Proactive Investors -

- FTSE 100 advances, up 27 points

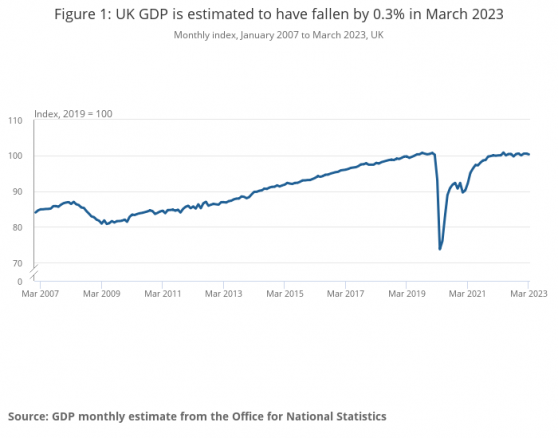

- UK GDP grows 0.1% in first quarter, falls in March

- Diageo (LON:DGE) falls as Jefferies downgrades on US concerns

Diageo falls as Jefferies downgrades on US concerns

Not such a good day for Diageo PLC which sits top of the FTSE 100 fallers, down 1.9%.

The owner of Johnnie Walker, Guinness and Baileys has been downgraded to hold from buy by Jefferies over concerns of the near-term outlook for the key US market.

The US business accounts for nearly 40% of sales and close to 50% of profits.

The broker predicts organic sales growth in the US of just 1% in financial 2024 below the consensus 0f 4.5% reflecting a slowdown after what it calls the “pandemic super cycle,” the risk of inventory realignment and the slower macroeconomic environment.

While accepting Diageo is a stronger business now than before the pandemic Jefferies pointed out recent data indicates that growth in the US continues to moderate.

“As we enter a period of hiatus for Diageo’s US growth, we see a risk that the shares tread water until growth returns to the med-term trend 4-5%,” the broker said in a note.

Jefferies highlighted three key challenges for the US business – can it grow off a higher base, the risk of destocking and the recession risk.

It noted spirits are “recession resilient not recession proof,” and highlighted there are some early signs of downtrading in categories such as high-end tequila.

The broker sees a risk that the industry pauses for breath after three higher than average years.

Jefferies cut its price target to 3,800p from 4,000p alongside the rating downgrade.

Shell (LON:RDSa) faces growing investor backlash

Shell PLC (LON:SHEL) is facing a growing backlash from shareholders at its AGM due to dissatisfaction with the oil giant's climate efforts.

Two more pension schemes, Nest and London CIV, have signalled their intention to vote against the firm's directors at the meeting, following similar moves by the Church of England Pensions Board and Brunel Pensions Partnership.

Nest and London CIV, which represent approximately £78bn in combined assets under management, confirmed their decision to vote against the oil company ahead of its AGM on May 23 in response to Shell's plans to revise down its greenhouse gas emissions targets while potentially expanding its investment in fossil fuels.

Nest, the government-backed auto-enrolment provider, said it would vote against the re-election of Shell's chair and its 'Energy Transition' resolution in response, and that it would instead support a resolution calling on Shell to align its carbon reduction targets with the Paris Agreement.

"Following its record profits, we had hoped Shell would step up its activities towards meeting its net-zero ambitions. Instead, they're kicking the can down the road and increasing the risks on long-term shareholders," said Nest's senior responsible investment manager Katharine Lindmeier.

Alongside, criticism om its green credentials the energy giant has ben accused of profiteering, racking up profits as oil prices soared due to war in Ukraine.

Campaigners have called for a windfall tax, a cause championed by the Labour Party.

Shares in Shell are trading around 0.5% higher while the FTSE 100 is 37 points to the good, at 7.767.

GSK reports positive trial findings for meningitis drug

More good news from GSK. Further to the news of a favourable court ruling in Canada and raising £800mln from the sale of shares in Haleon, the pharmaceuticals giant has reported positive preliminary results from a phase 3 trial regarding its 5-in-1 meningococcal ABCWY vaccine candidate.

Subjects in the trial were healthy individuals aged between 10 and 25 and received two doses of the vaccine candidate given six months apart.

GSK (LON:GSK) said the study showed no inferiority of the vaccine candidate in the primary endpoints for the five Neisseria meningitidis serogroups A,B,C,W and Y in the individuals when compared to two doses of meningococcal group B vaccine Bexsero plus one dose of the meningococcal group A, C, W-135, and Y conjugate vaccine Menveo.

Neisseria meningitidis bacteria can cause diseases such as meningitis, an infection of the protective membranes around the brain and spinal cord, and life-threatening sepsis.

Chief Scientific Officer Tony Wood said: "It's particularly encouraging to see the breadth of coverage against the broadest panel of circulating MenB strains to date, as we know MenB is the most common cause of meningococcal disease in the US with the lowest immunisation rate."

Shares continued to hold in positive territory, up 1.8%, while the FTSE 100 is up 32 points, or 0.4%.