(Reuters) - Gem Diamonds Ltd (L:GEMD) reported a 14 drop in half-year revenue, hurt by lower production and a decline in average diamond prices, and said it received an acquisition offer for its mine in Botswana.

The company, which mines diamonds from the Letseng mine in Lesotho, said on Thursday its revenue fell to $93 million for the six months to June 30, from $109 million a year earlier.

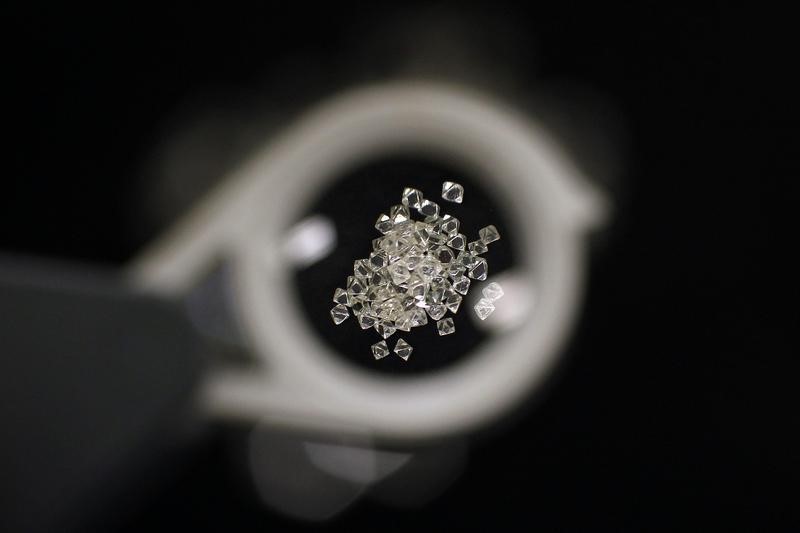

The average price per carat fell to $1,779 for the period, from $1,899 in the same period last year, while carats recovered fell 12 percent to 50,478, Gem Diamonds said.

Weaker demand from China and the United States has hurt diamond prices, while India's surprise move to abolish high-value bank notes in November also dented demand for diamonds in the Asian country.

Gem Diamonds said cost-cutting measures are underway and that it identified savings of $15 million to be implemented from October.

The company, which placed its Ghaghoo mine in Botswana under maintenance in February, added the board was considering the mine's purchase offer.