Benzinga - by The Arora Report, Benzinga Contributor.

To gain an edge, this is what you need to know today.

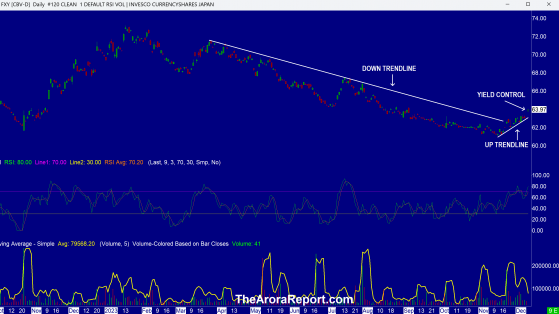

Yield Control Please click here for a chart of Invesco CurrencyShares Japanese Yen Trust (ARCA: FXY).

Note the following:

- We have been sharing with you that what the Bank of Japan (BOJ) does will have a major impact on the U.S. stock and bond markets.

- The chart shows that the downward trendline has now been decisively broken. The downward trendline has been in place because the yen has been artificially suppressed by BOJ.

- The chart shows that an upward trendline is now in place.

- The chart shows a break away move in yen overnight on speculation that BOJ is about to abandon yield control. The speculation was triggered by BOJ Governor Ueda indicating that the policy would “become even more challenging from the year end and heading into the next year.”

- In The Arora Report analysis, now there is a 40% probability of a significant change in BOJ policy.

- The up move shown on the chart is equivalent to the yen rising by about 1.5% against the dollar. This is the biggest one day move since January. For a currency, a 1.5% move is a huge move.

- On the yen move, stocks in Asia fell first, which then caused a downdraft in Europe. Without the yen move, there would have been a rip roaring rally in the U.S. stock market today. The yen move is suppressing the rally attempt.

- Since the momo crowd is in control and the momo crowd does not do any analysis, the momo crowd is oblivious to the yen move and is aggressively buying the slight dip in stocks in the early trade.

- As we have been sharing with you, a significant amount of money is borrowed in yen and invested in U.S. stock and bond markets. This strategy becomes less attractive as the yen moves higher and rates in Japan go higher.

- In an important development, JPMorgan Chase & Co (NYSE: JPM) CEO told Congress that he would shut down crypto if he had the power to do so. It is back to the future in bitcoin. Please read the bitcoin section below.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

In The Arora Report analysis, this leading indicator runs counter to the consensus in the stock market of aggressive rate cuts by the Fed next year. This data makes tomorrow’s jobs report even more important.

Europe We previously shared with you that now six rate cuts are expected in Europe next year. Euro area GDP came at -0.1% vs. 0.0% consensus. This new data supports rate cuts in Europe.

Magnificent Seven Money Flows In the early trade, money flows are positive in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is aggressively buying stocks in the early trade. Smart money is