Benzinga - by Piero Cingari, Benzinga Staff Writer.

The Chinese government is contemplating an increase in fiscal stimulus, reflecting a desire to recover a portion of the economic growth that has been lost over recent quarters to achieve the annual growth target of 5%.

That’s according to Bloomberg, citing sources familiar with the situation. Government policymakers are currently weighing the possibility of issuing at least 1 trillion yuan ($137 billion) in additional sovereign debt to fund infrastructure investments, including projects related to water conservation.

No official announcement has been made yet.

These developments have led to a surge in global equity indices. In Hong Kong, shares, as tracked by the Hang Seng Index, saw an increase of 0.8%, and a similar performance was observed by the S&P/ASX 200 in Australia.

Within the Asian region, the Japanese Nikkei Index showed the strongest performance, with gains of up to 1.8%.

Some notable stock gainers in the Asian market included companies like Kawasaki Kisen Kaisha Ltd. (OTCPK: KAIKY) and Miniso Group Holding Ltd. (NYSE:MNSO), both experiencing a 6% increase.

In Europe, stocks also displayed positive momentum, with Italy’s FTSE Mib 30 and Spain’s IBEX 35 indices standing out, both registering a 1.7% increase.

In the European market, Just Eat Takeaway.com NV (OTCPK: JTKWY) rose by 6%, alongside Alstom (OTCPK: ALSMY), which also saw a 6% increase, and TUI AG (OTCPK: TUIFF) with a 5.7% increase.

Read Also: Stocks Futures Signal Cautious Optimism Amid Hopes Of Fed Pause, PepsiCo’s Solid Q3; Focus Shifts To Week’s Inflation Data

Country Garden Issues Default Warning

At the same time, concerns persist regarding issues in the property sector, particularly regarding Country Garden Holdings, which is currently facing the risk of default. The former leading construction company in China issued a warning via a stock exchange filing on Tuesday, indicating its inability to meet future offshore payment obligations, including those related to dollar-denominated bonds.Ting Meng, a senior credit strategist at Australia and New Zealand Banking Group, told Bloomberg that Country Garden’s recent statement may force offshore bondholders to push forward a restructuring proposal.

The company announced on Tuesday a significant drop of 81% in contracted sales for September compared to the previous year, primarily due to the persistently weak demand from homebuyers in China. This decline caused Country Garden’s shares to fall by 11% in Hong Kong on Tuesday, following a 6.7% drop in the previous session.

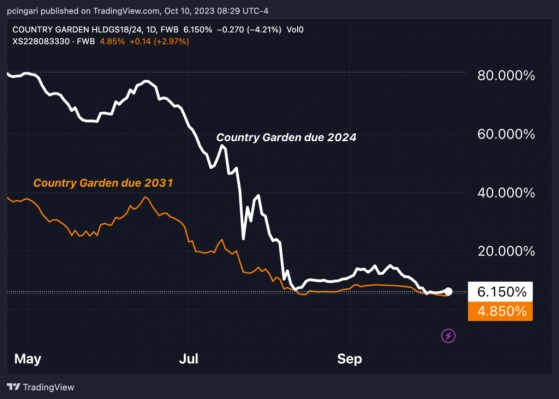

Notably, Country Garden’s dollar bond maturing in January 2024 is currently trading at 6 cents on the dollar, while the bond due in 2031 is trading at less than 5 cents on the dollar.

Domestic stocks in China underperformed global equities on Tuesday. The Shanghai Composite index declined by 0.7%, and the Shenzhen Component saw a loss of 0.6%. These losses extended from the previous session.

Chart: Country Garden’s Dollar-Denominated Bonds Tumble

Now Read: Asia Mixed, Eurozone In Green, Crude Retreats After Monday’s Surge – Global Markets Today While US Was Sleeping

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga