By Jesse Cohen

Investing.com - U.S. stock futures pointed to a lower open on Tuesday as expectations waned for a hefty interest rate cut by the Federal Reserve later this month.

At around 7:30AM ET, the blue-chip Dow futures were down 90 points, or 0.3%, the S&P 500 futures slipped 9 points, or 0.3%, while the tech-heavy Nasdaq 100 futures dropped 30 points, or 0.4%.

Global stocks have been on the backfoot since late last week, when strong U.S. jobs data tempered expectations the Fed will deliver a large rate cut at its July 30-31 meeting.

U.S. nonfarm payrolls rose by 224,000 in June, the most in five months, data showed on Friday, beating economists' consensus estimate of 160,000.

The robust jobs data saw investors dial back bets of a 50 basis point rate cut later this month, with the market now seeing less than a 5% chance of such a move, down from roughly 30% before the data was released.

Markets are still pricing in a quarter-point cut with 100% certainty, though not all are as convinced.

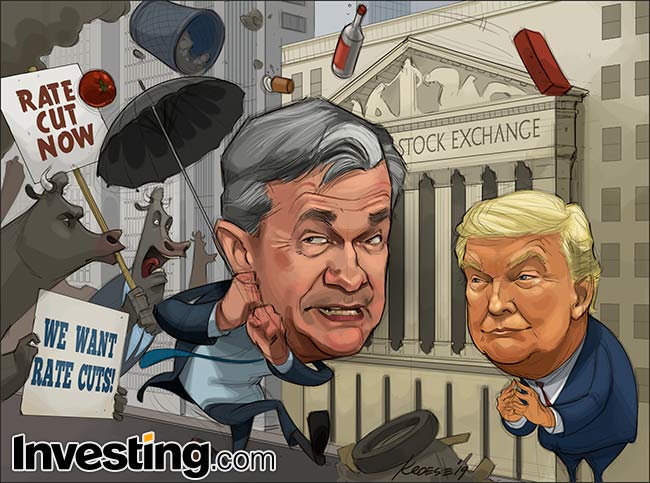

Focus now turns to Federal Reserve Chair Jerome Powell, who could provide further clues on the near-term outlook for monetary policy when he speaks at an event hosted by the Federal Reserve Bank of Boston at 8:45AM ET Tuesday.

He is then due to appear in Congress on Wednesday and Thursday for his semi-annual testimony which will see the Fed chief speak in front of the House Financial Services Committee and the Senate Banking Committee.

U.S. President Donald Trump has repeatedly criticized the Fed for not lowering borrowing costs this year, saying last week: “If we had a Fed that would lower interest rates, we’d be like a rocket ship.”

For its part, the Fed has reiterated its independence, with Powell saying last month that the U.S. central bank is “insulated from short-term political pressures.”

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report