Welcome to the Investing.com UK weekly FTSE 100 latest update, designed to keep investors informed on the newest UK stock market movements and key developments. In this weekly report, you'll find a summary of the last week's significant news, and trends affecting the FTSE 100 index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday during London Stock Exchange (LSE) market opening times between 8:00am-4:30pm UK local time (GMT+1).

FTSE 100 Share Price Opening 9th September 2024

The closing share price for the start of this week, Monday 9th September, was 8,270.84 , which sat +1.09% higher than at close on Friday 6th September, suggesting a strong start in an attempt to make up for the previous week’s losses.

Investor Sentiment This Week For FTSE 100 Predictions

The FTSE 100 started the week with a +1.09% boost on Monday, but has unfortunately seen falls every day since. The swing to a more bearish sentiment that we saw at the end of last week seems to have largely played out despite some green moments for the index this week.

Surge in Employment Beats Expectations

In July, the UK labour market showed significant strength as employment surged by 265,000 – the largest increase in over 18 months, far surpassing the forecast of 115,000 new jobs. This uptick was driven primarily by growth in full-time employment. Interestingly, more individuals are now juggling second jobs, which account for 3.9% of all employed people, according to the Office for National Statistics (ONS).

Dip in Unemployment and its Implications

The unemployment rate dropped slightly to 4.1% in the July quarter, from 4.2% in the previous quarter, aligning with expectations. This solid performance in the job market could influence the Bank of England’s (BoE) stance on interest rates. Policymakers recently lowered the bank rate by 25 basis points in August, moving the benchmark rate down from a 16-year high.

Economic Resilience and Inflation Concerns

The robust employment data points to a resilient economy, which might spark concerns about inflation. A strong job market can drive up wages and, consequently, consumer spending, potentially leading to higher prices. This scenario could make some members of the BoE’s Monetary Policy Committee (MPC) anxious about inflation, favouring a tighter monetary policy.

Mixed Signals on Wage Growth

On the flip side, wage growth showed signs of easing. The private sector saw a year-on-year increase of 4.9% in July, down from June’s 5.3%. Similarly, public sector wage growth softened to 5.7% in July from 6% in June. The construction sector witnessed the smallest annual wage growth rate at 3.9%.

Looking Ahead: BoE’s Next Move

The next key date for investors is the BoE’s decision on 19th September (next Thursday). Given the mixed signals—resilient employment figures coupled with moderate wage growth—it will be interesting to see whether the central bank opts to maintain, cut, or hike interest rates.

Overall, this week’s developments in the FTSE 100 highlight a resilient job market with potential implications for future monetary policy.

September is historically a volatile month for stocks but, as always, long-term investors are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to an additional 10% off your 1-year plan!

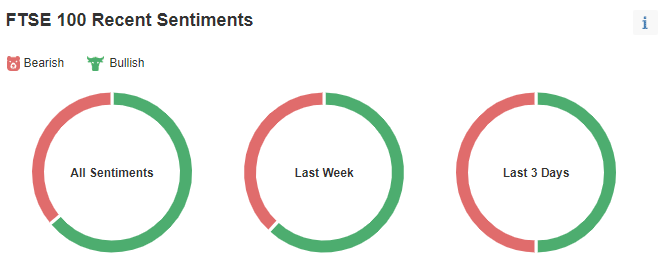

We can see that the Investing.com UK community’s sentiment towards the FTSE 100 index has kept its bearish momentum, but has pulled back very slightly, with a 50-50 Bearish-to-Bullish split, compared to last week’s 64-36 split.

Notable FTSE 100 Movements & Stock Market News

Here are some of the top stories from the footsie 100 constituents over the past 5 days. Unfortunately, it’s mostly bearish news this week.

Rolls-Royce's Share Decline

Rolls-Royce Holdings PLC (LON:RR) shares have recently dropped, influenced by issues with its Airbus A350 engine and a broader market downturn. Last week, Cathay Pacific temporarily grounded its Airbus A350 due to Rolls-Royce engine concerns. However, Cathay later reported that the issue was limited and resolved, easing fears of further groundings. But by this time, the share price had already fallen from a record high of 504p in August to 462p.

But even with additional, wider market woes, Rolls-Royce remains somewhat insulated due to its strong presence in defense and its continuous demand for aircraft engine services. So while this dip has been disappointing for investors, we shouldn’t act too hastily when it comes to this quiet giant

Despite the recent blip, Rolls-Royce has demonstrated solid financial performance. Revenues increased from £6.9 billion to £8.1 billion, while profits have surged from £673 million to £1.1 billion. Free cash flow, a crucial metric, rose to £1.15 billion.

Currently, Rolls-Royce trades at a discount compared to competitors such as General Electric (NYSE:GE). The company has a market cap of $51.85 billion, significantly smaller than GE’s $174 billion. Its price-to-earnings (P/E) ratio is 16, and its forward P/E is 28, indicating potential room for growth.

Rolls-Royce faces recent market turbulence and an engine issue, but its strong financial health and lower valuation compared to competitors may offer an attractive investment opportunity. For investors, the company's resilience in diverse sectors and its undervaluation could present a strategic buy.

Burberry And JD Sports Share A Slump

Burberry Group PLC (LON:BRBY) shares continue to struggle, with another 5% wiped off its value this morning. At 571p per share, Burberry's valuation has now plummeted to levels not seen since November 2009, nearly 15 years ago. The company's prolonged decline has fueled speculation that it will exit the FTSE 100 in the next reshuffle on 23 September, to be replaced by insurer Hiscox (LON:HSX) Ltd.

Burberry has faced multiple challenges, including a sluggish global rebound in luxury markets, the departure of its chief executive, and a suspended dividend. These headwinds have contributed to a steep drop in the stock's price, highlighting the volatility in fashion stocks.

Similarly, JD Sports Fashion PLC (LON:JD) faces its own hurdles. The sportswear retailer recently confirmed it will close a distribution warehouse in Derby, resulting in nearly 200 job losses. This decision follows a strategic review of its global supply chain network. JD Sports has operated the 514,000 sq ft Derby facility since 2021.

A JD spokesperson described the closure as a "difficult decision," noting that a redundancy consultation began in July. Despite reporting an 8.3% sales growth in the past quarter, JD Sports saw its profit margins squeezed due to spending on promotions. Chief executive Régis Schultz warned that the "global macro environment remains volatile" and urged caution regarding the outlook for the rest of the year.

The fortunes of Burberry and JD Sports underscore the volatility in fashion stocks, driven by both sector-specific challenges and broader economic conditions. Investors should stay informed and vigilant as these dynamics continue to unfold.

GB News Founder Buys The Spectator

Redbird IMI (LON:IMI), owner of the Telegraph Media Group, has sold The Spectator to Brexiteer and controversial hedge fund manager Paul Marshall for £100 million. Marshall, known for funding the right-wing GB News TV channel, acquired the publication amid a complicated ownership saga.

Last year, UAE-backed Redbird IMI bought The Telegraph from Lloyds Banking Group (LON:LLOY) PLC after the Barclay brothers defaulted on loans. Redbird IMI's control was later blocked by the Tory government due to fears of UAE political influence, prompting an auction.

The sale has seen interest from prominent figures like Maurice Saatchi, private equity group CVC, the Murdoch empire, and the Daily Mail.

The Spectator’s editor, Fraser Nelson, called the £100 million deal a “vindication” of its “unusual business model.” He noted that the publication's value increased fivefold since its £20 million valuation in 2005, driven by a doubling of subscriptions despite a shrinking magazine market. The auction attracted 22 bidders, highlighting the publication's strong appeal.

AstraZeneca Becomes A FTSE Faller

AstraZeneca PLC (LON:AZN) saw a significant decline this week, shedding a staggering £9 billion in value as its shares dipped by 4.8%. This sharp drop made AstraZeneca the biggest drag on the FTSE 100 mid-week, reflecting investor disappointment.

The decline’s primary cause came from disappointing results from a late-stage trial of a lung cancer drug. The TROPION-Lung01 trial aimed to evaluate the effectiveness of the new drug datopotamab deruxtecan (Dato-DXd) compared to docetaxel, the current standard chemotherapy treatment. Unfortunately, the overall survival rate from the new drug "did not reach statistical significance," according to AstraZeneca. This trial targeted adult patients with advanced or metastatic nonsquamous non-small cell lung cancer (NSCLC) who had already undergone at least one other therapy. Given the high stakes involved in such treatments, the results have understandably shaken investor confidence.

The broader FTSE 100 also felt the impact, dipping by 35 points to 8,235. These developments underscore the volatility that can accompany drug trial outcomes and their substantial impact on market performance. Investors should keep an eye on AstraZeneca as it navigates this setback and any potential future updates.

FTSE 100 Close Today

The above investor sentiment and factors driving this week's ‘Footsie’ volatility meant that today the FTSE 100 is likely to close at a price which sits only slightly higher than the weekly FTSE 100 opening price of 8,181.47.

Best FTSE 100 Shares To Buy

Investors can also use our free stock screener to filter top FTSE 100 companies according to their investment strategy, and add them to a watchlist today.