Benzinga - by Zacks, Benzinga Contributor.

DaVita (NYSE: DVA) recently extended the pilot phase of a previously announced supply and collaboration agreement with Nuwellis (NASDAQ: NUWE) until Aug 31, 2024.At the conclusion of the pilot phase, DaVita may extend the supply agreement with Nuwellis for continued provision of both inpatient and outpatient ultrafiltration services for up to 10 years.

The objective of this program is to test Aquadex ultrafiltration therapy in certain U.S. marketplaces for adult patients with congestive heart failure and associated disorders. The extension of the pilot phase will provide DaVita, serving as a leading provider of kidney care services, additional time to evaluate the use of ultrafiltration therapy with the Aquadex SmartFlow system with high-need patients in the hospital.

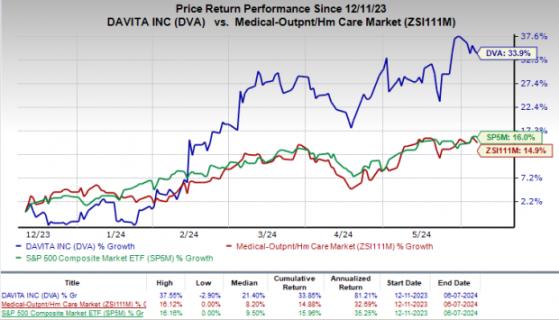

Price Performance In the past six months, DVA shares have gained 33.9% compared with the the industry's rise of 14.9%. The S&P 500 has gained 16% in the same time frame.

Image Source: Zacks Investment Research

More on the Collaboration In June 2023, DaVita and Nuwellis entered into a supply and collaboration agreement for the use of Aquadex ultrafiltration therapy to treat adult patients with congestive heart failure. When paired with DaVita's care team, the Aquadex technology lowered associated healthcare costs for payers and providers while providing ultrafiltration therapy to patients with heart failures experiencing fluid overload.

This opportunity for long-term collaboration highlights the commitment of both companies to advancing patient care through innovative medical solutions.

More on the Aquadex SmartFlow System The Aquadex SmartFlow technology removes extra fluid from patients experiencing hypervolemia (fluid overload) in a simple, flexible, and intelligent manner, delivering scientifically validated therapy.

The Aquadex SmartFlow system is recommended for use in adult and pediatric patients weighing 20 kg or more who have fluid excess that is not improving with medical therapy, including diuretics, either temporarily (up to 8 hours) or permanently (more than 8 hours in patients who require hospitalization).

Industry Prospects Per a report by Transparency Market Research, the global fluid management market size was valued at $9.2 billion in 2022 and is expected to reach $22.1 billion by 2031 at a growth rate of 10.6%.

The rise in health consciousness across the globe acts as one of the major factors driving growth of the fluid therapy market. The development in commercial pipelines and the rise in occurrences of chronic diseases such as gastrointestinal tract, cancer, diabetes and nephrology accelerate the market growth.

DaVita Inc. Price

DaVita Inc. price | DaVita Inc. Quote

Zacks Rank & Other Stocks to Consider DVA carries a Zacks Rank #2 (Buy) at present.

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. (NASDAQ: ALGN), Ecolab (NYSE: ECL) and Boston Scientific Corporation (NYSE: BSX).

Align Technology, currently carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted earnings per share of $2.14, which beat the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN's earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL's earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.7%.

Ecolab's shares have rallied 33.8% against the industry's 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX's earnings surpassed estimates in the trailing four quarters, the average surprise being 7.5%.

To read this article on Zacks.com click here.

Read the original article on Benzinga