Proactive Investors -

- FTSE 100 in negative territory, down 6 points

- IAG tumbles despite return to profit and Air Europa deal

- Consumer confidence improves in February - GfK

EFL TV rights

English Football League (EFL) television rights are set to double in value as a host of broadcasters get ready to challenge Sky Sports.

The cost to secure the TV rights for the Championship, League One and League Two, is expected to double to over £200mln a year, according to the Daily Mail.

The EFL has reportedly been inundated with expressions of interest since the sale process began in October ahead of the invitation to tender next week.

Sky Sports have held the rights since 2002 but will have to almost double their current £119mln-a-year deal to maintain exclusive coverage as the EFL considers a hybrid model involving several broadcasters.

Dazn, which was founded in London and gives its international users access to the Premier League, and Swedish broadcaster Viaplay are rumoured to be interested in the rights.

Next week’s tender will make every EFL game available for purchase, which could lead to the end of the 3pm Saturday blackout.

FTSE 100 is down 6 points to 7,901.

London's movers

A quick look at today’s fallers and risers in London.

Fallers

IAG- down 6% to 155p

British Airways (LON:ICAG) owner, International Consolidated Airlines, returned to profit in 2022 and sealed a deal for the remaining shares in Air Europa it doesn’t own but the news failed to impress the market.

For the year to December 31, 2022, pre-tax profits were €431mln compared to a loss of €2.93bn in 2021 as revenue jumped to €23.07bn from €8.46bn.

Kin and Carta- down 30% to 129p

Kin + Carta PLC, the digital transformation consultancy, nosedived after issuing a profit warning due to macro headwinds experienced at the end of the first half.

“The company is reducing expectations for the year to reflect more cautionary client spending and elongated sales cycles seen across the industry,” it said.

Webis- down 6% to 2p

Shares fell after revealing its main WatchandWager arm had a difficult time during the months of September, October and November.

The gaming group’s chairman Denham Eke called it a “mixed start” to the financial year for the group’s principal subsidiary, with trading having been “strong” during the summer months, with “excellent” commission levels from Saratoga in New York and Del Mar in California.

Risers

Jupiter Fund Management- up 10% to 147p

Shares orbited higher after the group announced a better-than-expected set of results for the latter half of the year.

The FTSE 250-listed fund manager saw its share price rise on the back despite reporting a 64% decline in underlying profit to £77.6mln for the past calendar year.

However, this was much higher than the £63mln analysts had forecast, with investors also likely to have been impressed by the positive fund inflows of £0.7bn in the fourth quarter, turning positive in the second half for the first time since 2017.

US stocks seen lower

Wall Street is expected to open lower as the week draws to a close, with attention shifting to the release of January's Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, for further proof of slowing inflation in the US economy.

Futures for the Dow Jones Industrial Average fell 0.4% in Friday pre-market trading, while those for the broader S&P 500 index declined 0.6% and contracts for the Nasdaq-100 shed 0.9%.

Following a volatile session, the Dow ended Thursday 0.3% higher at 33,154 and the Nasdaq Composite added 0.7% to 11,590. While the S&P 500 improved by 0.5% to 4,012, it is still on track for its worst weekly performance since December.

One year on from Russia’s invasion of Ukraine and three years to the day of the first big COVID-related sell-off of risk assets, the aftershocks are still being felt every day in markets, commented Deutsche Bank strategist Jim Reid,

“This has continued this week, with intraday volatility remaining high. Risk assets whipsawed yesterday, with the S&P 500 up nearly +1% in early trading before selling off -1.5% in the late US morning following further upward revisions to inflation data in the US and Europe,” Reid said. “However that marked the high in yields for the day and a fixed income rally back lifted tech stocks, and in the end, the S&P broke a four-day losing streak to close up +0.53% with the NASDAQ at +0.72% ahead of today’s important PCE print.”

The headline PCE price index is expected to show an annualized increase of 4.9% for January, a touch lower than the 5% registered in December.

The core PCE index, which excludes food and energy, is likely to register an annualized rise of 4.3%, from 4.4% in December, according to consensus expectations.

With little corporate news out today, investors will be focusing on next week, Russ Mould, investment director at AJ Bell, said. “On the US markets, we will get a good insight into consumer spending when retailer Target and drinks group Monster Beverage report on Tuesday,” Mould said. “Home improvement group Lowe’s reports on Wednesday; so does discount retailer Dollar Tree.”

Leeks become latest veg off the menu

Leeks could become the latest vegetables to be rationed after a poor growing season, growers have warned.

Leek growers have suffered amid high temperatures and low rainfall - meaning supplies could run out by April.

Tim Casey, chairman of the Leek Growers Association, said customers might have to rely on imported crops through May and June.

He told the Telegraph: "The drought and the high temperatures in the summer stunted growth. Although we were irrigating the leeks like mad, all we were really doing was keeping them on life support and stopping them from dying."

"We had a relatively kind autumn and a lot of growth but it wasn't able to make up time for the crops before the winter came with cold weather and everything stopped."

The FTSE shrugged aside the latest dietary concerns, holding firm at 7,926.65, up 18.93 points, or 0.2%.

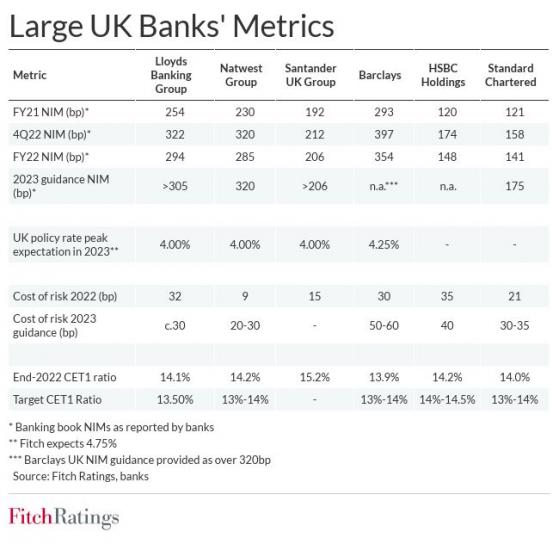

Fitch expects UK banks net interest margins to peak in 2023

Most UK banks’ net interest margins are close to peaking due to the approaching end of policy rate rises, higher pass-through rates to depositors, and lower yields and volumes in key lending segments, Fitch Ratings said Friday.

In a report the ratings agency stated it thinks most of the banks’ NIMs will peak in 2023 as depositors become more selective in search of higher yields, mortgage margins fall, the slowing economy weighs on credit demand, and the policy rate peaks by mid-year.

Fitch expects mortgage spreads to narrow due to higher swap rates and continued competitive pressures.

Funding costs are likely to increase as the recent policy rate rises gradually feed into higher deposit costs, with customers seeking the best rates available, and as wholesale funding is refinanced at higher cost.

Meanwhile, loan growth is likely to slow due to the tougher operating environment, and we expect banks to be cautious in their lending decisions, particularly in the sectors that are most exposed to an economic downturn.

These factors will be partly offset by income from structural hedges that were largely put in place in 2022, which should help to prevent a rapid significant decline in NIMs after they peak.

NIMs could be further supported if the policy rate increases beyond banks’ expectations, which it might if inflation remains high, although the impact would depend on banks' ability to pass higher rates on to borrowers, and how much this would be offset by pass-through to depositors.

Fitch forecasts the Bank of England to raise rates to 4.75% this year, before reducing them to 4.0% in 2024. Among the major UK banks, HSBC, Standard Chartered and, to a lesser extent, Barclays are also sensitive to US dollar interest rates given their geographical profiles, the ratings agency explained.

Fitch noted the large UK banks’ asset quality held up well in 2022, with impaired loans ratios remaining near historical lows but it expects a moderately higher cost of risk in 2023, although still within their target normalised ranges.

ONS data confirms food shortages

The shortage of food in the shops is reflected in new data from the Office for National Statistics.

An ONS report showed a quarter of adults reported that they could not find a replacement when the items they needed were not available when food shopping in the past two weeks.

This proportion has increased from 15% in a similar period a year ago, indicating that Britain’s fruit and vegetable shortages are not just down to seasonal factors.

Nearly 2 in 10 adults experienced shortages of essential food items that were needed on a regular basis in the past two weeks, up from 13% a year ago.

Around 22% adults experienced shortages of non-essential food items in the past two weeks. Since March 2022, the proportion has seen a general increase to its current level, the ONS says.

Read more on Proactive Investors UK