Benzinga - by Shanthi Rexaline, Benzinga Editor.

Tesla, Inc. (NASDAQ:TSLA) shares have been on a downward trend for over two years, underperforming the broader market. A recent report suggests some early backers are losing faith amid the company’s flailing fundamentals.

What Happened: John Belton, a portfolio manager at Gabelli Funds, believes Tesla’s stock price is disconnected from its fundamentals, according to Reuters. “We think the stock works best when there are auto company fundamentals that justify the stock price,” he added.

Gabelli Funds entirely sold its Tesla holdings by the end of the first quarter of 2024. It previously held 65,900 shares valued at $16.37 million at the end of the fourth quarter of 2023.

Slowing Growth & Shifting Strategies

Tesla’s robust sales growth, even during the pandemic, began to slow in 2022, reflecting industry-wide trends and weaker economic conditions impacting discretionary spending. Price cuts implemented to boost volume failed to significantly improve margins.

Investors who witnessed the meteoric rise coinciding with the Model Y launch in early 2020 have largely held on despite the recent downturn. However, their patience is wearing thin.

Prominent Concerns

The Reuters report highlights growing skepticism among former “die-hard” believers. Gary Black, a prominent Tesla bull from Future Fund, remains optimistic but has expressed dissatisfaction with the company’s strategy. He advocates for a sub-$30,000 EV and increased marketing to educate potential customers.

Despite his bullishness, Black’s Future Fund Active ETF (NYSE:FFND) now holds only 1,842 Tesla shares, with a portfolio weighting of 2.83%, down from over 5% in March.

Gerber Kawasaki Wealth & Investment Management‘s Ross Gerber, another former Tesla supporter, has become a vocal critic of CEO Elon Musk and the company’s direction. His firm’s ETF, the AdvisorShares Gerber Kawasaki ETF (NYSE:GK), currently holds just 808 Tesla shares. Gerber criticizes Musk’s reduced involvement and the lack of a strong public relations team.

Mutual Fund Trimming

The report also mentions that 10 out of 18 mutual funds tracked by Morningstar reduced their Tesla holdings in the first quarter, with four making significant cuts exceeding 15%. Only four funds increased their positions.

Stock Struggles

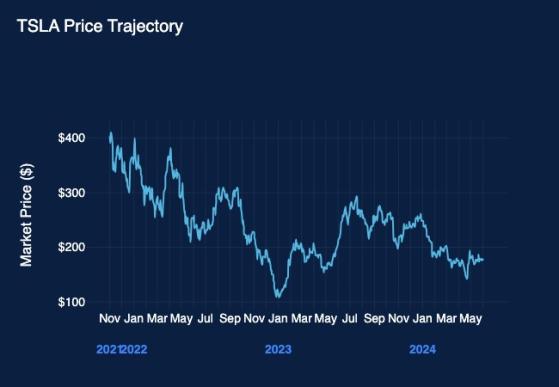

Tesla’s stock has lost roughly 30% this year and 58% since its November 2021 peak. Notably, the broader market, represented by the SPDR S&P 500 ETF Trust (NYSE:SPY), is near its all-time high, according to data from Benzinga Pro.

Analyst Outlook

Despite the current challenges, most analysts believe Tesla’s difficulties are temporary. They remain optimistic about growth levers like energy storage, full self-driving technology, and robotaxis.

Out of 32 analysts, 9 recommend buying Tesla, 14 hold neutral ratings, and only 9 recommend selling, according to TipRanks. The average analyst price target of $176.40 suggests flat performance over the next year.

Shifting Ownership

Another noteworthy trend is the increasing ownership by retail investors, now nearly equal to institutional ownership. Events in the next two months, including the June 13 shareholder meeting, second-quarter deliveries, and earnings reports, and the Aug. 8 “robotaxi unveil,” could significantly impact the stock price.

Tesla ended Tuesday’s session down 0.86% at $174.77, according to Benzinga Pro data.

Read Next: Elon Musk Reveals How Tesla May Split $10B AI Budget: Nvidia To Get Billions, But In-House Efforts Take Center Stage

Image made via photos on Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga