only just as 2022, with the PMI rising to 49.9 in December from 48.8 in November.

Although the best reading since September, and indicative of a broad stabilisation of activity, the latest survey data from S&P/CIPS and anecdotal evidence from panellists nonetheless painted a picture of a difficult operating environment.

???????? UK Services #PMI rose to 49.9 in December (Nov: 48.8), indicating a near-stabilisation of services activity at the end of 2022. #Employment levels were unchanged though, ending a run of growth going back to early 2021. Read more: https://t.co/STRLQbhIBR pic.twitter.com/PPiXpbMXYr— S&P Global PMI™ (@SPGlobalPMI) January 5, 2023

On the bright side new business fell at its weakest rate for three months and cost pressures also showed signs of weakening, with inflation rates down for both operating expenses and charges.

Nonetheless, price pressures remain elevated, and the business environment challenging.

Firms subsequently exhibited a cautious attitude to hiring staff, which overall were left unchanged compared to November.

9.25am: New car sales at 30-year low

New car registrations in the UK fell last year to their lowest level in three decades, new figures from the Society of Motor Manufacturers and Traders (SMMT) show.

Despite a recovery in the second half of 2022, a continuing parts shortage hit production lines.

Chip crisis subdues new car market but EVs now second only to petrolhttps://t.co/T5oHMbIPL6 pic.twitter.com/cVtA38amR4— SMMT (@SMMT) January 5, 2023

Meanwhile, demand for electric vehicles continued to grow and they accounted for almost a fifth of new car sales.

But charging infrastructure is not being built quickly enough to cope with growing demand, warned the Society of Motor Manufacturers and Traders (SMMT).

Across the whole of 2022, 1.61mln new cars were registered in the UK, the lowest level since 1992.

"It's still the long Covid effect," said Mike Hawes, chief executive of the SMMT. "The key issue is global disruption to supply chains," he added.

"The demand we know is there… manufacturers have just really struggled to be able to make vehicles in sufficient quantities."

9.15am: HSBC in favour at Jefferies

Away from the high street and another stock on the move today was HSBC Holdings (LON:HSBA) PLC which advanced 2.1% as Jefferies added the company to its buy list and hiked its price target by 42% to 770p from 574p.

“We believe the China/HK re-opening and capital return prospects of HSBC are underappreciated attributes which create positive return/risk asymmetry” the broker said.

The broker suggested a re-opened economy would drive higher loan demand and general activity which should benefit the FTSE 100 listed lender.

Upgrading the stock to buy from hold analysts estimated that the sale of the bank's Canada business can unlock US$14bn of buybacks and special dividends across 2023 and 2024.

As a result it sees “see credible re-rating potential given estimated 13% ROTE in 2024.”

9.00am: Retailers confound expectations with strong sales

Retailers lead the way today with the strong trading statements from Next, Greggs and B&M giving a lift to the likes of JD Sports Fashion plc, Frasers Group plc, ASOS (LON:ASOS) plc, Marks & Spencer Group plc and Primark owner, Associated British Foods (LON:ABF) PLC amongst others.

Simon French, chief economist at Panmure Gordon pointed out the news painted a picture that doesn’t fit narrative of doom and gloom.

First few UK festive trading updates (Next, B&M, Greggs) painting a picture that doesn’t fit narrative of doom & gloom. In our 2023 outlook we noted regressive nature of staples inflation would generate some incredibly difficult hardships - but may not be reflected at macro level— Simon French (@shjfrench) January 5, 2023

He suggested this may reflect strong aggregate household balance sheets, behavioural adaptations and high vacancy rates.

Next remained the star performer, up nearly 6%, after better-than-expected Christmas trading figures.

Stifel analyst Caroline Gulliver believes Next's Christmas performance, particularly in stores, “will make it one of the retail clothing & home winners this Christmas,” and its forecast fiscal year 2023 pre-tax profit decline of only 8%, “will make it one of the most resilient retailers in calendar 2023.”

She pointed out the guidance for the current year of £860mln was around 3% above consensus of £835mln and Stifel £837mln forecast, while the estimate for fiscal year 2024 of £795mln was around £12mln ahead of consensus.

The broker recently upgraded the retailer to buy.

ON B&M, which is trading 1.8% higher, Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) commented “‘’The appetite for bargain hunting has increased sharply amid the big cost-of-living squeeze with shoppers flooding into discount stores.”

“B&M European Value retail is benefitting from this trend with its cut-price products piled high in baskets during the pre-Christmas period.”

Stifel analyst David Hughes agreed. He said the performance “reflects the draw of B&M's strong price position at a time when the rising cost-of-living crisis continues to put pressure on household budgets.”

Greggs, up 0.8%, was also seen as benefiting from its value offering.

“Essentially, Greggs has a lot going in its favour because it exists at the end of the value spectrum, and the group is capitalising on this“ noted Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown noted.

She pointed out the bakery-chain’s pricing is also being held as a “key area of strength in current conditions, and has meant that together with cost savings, margins have held up for the full year.”

8.15am: FTSE 100 lifted by retail cheer

Trading in London got off to a better than expected start as a batch of upbeat trading statements across the retail sector confounded expectations for a weaker start.

At 8.15am the FTSE 100 was up 5 points at 7,590 while the FTSE 250 fell slightly, down 29 points, to 19,362.

Next PLC gave investors a late Christmas present as it reported better-than-expected Christmas sales, up 4.8%, which compared to previous guidance for a fall of 2%.

This prompted the clothing retailer to raise its pre-tax profit forecast for the current year by £20mln to £860mln although it expects Inflation in essential goods, particularly energy, rising mortgage costs and continued price inflation would dampen demand in the coming year with profits seen falling to £795mln.

But as Peel Hunt pointed out this guidance was still £30mln ahead of its current forecast and £12mln ahead of consensus estimates.

“Overall, a more positive tone than autumn, which we expect to feed into the shares” the broker said. They were right with shares up 5.8%.

Greggs also rose in early trading, up 1%, as it held full year guidance as strong sales of seasonal goods such as its festive bake, sweet mince pies and salted caramel lattes pushed fourth quarter sales up 18.2%.

The retailer, famed for its value sausage rolls, said sales for fiscal year 2022 were £1,513mln, up 23.0%, compared to last year with like-for-like sales in company-managed shops 17.8% higher than sales seen in 2021.

B&M European Value Retail also rose as it reported strong momentum across its "golden" third quarter despite a challenging macroeconomic environment.

In the 13-week period from September 25, revenue grew by 12% year-on-year to £1.57bn with a very good performance across all B&M UK categories as well as solid momentum in B&M France and Heron Foods.

As a result, it forecast full-year earnings between £560mln to £580mln, above current analyst outlook consensus of £557mln.

The group also expects to pay a special dividend of 20.0p per share and the shares responded by rising 2.3%.

7.50am: Cable goes bearish, Fed sticks to its guns, EUR responds to surprisingly cool inflation data

In further proof of a cooling UK housing market, mortgage approvals fell to their lowest level since June 2020 in November, according to yesterday’s reading.

Today’s services and manufacturing output data will likely add to all-round proof of a cooling economy.

Economic cooling was the trend on both sides of the Atlantic- In the US, Federal Open Market Committee (FOMC) minutes released yesterday showed the committee expects growth this year to be below trend, but that is needed to bring supply and demand into balance and reduce inflationary pressures.

Yet as Pantheon Macroeconomics noted, “FOMC members remain focussed on current inflation and inflation risks, with fear of overkill on monetary policy receiving very little attention”.

Amid these data points, Cable closed the Wednesday session 0.75% higher at 1.205, effectively recouping Tuesday’s losses.

But the pair went bearish this morning, cutting back to 1.202 in the Asia trading window.

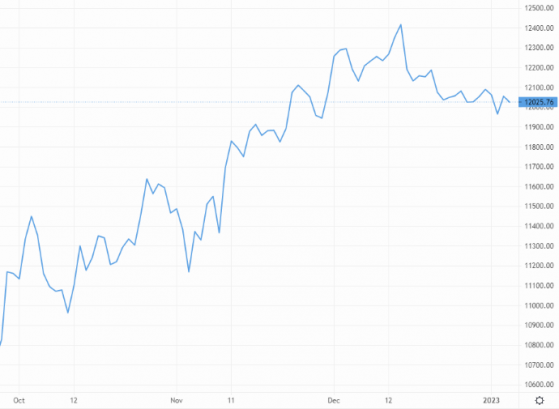

GBP/USD hits low note after Wednesday surge – Source: capital.com

Advance Eurozone inflation data is throwing out some surprises. Headline inflation in December is expected to read below 9% tomorrow (although core inflation is likely to stay constant).

The downward revision follows yesterday’s single-digit German inflation surprise, sparking renewed hope for a gentler central bank policy and improvement in the Eurozone bond market.

On that note, bund yields, despite edging higher this morning, have dipped to 2.3% from 2.57% on December 30.

EUR/USD closed 0.6% higher yesterday, and has so far remained flat at 1.060 today.

EUR/GBP closed slightly lower yesterday, but the pair has added 0.3% to 88.21p in this morning’s Asia trading hours.

7.40am: Strong Christmas at Next but profits to fall next year

Next PLC gave investors some good and bad news as it updated on trading today with strong Christmas sales offset by a warning that profits would fall in 2023/24.

Trading in the nine weeks to 30 December was strong with full price sales up +4.8% versus last year which was around £66mln better than the retailer’s previous guidance of -2.0% for the period given in November.

As a result the FTSE 100 listed group has increased its full year profit before tax guidance by £20mln to £860mln, up +4.5% versus last year with EPS seen at 567.2p, up +6.9% versus last year.

Retail sales were particularly strong in the period, up 12.5%, while online sales rose 0.2%, while the end-of-season sale is progressing well and clearance rates are ahead of our expectations.

But the clothing seller was cautious as it looked ahead to the coming year expecting full price sales to fall 1.5% taking pre-tax profits down 7.6% to £795mln.

7.05am: FTSE seen lower

FTSE 100 is expected to open lower after two days of gains following the release of the FOMC minutes which showed Fed officials remain steadfast in their commitment to tackling inflation.

Spread betting companies are calling the lead index down by around 19 points.

US markets broadly shrugged off the minutes but closed off earlier highs with the Dow Jones Industrial Average up 133 points, or 0.4%, to 33,270, the S&P 500 up 29 points, or 0.75%, to 3,853 and the Nasdaq Composite up 72 points, or 0.69%, to 10,459.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank noted “The FOMC minutes were hawkish enough to get the S&P500 erase early gains, but not hawkish enough to get the index to close in the red.”

“Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2%, which was likely to take some time,” the meeting summary stated.

Ian Shepherdson, chief economist at Pantheon Macroeconomics noted “FOMC members remain focused on current and inflation and inflation risks, with fear of overkill on monetary policy receiving very little attention.”

“In other words, don’t expect them to soften their inflation line until it becomes blindingly obvious that a serious shift in the data is underway.”

In London, retailers will take centre with a batch of Christmas trading updates due from B&M European Value Retail SA, Greggs PLC and Next PLC.

Another batch of PMI surveys are also due in the UK and the US while initial jobless claims figures in the US will give a further guide as to the health of the US jobs market ahead of tomorrow’s non-farm payrolls numbers.