- FTSE 100 falls 44 points

- Sainsbury rings up gains

- BT under pressure

9.37am: UK service sector output weakest since January 2021, as mini-budget turmoil hits sentiment

Ahead of the Bank of England decision come more signs of weakness in the UK economy.

The S&P Global/CIPS services purchasing managers index fell from 50 in September to 48.8, signalling contraction. This is the lowest reading since January 2021.

Lower volumes of service sector output were mostly linked to cautious spending patterns among businesses and consumers, said S&P

A number of firms noted that political uncertainty since the mini-Budget had adversely impacted business investment and encouraged a wait-and-see approach to new projects.

There were also signs that higher energy bills had led to reduced spending on non-essential services.

October data revealed the first decline in UK service sector activity for 20 months with the #PMI at 48.8 (Sep: 50.0). Concerns over high inflation, the macroeconomy and the political environment hit client demand. Read more: https://t.co/MCNTCTktk6 pic.twitter.com/Fcfyqsqefn— S&P Global PMI™ (@SPGlobalPMI) November 3, 2022

Business confidence has also been hit.

Tim Moore, economics director at S&P Global Market Intelligence, said: "Stubbornly high inflation, increased borrowing costs and worries about the UK economic outlook all contributed to weaker business optimism in October. Aside from the slump at the start of the pandemic, the degree of confidence across the service economy is now the lowest since December 2008."

The composite index - services and manufacturing - fell from 49.1 to 48.2.

This is the third month running the index has been below the 50.0 no-change mark. Manufacturing production fell at a much faster pace than service sector activity, said S&P.

The pound is under pressure, with sterling down 0.96% against the dollar to US$1.1271 and off 0.39% against the euro to €1.1548.

8.55am: Super-size Bank hike expected

The Bank of England is widely expected to raise interest rates by 75 basis points later.

A smaller hike of 50 basis points cannot be ruled out, but last time round the market took issue with a similar increase, fearing the Bank was behind the curve on tackling inflation. A day after its last meeting, of course, came the contentious mini-budget which sent things spiralling out of control and led to the Bank stepping in to steady the gilt market.

Craig Erlam at Oanda said: "The Bank of England will likely join the Fed in raising rates by 75bps later today. The central bank has had the unenviable job of fighting soaring inflation amid enormous economic and political uncertainty. In recent months the country has had three Prime Ministers, three very different economic agendas, and no budgets outlining them. Not ideal for a central bank that's fighting double-digit inflation.

"It hasn't handled things perfectly this year either, that's clear. It's taken a far more cautious approach than others leaving it in the situation now that it must raise rates aggressively and publish economic forecasts with little insight into government spending and tax plans. The outlook is uncertain enough without that."

Victoria Scholar at interactive investor said: “It is far from certain, but the Bank of England could be set to carry out its biggest rate hike since 1989 raising interest rates by 75 basis points to 3%. This would be the eight consecutive interest rate increase lifting rates to the highest level since 2008 at the start of the global financial crisis. The Monetary Policy Committee’s vote is likely to be divided with the potential for a less aggressive 50 basis point hike instead. The size of the increase will signal how concerned Bank of England policymakers are about inflation versus a recession as it looks to curtail further price rises without inadvertently causing unnecessary economic pain.

"Looking further ahead, the markets are pricing in another 50-basis point increase from the Bank of England in December after which the pace of tightening may slow, depending on the path of inflation."

Jim Reid at Deutsche Bank (ETR:DBKGn) points out that the recent market turmoil saw investors expecting a much bigger rise from the Bank at one point.

He said: "Since the BoE’s last meeting in September, an awful lot has happened in the UK, including a mini-budget that triggered market turmoil, a temporary BoE intervention to buy longer-dated gilts, a policy reversal on most of that mini-budget, and then Liz Truss’ replacement as PM by Rishi Sunak. That volatility has been reflected in market pricing for today’s decision as well.

"Straight after the last meeting, overnight index swaps were pricing in a 75bps hike, but at the height of the mini-budget turmoil they went as far as pricing in more than 200bps worth by today, including a decent chance of an intermeeting hike. However, as the situation has calmed down, pricing has returned to its original starting point of a 75bps hike again."

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown (LON:HRGV), said: "Inflation is proving a tough opponent to beat so another super-size hike is widely expected. Bank of England policymakers may not be equipped with an aide memoire of a fiscal statement to work out how much corrector pen it needs to try and erase inflation, but they have a pretty clear timetable laid out about the course the economy is set to take. There will be a close eye trained on accompanying comments, especially policymakers’ expectations for just how high the price spiral will go, and the shrinking effect on output of this sharp tightening of policy."

8.25am: Rolls down to earth after trading update

Rolls-Royce Holdings PLC (LON:RR.) is also proving a drag on the market.

The aero engine maker maintained its guidance for 2022 despite supply chain issues, rising energy and raw material costs, and the recent turmoil in the financial markets.

But its shares are down 4.42% as investors were hoping for more.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: “Rolls Royce is doing all it can within its control. Costs are being managed by inflation-linked clauses in its customer contracts, debt’s being repaid, and crucial Engine Flying Hours are edging upwards. The trouble is, and which has been the case since the pandemic struck, the group’s grappling against a multitude of headwinds from external forces.

"Engine Flying Hours, which are used to calculate how often Rolls Royce’s engines are serviced, will never take off completely while restrictions remain in China. At the same time, while the debt pile is coming down, and is on a fixed interest rate, it is still suffocatingly large. The group’s carrying £4bn of drawn credit around, and that will limit growth for a while yet because lightening that load takes priority over anything more exciting."

8.13am: Footsie falters as Fed suggests US rates will go higher than expected

Leading shares have opened lower after the Federal Reserve indicated US interest rates would have to go higher than previously expected, and ahead of a forecast 75 basis point rise in UK rates at midday.

Victoria Scholar, head of investment at interactive investor, said: "The Fed’s latest interest rate hike has sent global markets lower with the Nasdaq closing down more than 3% after the central bank suggested that it is prepared to go further to tackle inflation. Fed Chair Jay Powell warned that US rates will peak above expectations, dashing hopes that the rate hiking cycle was beginning to wind down and that inflation was under control in the eyes of the Fed."

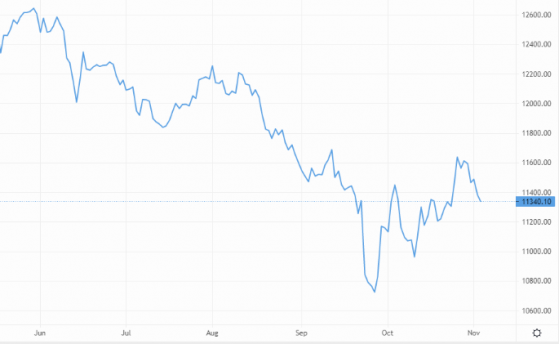

With Wall Street lower and Asia markets under pressure, the FTSE 100 is down 44.23 points or 0.62% at 7099.91.

BT Group PLC (LON:BT.A) is down 4.09% despite first half earnings rising 3% and the company saying it was on track to meet its full year guidance as it increased its cost savings target.

Scholar said: "The telecoms giant is grappling with pressures from rising inflation and fears of a recession, which is why BT is raising its cost savings target as a way to provision for the macroeconomic headwinds and to pay for the build of its fibre network.

"BT has also been dealing with a series of challenges from rising interest rates given its heavy debt levels as well as an unhappy workforce resulting in a series of strikes amid a dispute over pay. Earlier this month, BT also reduced its group revenue guidance after the creation of its Warner Bros Discovery sports joint venture."

But J Sainsbury PLC is up 3.11% despite an 8% fall in interim profits to £340mln. As analyst Nick Bubb said, it could have been worse given the challenging environment.

The supermarket group also stuck with its full year forecast of underlying profits of between £630mln and £690mln.

7.49am: Dollar leaps ahead following jumbo hike, euro gathers support against Sterling

As expected, the US Federal Reserve raised interest rates by 75 bps yesterday, marking the fourth straight jumbo hike in a row.

The market is starting to price in a looser policy, i.e. 25 to 50 bps, according to Daniele Antonucci, chief economist at Quintet Private Bank.

Antonucci said: “The important bit was that the central bank acknowledged the substantial cumulative monetary policy tightening and the likely further impact on the economy. These changes in the statement suggest that the Committee is probably leaning towards slowing the pace of rate hiking to 50 bps at the December meeting.”

Unsurprisingly, this propelled the greenback forward. The GBP/USD pair is currently at nine-day lows of US$1.136.

Cable gears up for today’s BoE rate decision – Source: capital.com

But it was the euro that took the hardest beating, having closed the Tuesday session 64 pips lower and dipping another 26 pip in this morning’s Asia session so far.

At US$0.978, the EUR/USD pair has returned to two-week lows.

EUR/GBP is finding more support; the pair is currently changing hands at 86.18p having closed higher yesterday.

That could change when the Bank of England announces its interest rate decision later today.

Expectation is for another jumbo 75 bps hike, and anything softer could see a cooling off for the British pound.

7.00am: FTSE seen lower as Fed signals further rate rises are on the way

The FTSE 100 is expected to be marked down in early trading after the Federal Reserve raised US interest rates by 75bp and indicated more increases were on the way sending US stocks sharply lower.

Spread betting companies are calling the lead index down by around 45 points.

The Dow closed Wednesday down 505 points, 1.6%, at 32,148, the Nasdaq Composite slipped 366, 3.4%, to 10,525 and the S&P 500 lost 97 points, 2.5%, to 3,760.

The 75bp rise was expected but US markets fell back sharply after Fed chair Jerome Powell signalled further hikes were on the way: "We have a way to go," before rate hikes could be paused.

Michael Hewson chief market analyst at CMC Markets said: “While Powell acknowledged that a slowdown in the size of rate rises was likely, it didn’t alter the fact that rates would probably still need to go much higher in order to get inflation back to target of 2% over time.”

In London, the Bank of England will announce its interest rate decision at noon with expectations of a 75bp increase to match the Fed although some analysts suggest the recent poor economic data may prompt a lower increase.

Energy stocks will be in focus once more after a report in The Times suggesting the windfall tax on oil and gas companies will be extended by the government.

A busy day of corporate news kicks off with results from BT Group PLC (LSE:BT.A), Rolls Royce PLC and J Sainsbury PLC (LSE:SBRY) amongst others.