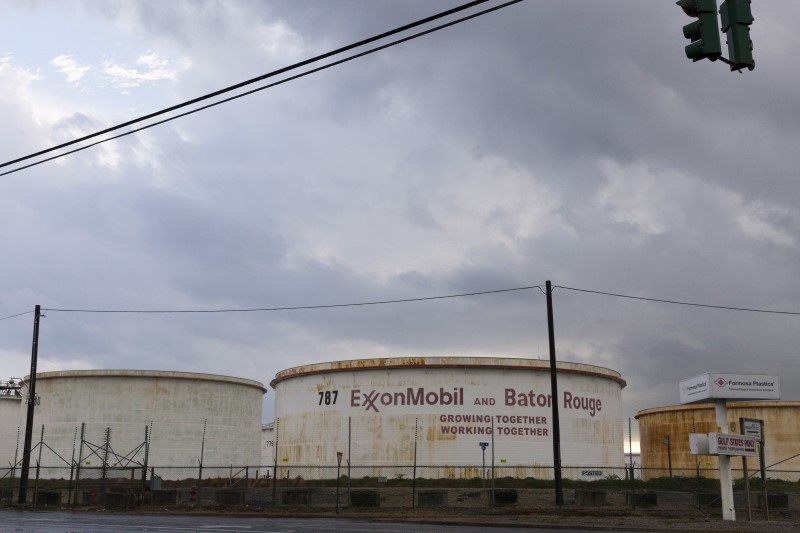

On Thursday, Exxon Mobil (NYSE:XOM) projected a significant increase in its third-quarter profits, anticipating a leap of $1 billion due to escalating oil prices. Exxon Mobil, with a market cap of $437.44 billion and a P/E ratio of 8.73, as per InvestingPro data, has been a prominent player in the Oil, Gas & Consumable Fuels industry.

The company's financial health is further highlighted by its perfect Piotroski Score of 9 and its consistently increasing earnings per share, according to InvestingPro Tips. Exxon Mobil has a history of maintaining dividend payments, having done so for 53 consecutive years, and has raised its dividend for 40 consecutive years. This consistency is a testament to the company's strong financial performance and stability.

In other economic news, economists predict that the job report scheduled for Friday at 08:30 ET (12:30 GMT) won't have any substantial impact on the Federal Reserve's rate trajectory. This suggests that the central bank's monetary policy might remain unaffected by the upcoming employment data.

Meanwhile, retail giant Walmart (NYSE:NYSE:WMT) has noticed a slight shift in shopping trends, with customers putting less food in their carts. The company ascribes this trend to the popularity of weight loss drugs like Ozempic, which could be influencing consumer behavior towards food purchases.

These developments highlight the dynamic nature of financial markets and consumer behaviors, as companies continue to adjust their strategies based on varying economic indicators and changing consumer patterns. For more detailed insights and tips on companies like Exxon Mobil, consider subscribing to InvestingPro, which provides additional tips and real-time metrics. For instance, there are 13 more insightful tips available for Exxon Mobil on InvestingPro. For more information, visit InvestingPro Pricing.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.