Benzinga - by Naeem Aslam, Benzinga Contributor.

Investors had a lot to digest over the weekend, which included not only the Dow Jones Industrial Average closing above the 40k level for the first time in history but also the tragic death of the Iranian President. Over the weekend, when the initial news broke out about the crash of the helicopter that was carrying the Iranian President, investors were highly nervous as speculators started to pump the media with the idea with the idea that perhaps there could be a foreign hand in the helicopter crash. However, the crash turned out to be an unfortunate accident, and investors are feeling a sense of relief that it didn't carry many political consequences. The question for traders now is: Where do we go from here on?

Markets Performance Last week, we saw stellar performance for the US stock indices as the Dow Jones Industrial Average closed above the 40K mark for the first time. All three major US stock indices are up strongly for the month, and it seems that they are well on track to post strong performance this month. Month-to-date, the S&P 500 index is 5.31%. The Dow Jones Industrial Average has soared 5.79%, and the Nasdaq Inde has gained 6.17%.

Factors Influencing The Price So far this month, a number of important factors have helped the US stock market. Firstly, the US labor market has clearly indicated that it has lost some steam, which means that the Fed cannot maintain its current stance in terms of keeping rates higher for longer. Second, we had the US CPI reading, which also confirmed that inflation may be on the right track once again. This is because the inflation rate has dropped from its precious level, and there is less pressure on the Fed. Thirdly, if we look at the earnings report so far, it also shows that things have actually turned out to be above expectations, and the painting painted by the earnings data shows an optimistic picture.

The Data Points Should Be Kept In Mind I believe the majority of the momentum during this week will be carried over from the previous week. The most important economic event of the week will take place on Wednesday, when the Fed will deliver its FOMC minutes. Now, the interesting thing would be to see how many more FOMC people are leaning towards a rate cut, and how early that would take place. The first rate cut is expected to be in September, but if we get anything before that, that would be highly bullish, and the FOMC minutes would indicate how quick the Fed will move.

The second important data point that traders would need to pay attention to would be the flash manufacturing PMI and services PMI numbers on Thursday. Finally, the market will highly applaud an improvement in the consumer sentiment data, due on Friday. The expectations for the revised UoM consumer sentiment are 67.7, while the previous reading was 67.4.

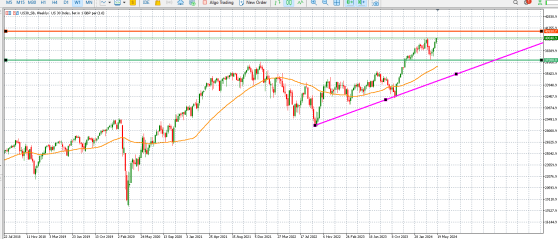

The Price Action Looking at the fundamentals, there is no doubt that the rally has a lot of steam behind it, but the important thing to note will be the FOMC minutes. From a technical perspective, the price appears to be due for a retracement due to its excessively rapid upward movement. If the FOMC minutes indicate that the Fed remains hesitant to adjust the interest rate before September, this could potentially lead to a decline. The chart below displays the important support and resistance zones.

US30 Chart by Zaye Capital

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga