Proactive Investors -

- London, Europe open the week lower

- Mining and oil stock drag on footsie

- Sunak to meet UK plcs

9.56am: Sunak to woo UK plcs as CBI crisis deepens

Prime Minister Rishi Sunak is to hold talks with UK business leaders at today’s Business Connect conference in what is being billed as Sunak’s attempt to build bridges with British businesses after fractured relations with former PMs Johnson and Truss.

Sunak, finance minister Jeremy Hunt and business minister Kemi Badenoch will speak at a series of events on Monday to more than 200 executives spanning all sectors.

"We are bringing together some of the UK's biggest companies and investors for meaningful dialogue – and I'm a prime minister passionate about working with business to unlock opportunity and progress," Sunak said in a statement.

Business Connect will in some way act as a replacement for the crisis-riddled Confederation of British Industry (CBI), which faces being completely abandoned amid shocking allegations of rape and sexual misconduct among colleagues.

Almost every major British business has ditched the lobby group following the allegations.

Lady Patience Wheatcroft, former non-executive director of Barclays (LON:BARC), said it would be “nigh-on impossible” for the CBI to do its job following the scandal.

9.40am: European markets down

European markets are having a bearish start to the week, with DAX opening 0.13% lower at 15,863 and France’s CAC 40 index trailing its international counterparts with a 0.24% dip to 7,558.

It’s worth remembering, though, that Paris hit an all-time high last week, and year-to-date performance remains at least 14% higher.

“A sea of red across European indices says everything you need to know about investors’ mood,” said Russ Mould at AJ Bell. “While the losses are relatively minor, the fact the key European markets are falling at the start of the new trading week suggest that investors are nervous once again about the outlook.”

Yet Germany’s most prominent leading indicator, the Ifo index, increased for the seventh month in a row, coming in at 93.6 from 91.1 in March.

“An improving Ifo index is always good news,” said ING. “However, a weaker current assessment component and below-average expectations do little to take away the stagnation risk for this year.”

ING says Germany is “flirtation with recession”, although a rebound in industrial activity, however short lived, has staved it off for the time being.

Bank in London, the FTSE 100 blue-chip index is currently 0.19% down at 7,899, driven lower by a poor showing in the mining and oil segments.

9.27am: Inflation to fall?

Former Bank of England Chief Economist Andy Haldane reckons UK inflation will fall significantly in the next six months and advises interest rate setters to consider pausing further increases in borrowing costs.

In an interview with Sky News on Sunday, Haldane, who left the Bank in 2021, believes that inflation could drop to 3-5% due to an expected slowdown in energy price increases.

Haldane’s comments come at a turning point for central banks in the major economies after the most aggressive tightening cycle in a generation.

Some analysts posited that the Bank of England was done with its hiking cycle, but in contracts to Haldane’s comments, last Wednesday’s inflation read came in higher than expected at 10.1%.

Recent wage and CPI data also came in above expectations.

ING stated today that “if services inflation continues to trend higher and recent survey evidence showing reduced price pressures begin to revert, then the Bank could go further – though the three or four rate hikes markets are currently pricing appears extreme”.

At the very least, the market predicts an 88% chance of another 25 bps rate hike come May.

As for the stock market today, footsie remains 0.16% lower at 7,901, dragged by tepid performance among mining and oil stocks.

9.03am: Mining and oil stocks drag footsie lower

FTSE 100 remains down on the day, albeit only a touch, with 9.6 points or 0.12% of losses bringing the blue-chip index to 7,904.

This week is a big one for earnings, with pharma giants GSK (LON:GSK) and AstraZeneca (NASDAQ:AZN) and banking giants Barclays and NatWest (LON:NWG) all providing results.

But this Monday is objectively a quiet one, though First Republic Bank (NYSE:FRC) in the US undoubtedly providing some talking points later in the day. The market will be keen to see what one of the US’s largest regional lenders has to say six weeks after the mini-crisis.

Back to the UK, London markets got a confidence boost when AstraZeneca flipped US rival and former takeover threat Pfizer Inc (NYSE:PFE) in terms of market capitalisation.

AstraZeneca has added 5.7% in 2023, boosted by strong clinical results in its cancer and rare diseases research programmes, while Pfizer on the New York Stock Exchange has dipped over 20% year to date, burning its market value to around £182bn.

Today’s footsie leaders include Dowlais, the newly spun-out industrial group from Melrose Industries (LON:MRON), and GSK, putting the other top UK pharma multinational in good footing leading up to Wednesday’s earnings call.

In the banking sector, Barclays and Lloyds (LON:LLOY) are leading the pack with around 0.7% gains a piece, while NatWest is 0.5% higher and HSBC (LON:HSBA) is in the red.

The UK heavy industries appear to be dragging the blue-chip index down, with Glencore (LON:GLEN), Melrose, Shell (LON:RDSa), Fresnillo (LON:FRES) and BP (LON:BP) comprising the five worst performers.

On the forex markets, Cable has remained essentially flat at 1.244, as has EUR/GBP at 88.32p.

8.42am: Dowlais leads the blue chips

Newly spun-out industrial group Dowlais (LON:DWL) leads the FTSE 100 set this Monday, adding 1.8% since Friday’s close.

Former parent Melrose, meanwhile, is bottom of the blue-chip pile, having 1.5% knocked from its share price after last week’s three-to-one consolidation.

Dowlais comprises former Melrose Industries PLC segments GKN Automotive, GKN (LON:GKN) Powder Metallurgy and GKN Hydrogen, which were demerged from the group last Thursday.

GSK is also among the top movers, adding around 0.7% to 1,481 in anticipation of Britain’s second-largest pharma group (behind AstraZeneca, see below)’s second-quarter results on Wednesday, hot off the heels of the US$2bn acquisition of Bellus Healthcare.

Footsie is currently 0.1% lower on the day at 7,906.

8.29am: AstraZeneca overtakes former takeover rival Pfizer

British pharma giant has overtaken US counterpart Pfizers in terms of market capitalisation in the days leading up to the former’s quarterly earnings call on Thursday.

FTSE 100 constituent AstraZeneca has a market value of £189bn, having added 5.7% in 2023, while Pfizer on the New York Stock Exchange has dipped over 20% year to date, burning its market value to around £182bn.

Pfizer attempted a hostile takeover of its British rival in 2014, but its £55 per share offer proved unsuitable for voting shareholders.

AstraZeneca has been boosted by strong clinical results in its cancer and rare diseases research programmes.

Thursday’s trading statement is expected to top-line sales of US$10.7bn, core operating profit of US$3.5bn and core diluted earnings per share of US$1.68.

As for the footsie, the index opened 0.15% lower at 7,902 this morning.

7.53am: Sterling loses ground against dollar

The pound was knocked around 30 pips lower against the greenback in this morning’s Asia trading hours, cutting back 0.23% to 1.241 following a flat Sunday trade.

The long game remains bullish for the pound though, with year-to-date gains on the GBP/USD pair coming to over 2.8%.

It’s worth considering that UK inflation remains stickier than in the UK, placing greater emphasis on the Bank of England to maintain a more hawkish monetary policy over its US counterpart.

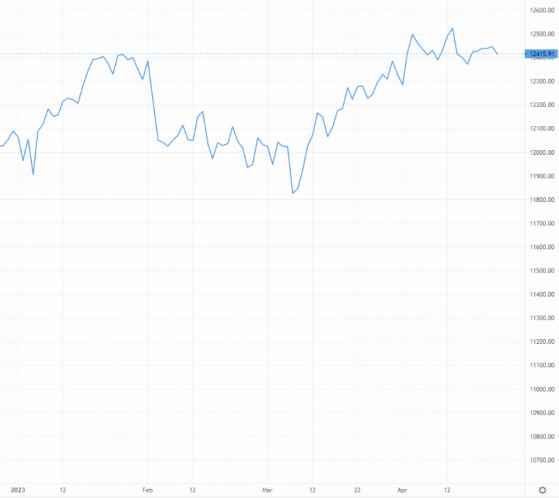

Cable remains higher year to date – Source: capital.com

Gold opened the week around the US$1,980 per ounce mark, slightly down from last week’s position due to the dollar ticking higher.

The euro gained on the pound this morning, with EUR/GBP edging 0.1% higher to 88.37p.

7.33am: CentralNIC has best-ever first quarter

CentralNic Group Plc (LON:CNIC) gross revenues for the first quarter came to US$194.9mln (£157mln) in the first quarter, according to the web services group’s trading update this morning, while adjusted EBITDA came to US$21.3mln

These figures represented 24% and 15% gains respectively.

Year-on-year organic growth for the trailing twelve months ending March 31, 2023 is estimated at approximately 45% when the audited figures are released on May 15.

Cash increased to US$102.9 by the end of the quarter from US$95mln in the previous quarter, reducing net debt to 49.2mln, taking into account the impact of the company returning US$4.3mln to shareholders via the share buyback scheme.

Directors remain confident that the group will continue to trade at least in line with current market expectations.

In a major highlight in the quarter, the group renewed its partnership with Microsoft (NASDAQ:MSFT) Bing to leverage CentralNIC’s existing AI capabilities with ChatGPT.

Chief executive Michael Riedl commented on the results: "I am thrilled to announce that CentralNic has had an outstanding start to the year, achieving our best-ever first quarter. Our continued industry leadership and reputation for excellence have enabled us to secure key partnerships with some of the world's leading technology companies, including Microsoft.”

Shareholders will today vote on the group’s inaugural dividend, marking “a significant milestone in our commitment to enhance shareholder value through a progressive dividend policy and continued share buybacks”, said Riedl.

CentraNIC was trading flat at 122.54 in pre-market trades.

7.15am: FTSE to open lower

FTSE 100 is expected to open lower this Monday, with pre-market trades pointing to a 0.15% dip on the blue-chip index.

Wall Street closed in a stronger position before closing for the weekend started, with the Dow Jones Industrial Average inching 22 points, or 0.07% higher at 33,808, and the S&P 500 3.7 points, or 0.09% higher at 4,133.

Nasdaq closed 12.9 points, or 0.11% higher at 12,072. However, US markets as a whole finished the weekly session lower.

European markets, meanwhile, eked out an all-time high with the CAC 40 in Paris closing the week at 7,577.

Don’t expect too much action on the UK earnings calendar today. CentralNic Group PLC is providing a trading update with Lok’nStore Group plc has its interim earnings call.

US earnings are more lively. All eyes are on First Republic Bank, the San Francisco regional lender that got particularly badly hit in the March mini-crisis. Investors will be expecting news on monetary outflows. Activision Blizzard Inc (NASDAQ:ATVI) is also providing results as well as Coca-Cola (NYSE:KO).

Read more on Proactive Investors UK