LONDON (Reuters) - ARM Holdings (L:ARM) reported a slightly better-than-expected 14 percent rise in first-quarter profit as the provider of technology for the iPhone outperformed a weak semiconductor market with strong demand for its most advanced chips.

The British company reported adjusted profit of 137.5 million pounds on revenue, measured in dollars, of $398 million (277 million pounds), both slightly beating market forecasts.

It said on Wednesday that based on current industry conditions, it expected full-year revenues to be in line with expectations.

But it cautioned that macroeconomic uncertainty remained, and could influence consumer and enterprise spending this year, potentially impacting semiconductor sales.

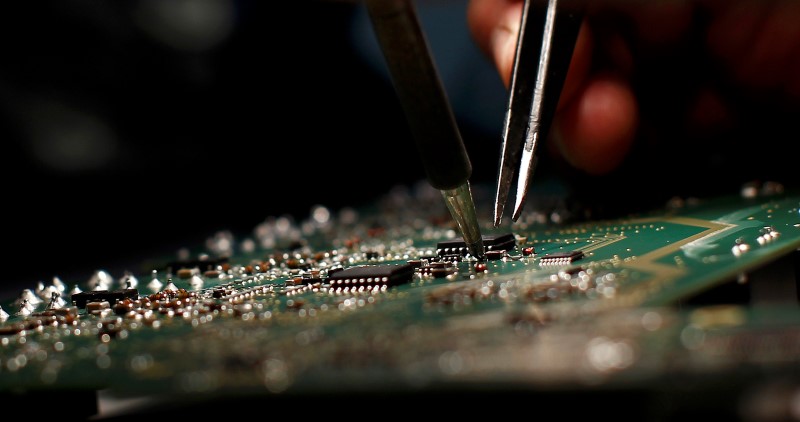

ARM has long dominated mobile processing, and its latest technology is now being used in in-house chips made by Samsung (KS:005930) and Huawei [HWT.UL] as well as Apple (O:AAPL).

Royalties paid on every chip shipped grew 15 percent, outstripping a 3 percent drop in global semiconductor sales, as more of the proceeds of processor sales go to the Cambridge-based firm.

ARM is also looking to markets like the Internet of Things - billions of connected devices - and enterprise servers as new sources of growth

But the company has not been immune to investor concerns about an increasingly saturated smartphone market and its shares have fallen to seven-week lows in recent days on reports that Apple has continued to reduce iPhone production in the current quarter.

Intel (O:INTC), its rival which largely failed to break into the mobile market, said on Tuesday it would cut up to 12,000 jobs and focus on the same opportunities as the PC market declines.