By Simon Jessop

LONDON (Reuters) - Emerging markets-focused asset manager Ashmore Group (L:ASHM) said total assets rose 10 percent in the third quarter of its financial year after the strongest net inflows since June 2013, sending its shares higher on Tuesday.

Demand remained strong despite a pick-up in volatility in many global markets during the quarter, with investors adding to their emerging market bets after years of eschewing riskier regions of the world.

Total assets in the three months to the end of March were $76.5 billion (£53.2 billion), up from $69.5 billion at the end of December, it said in a statement, helped by net inflows of $6.4 billion in new client money and performance gains of $600 million.

At 0709 GMT, shares in Ashmore were up 8.1 percent at 428.2 pence, leading gainers on Britain's mid-cap index (FTMC).

However, KBW analyst Jonathan Richards told clients the company would need to continue to record strong asset growth to justify a valuation that is at the top of its historic trading range and at a premium to peers.

"Overall, we forecast net inflows to be broadly flat in Q4 vs. Q3; which implies a strong organic growth rate," he wrote in a note, flagging a 'Market Perform' rating and 420 pence target price.

Ashmore said net flows were strongest in its local currency, blended debt and corporate debt strategies, and positive in its equities, external debt and liquidity strategies.

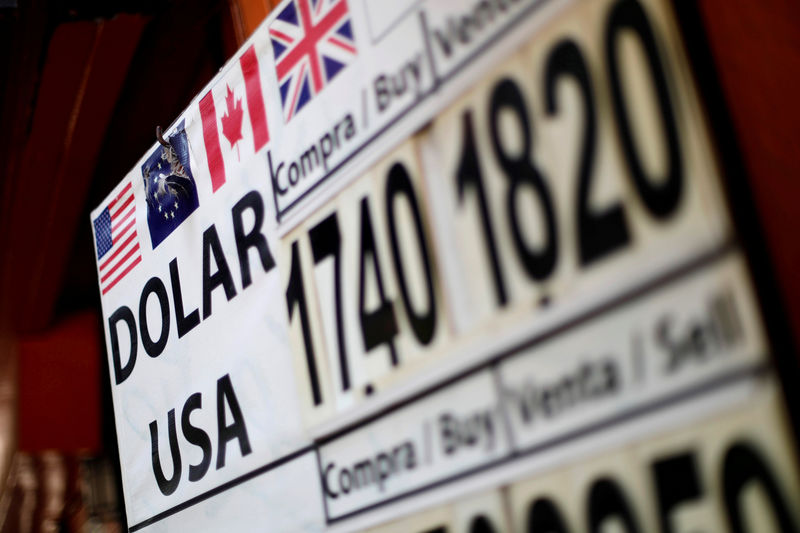

Local currency and blended debt portfolios also delivered the strongest performance, while dollar-denominated external debt and corporate debt performed in line with slightly lower market levels. Equity performance was marginally negative.

"The increased market volatility experienced over the past three months has had little effect on the fundamental drivers of returns in Emerging Markets and, as expected, both Emerging Markets fixed income and equity markets have outperformed," Chief Executive Mark Coombs said.

"Volatility that originates in the developed world typically leads to Emerging Markets assets being mispriced, presenting attractive investment opportunities."

Attractive valuations, the need to add to underweight allocations, better corporate earnings and credit fundamentals, and the prospect of currency strength as the dollar weakens, should all support investor confidence in emerging markets going forward, Coombs said.