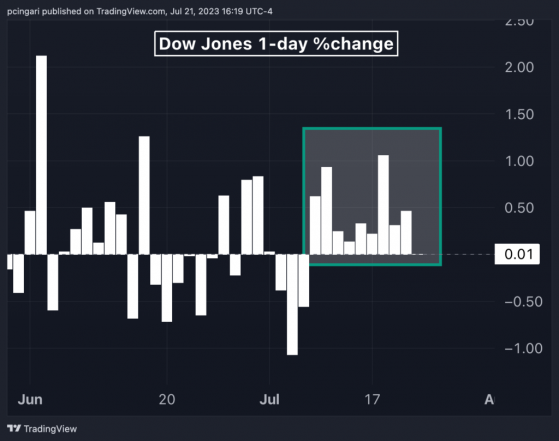

Benzinga - The Dow Jones Industrial Average (DJIA) recorded its tenth consecutive positive session Friday, marking the index’s longest winning streak since August 2017.

The blue chip index had only gained 0.01% at the end of the trading day Friday, highlighting the suspenseful nature of this milestone.

On Friday afternoon, volatility returned to the U.S. stock market, sending big tech firms tumbling in the hour before the closing bell. Yet the blue-chip segment managed to avoid losses and eked out a small but crucial upward tick, allowing it to achieve the winning streak.

For the week, the Dow Jones recorded a solid 2.1% gain, following a 2.3% rise in the previous week, bringing the index to levels last seen in mid-April 2022.

The SPDR Dow Jones Industrial Average ETF (NYSE:DIA), the largest exchange traded fund tracking the Dow, closed 0.09% lower, snapping its winning streak.

The Dow Jones’ daily top performer among its components was Merck & Company, Inc. (NYSE:MRK), which rose by 1.8%. Procter & Gamble Co. (NYSE:PG) followed closely, gaining 1.6%, while Chevron Corp. (NYSE:CVX) also exhibited strong performance with a 1.4% increase.

Among the daily laggards in the Dow index were technology giant Microsoft Corp. (NASDAQ:MSFT), which lost 0.9% for the overall session; American Express Company (NYSE:AXP), which faced a more significant drop of 3.7% due to disappointing second-quarter results, and Caterpillar Inc. (NYSE:CAT), down 1.3%.

Chart: Dow Jones Marks Longest Winning Streak In Over 6 Years

Traders Await Fed Meeting

The increased volatility witnessed at the close was likely influenced by options expiration, with approximately $2.3 trillion in derivative option contracts set to mature on Friday.Moreover, traders appeared to adopt a more cautious approach, likely driven by anticipation of the crucial Federal Open Market Committee Meeting scheduled for the week ahead.

The market has already factored in a 0.25% rate hike, which would raise the borrowing cost to 5-25%-5.5%, the highest level since early 2001.

The main concern lies in the Fed’s future plans, as there is a prevailing belief that this might be the last rate hike in the cycle. Fed futures indicate a mere 16% probability of another rate increase in September and a 30% chance by November.

Read now: Fed Meeting Preview: Interest Rates Expected To Surge To 22-Year Highs, But Communication On Future Steps Is Key

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga